Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 11 May 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

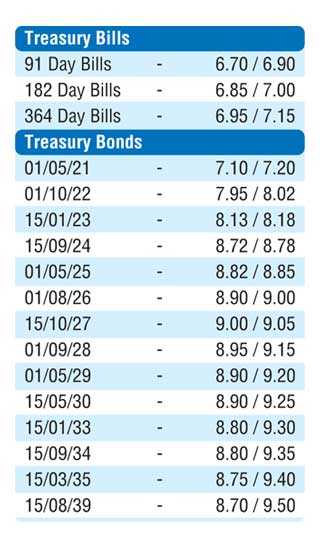

The secondary bond market remained active during the shortened trading week ending 6 May while trading within a narrow range across the yield curve. The continuous selling interest on the liquid maturities of 2024’s (i.e.15.03.24, 15.06.24 & 15.09.24), 01.05.25, and 15.10.27 saw its yields increase to weekly highs of 8.70%, 8.75% each, 8.85% and 9.07%, respectively, in comparison to its previous weeks closing levels of 8.62/70, 8.65/75, 8.67/73, 8.80/88 and 8.95/02.

However, buying interest at these levels curtailed any further upward movement in yields. In addition, maturities of 01.10.22, 15.01.23, and 01.08.26 were traded at levels of 8% to 8.03%, 8.14% to 8.18% and 9.02% to 9.04%, respectively, as well.

The weighted average rates on the 91-day and 182-day bills increased by 9 and 10 basis points, respectively, while the weighted average on the 364-day bill remained steady at 7%, at the weekly bill auction.

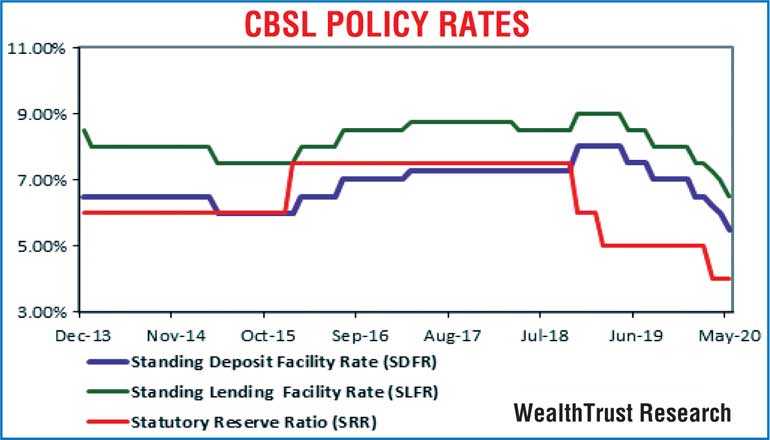

Subsequent to close of trading on 6 May, the Central Bank was seen cutting policy rates by 50 basis points to 5.50% and 6.50% on its Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) respectively. This was the fourth instance of easing policy for the year which totals 150 basis points so far.

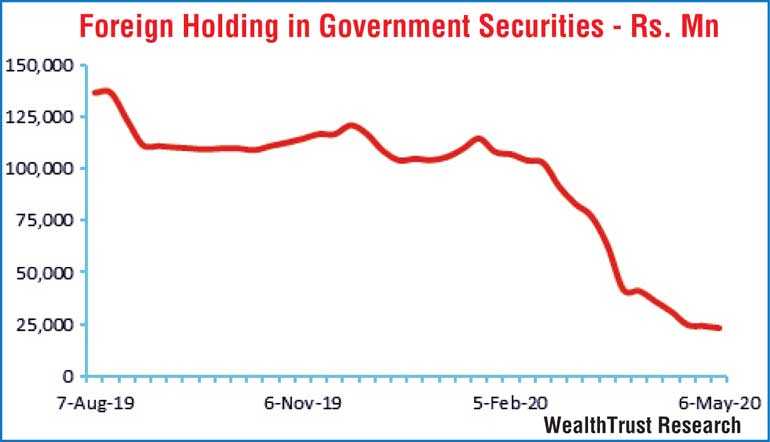

Furthermore, the foreign holding in rupee bonds continued to shrink for a 15th consecutive week, recording an outflow of Rs. 0.95 billion for the week ending 6 May.

In money markets, the weighted average rates on overnight call money and repo rates averaged 6.41% and 6.55%, respectively, for the week as the overall liquidity surplus stood at Rs. 94.83 billion by the end of the week.

The Central Bank DOD (Domestic operations Department) injected liquidity during the week by way of seven-day reverse repo auctions at weighted average yields of 6.50% and 6.93%, respectively, for commercial Banks and standalone primary dealers.

Rupee appreciates

In the Forex market, the USD/LKR rate on spot contracts appreciated during the week to trade within the range of Rs. 187.20 to Rs. 191 against its previous weeks closing of Rs. 192 to Rs. 192.80 on the back of selling interest by banks.

The daily USD/LKR average traded volume for the first two days of the week stood at $ 58.05 million.

(References: Central Bank of Sri Lanka, Bloomberg E-bond trading platform, Money broking companies)