Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 13 February 2023 00:40 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

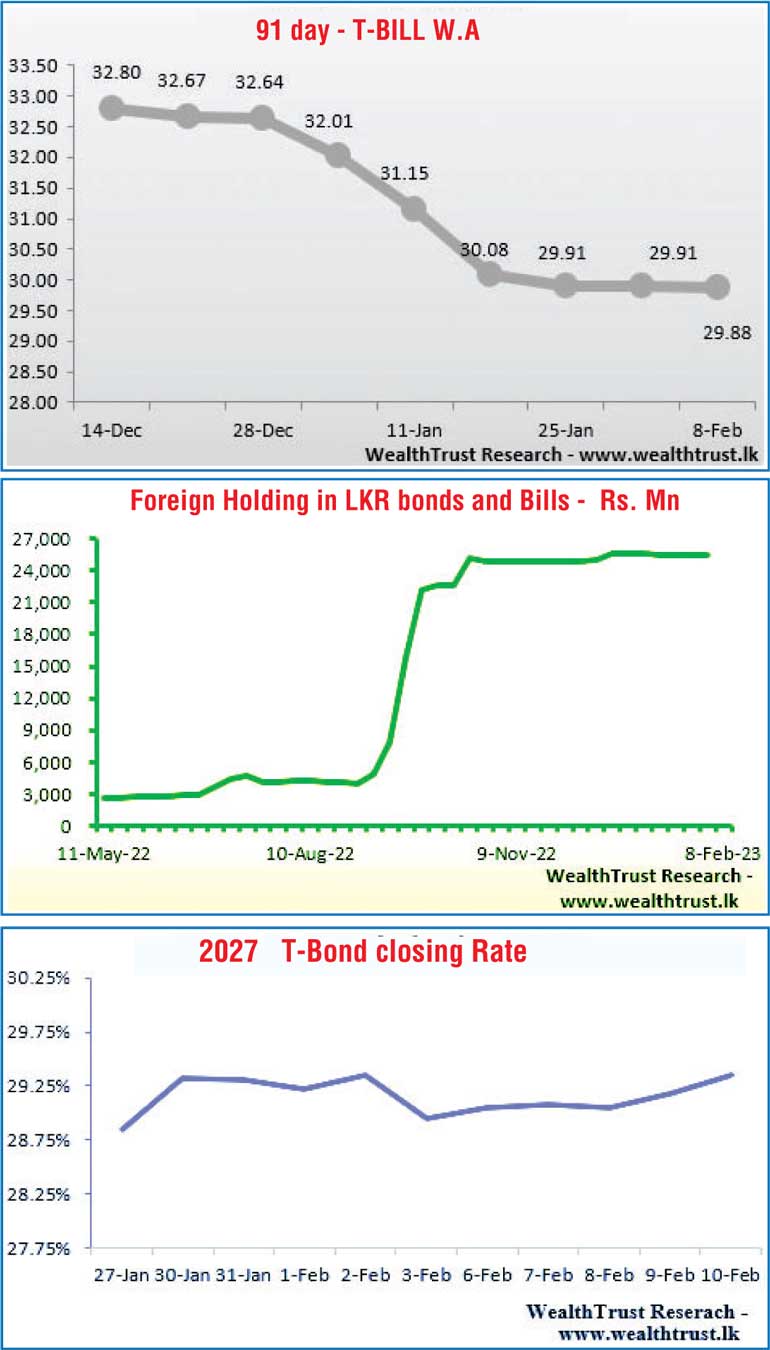

The secondary bond market sentiment turned bearish during the trading week ending 10 February, as yields were seen increasing towards the latter part of the week on the back of moderate activity.

The secondary bond market sentiment turned bearish during the trading week ending 10 February, as yields were seen increasing towards the latter part of the week on the back of moderate activity.

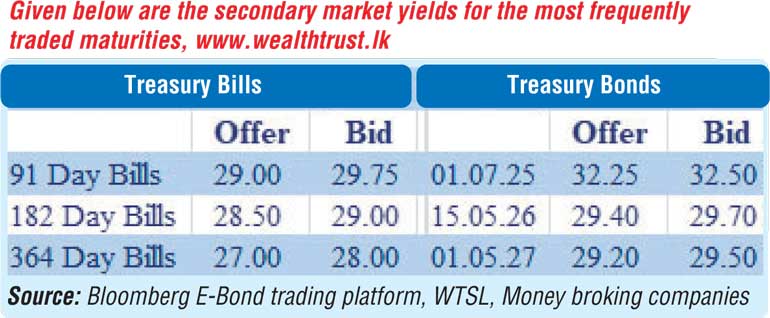

The increase in yields was led by the 15.05.26 duration as it was seen hitting a weekly high of 29.36% against its week’s opening low of 29.10%. In addition, selling interest on the maturities of 01.07.25 and two 2027’s (i.e., 01.05.27 and 15.09.27) saw its yields hit intraweek highs of 32.20%, 29.25% each respectively as well. Furthermore, trades on the maturities of 2028 (i.e., 15.01.28, 01.07.28 and 01.09.28), 15.05.31 and 01.07.32 were recorded at 27.11% to 27.14%, 26.20% to 26.23%, 25.82%, 27.10% and 26.10% to 26.78% respectively, reflecting an upward shift of the overall yield curve.

The upward momentum was further supported by the weekly Treasury bill auction outcome, where only an amount Rs. 53.6 billion was accepted in total at its first stage of the auction against its total offered amount of Rs. 100 billion. Nevertheless, a further amount of Rs. 71.40 billion was raised at the second stage of the auction, thereby leading to a full subscription.

The foreign holding in rupee bonds remained steady at Rs. 25.44 billion for the week ending 8 February while the daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 29.69 billion.

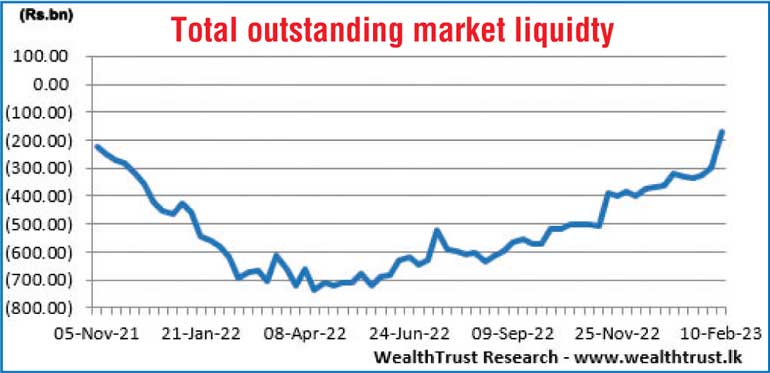

In money markets, the total outstanding liquidity deficit decreased considerably to Rs. 168.93 billion by the end of the week against its previous week’s Rs. 297.63 billion. The weighted average rates on call money and repo were registered at 15.43% and 15.50% respectively for the week.

The CBSL’s holding of Government Securities was registered at Rs. 2,551.15 billion against its previous week’s of Rs. 2,558.61 billion.

USD/LKR

In the forex market, the middle rate for USD/LKR spot contracts appreciated further during the week to close at Rs. 361.9226 against its previous week’s closing of Rs. 361.9686.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 44.60 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies.)