Sunday Feb 22, 2026

Sunday Feb 22, 2026

Friday, 3 September 2021 00:00 - - {{hitsCtrl.values.hits}}

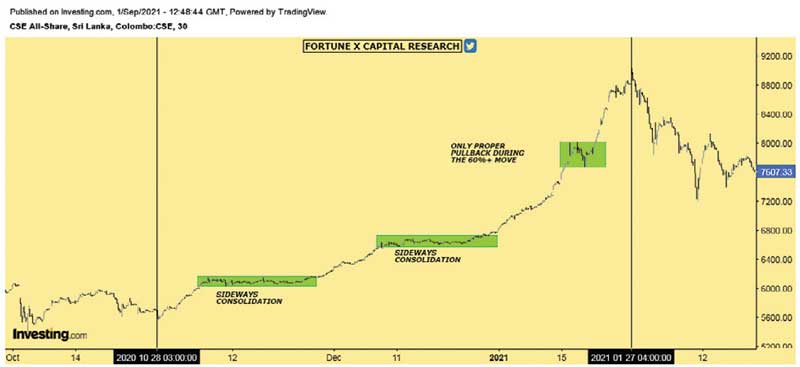

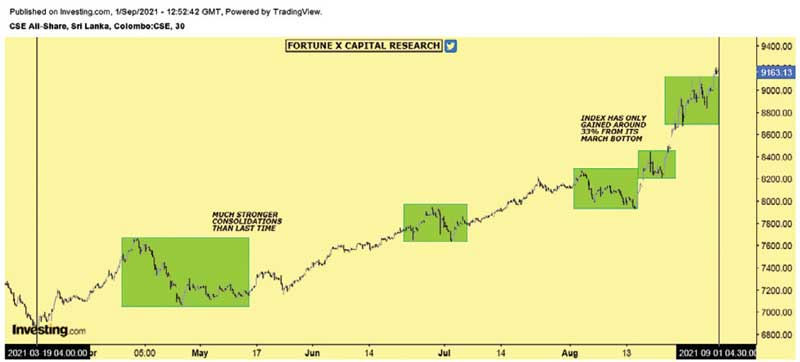

A comparison of the two major rallies we have seen over the past 12 months. The second one looks a lot better with several good consolidations along the way: Fortune X Capital Research

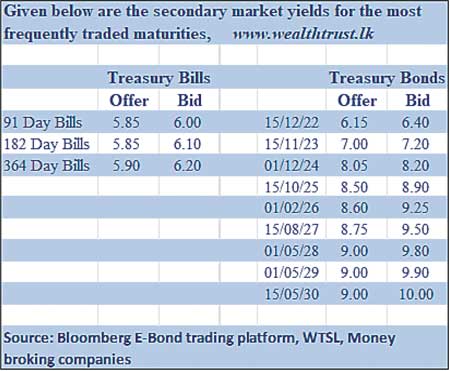

By Wealth Trust Securities

Activity yesterday in the secondary bond market was at a complete standstill once again with no trades taking place.

Activity yesterday in the secondary bond market was at a complete standstill once again with no trades taking place.

The total secondary market Treasury bond/bill transacted volume for 1 September was Rs. 17.65 billion.

In money markets, the net liquidity shortage increased further to Rs. 214.70 billion yesterday with an amount of Rs. 76.04 billion been deposited at Central Banks SDFR of 5% against an amount of Rs. 290.74 billion withdrawn from Central Banks SLFR of 6%. The weighted average rates on call money and repo too increased further to 5.96% and 5.81% respectively.

Rupee trades after a lapse of over three months

In the forex market, the USD/LKR rate on spot contracts was traded at a level of Rs. 203.02 yesterday for the first time since 17 May. The total USD/LKR traded volume for 1 September was $ 33 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)