Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 22 June 2020 00:30 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

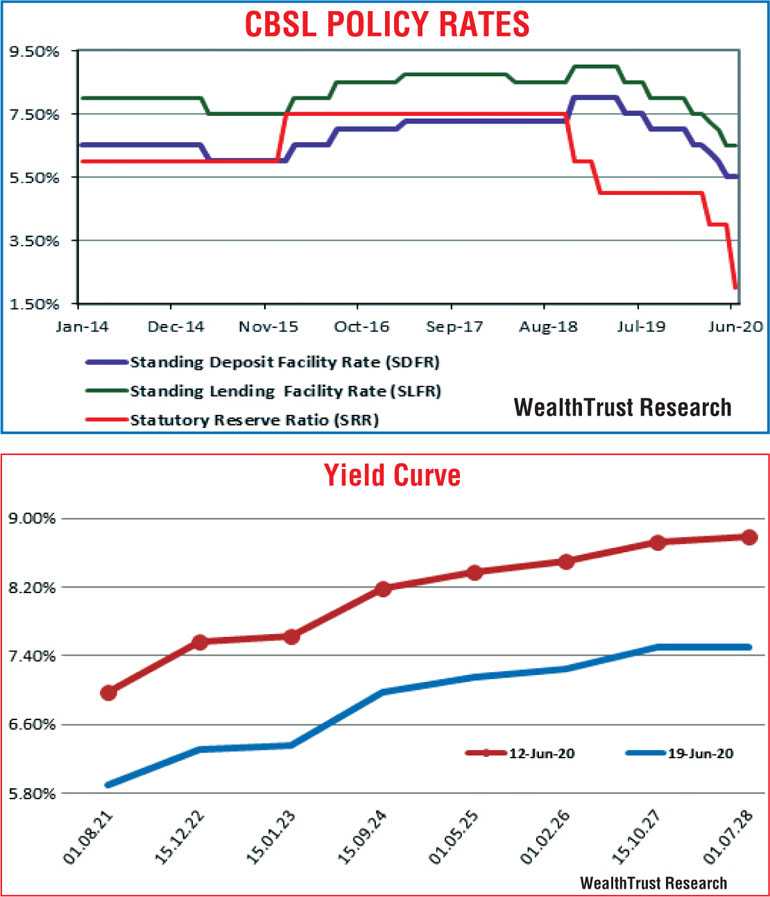

The sharp reduction in the SRR (Statutory Reserve Requirement) rate applicable for all rupee deposits in licensed commercial banks coupled with speculation of a policy rate cut led to secondary market bond yields crashing during the week ending 19 June, reflecting a steep parallel shift down of the overall yield curve on a week on week basis.

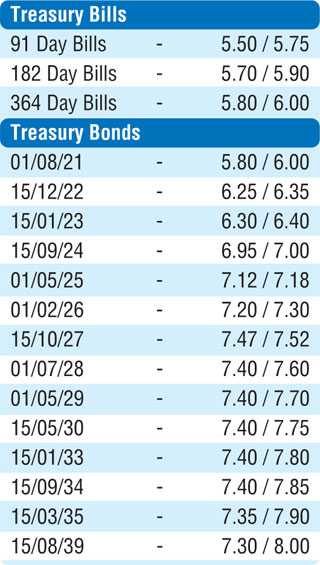

Vigorous buying interest on the liquid maturities of 15.12.22, 15.01.23, 15.09.24, 01.05.25, 01.02.26, and 15.10.27 saw its yields dip to weekly lows of 6.25%, 6.28%, 7.00%, 7.15%, 7.25%, and 7.42%, respectively, against its previous weeks closing levels of 7.55/58, 7.61/65, 8.15/20, 8.35/38, 8.48/52, and 8.68/75.

In addition, maturities of 15.12.21, 01.10.22, 15.07.23, 01.01.24, 15.03.25, and 01.08.26 dipped to lows of 5.95%, 6.28%, 6.45%, 6.85%, 7.15%, and 7.35% while in secondary bills, November to January 2021 traded at a low of 5.80% as well.

The momentum was even seen at the weekly Treasury bill auctions, at where weighted average rates decreased across the board by 37, 48 and 30 basis points, respectively, on the 91-day, 182-day and 364-day maturities.

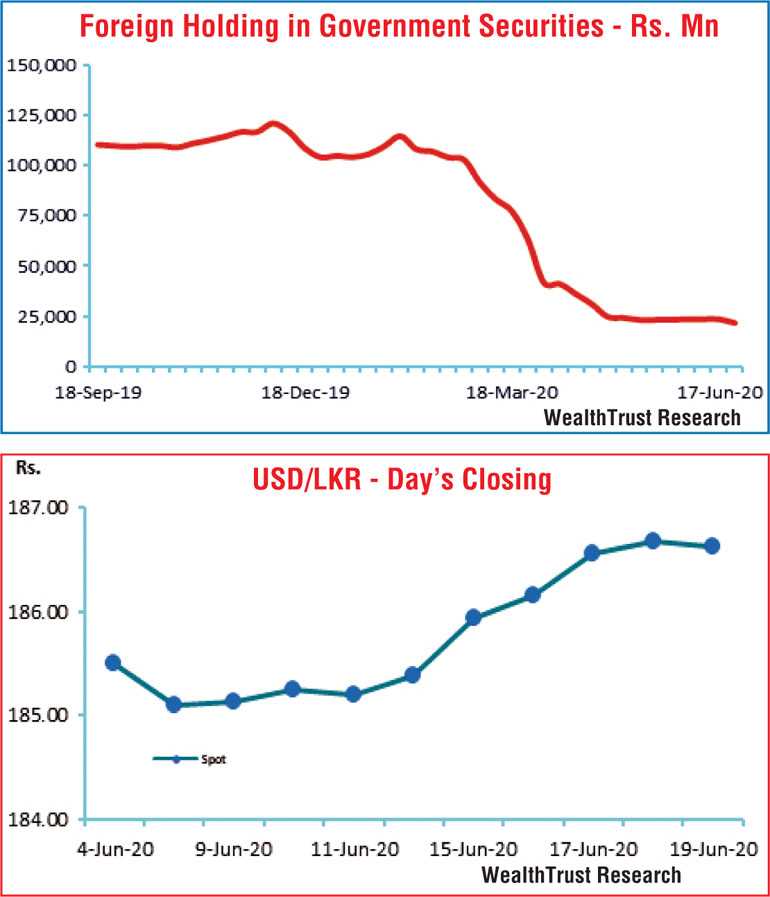

The foreign holding in rupee bonds decreased once again, recording an outflow of Rs. 1.9 billion for the week ending 17 June while its total holding stood at Rs. 21.61 billion.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged Rs. 24.21 billion.

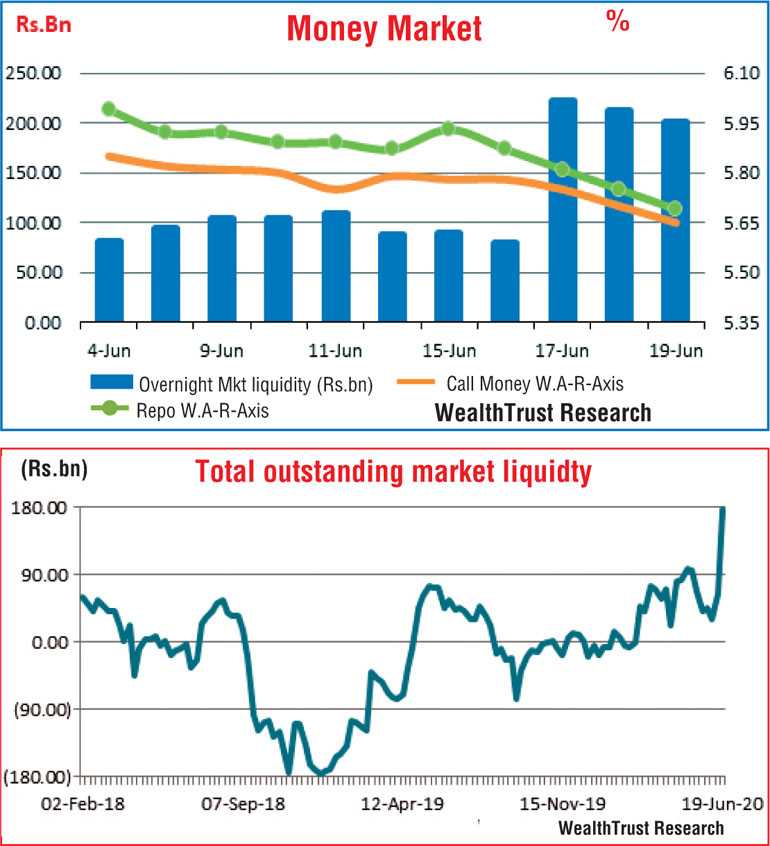

In money markets, the DOD (Domestic Operations Department) of the Central Bank refrained from conducting any auction during the latter-part of the week as the overall money market liquidity increased drastically to Rs. 177.18 billion following the SRR cut against its previous weeks of Rs. 63.69 billion.

It injected liquidity during the early part of the week for standalone primary dealers by way of six to seven-day reverse repo auctions at a weighted average rate of 6.50%. Weighted average on overnight call money and repo averaged 5.73% and 5.81% respectively for the week.

Rupee dips during the week

In forex markets, renewed buying interest by banks saw the USD/LKR on spot contracts depreciate during the week to hit a low of Rs. 186.95 before closing the week at the level of Rs. 186.60/65 against its previous week’s closing level of Rs. 185.30/45 on the back of continued buying interest by banks during the week. The daily USD/LKR average traded volume for the first four days of the week stood at $ 87.28 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)