Monday Feb 23, 2026

Monday Feb 23, 2026

Monday, 3 March 2025 04:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

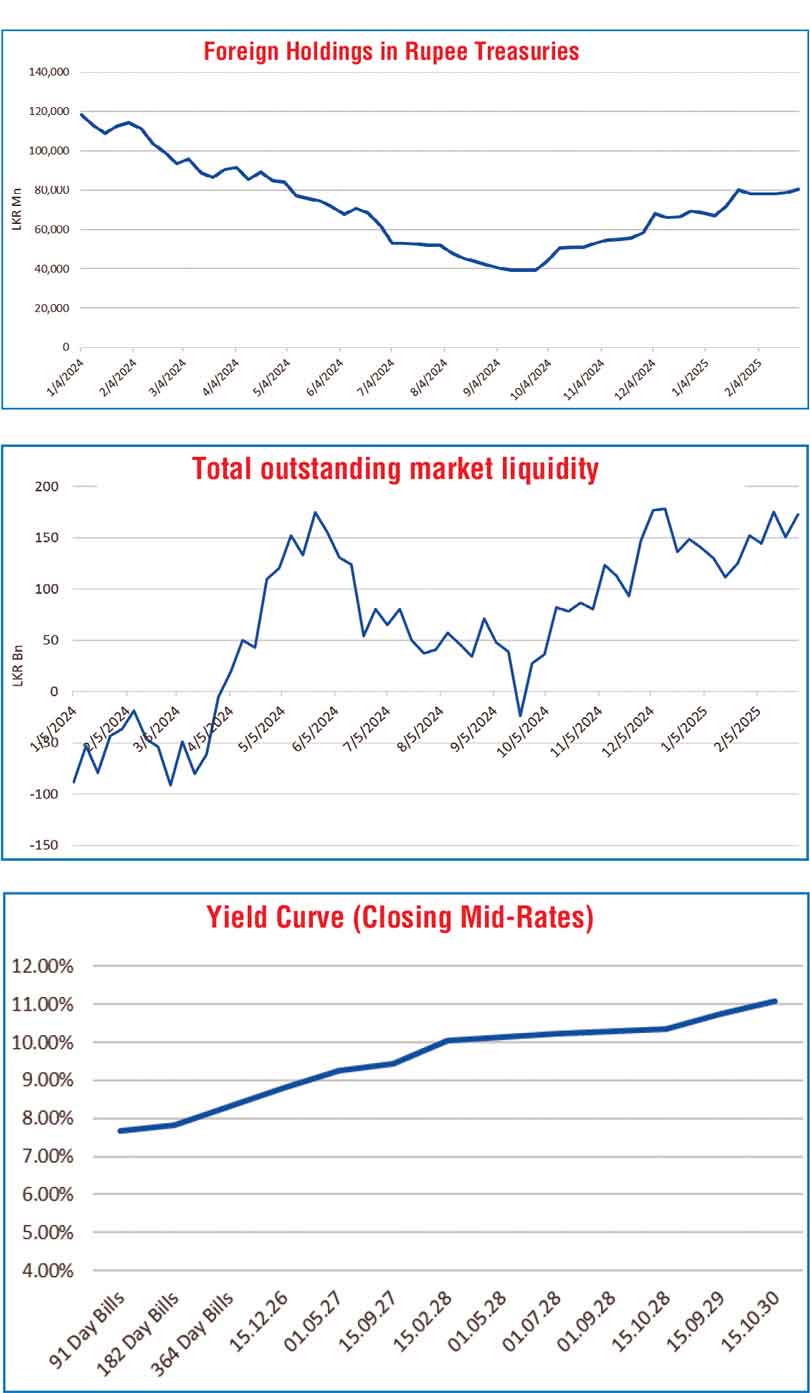

The Secondary Bond market commenced the week ending 28 February slowly, with yields initially edging up across the yield curve. However, the market quickly shifted gears and experienced a rally driven by buying interest that pushed yields lower, spurred by the bullish outcomes at the primary auctions. Demand was particularly concentrated on 2029 and 2030 tenors, leading to an increase in both activity and transaction volumes. However, profit-taking pressure at the tail end of the week on the shorter tenors i.e. 2026-2028 maturities saw yields pushed back up to close broadly steady week on week. In contrast, tenors of 2029 and beyond held ground, to reflect a dip week-on-week in terms of closing market two-way quotes. The resulting flattening of the yield curve came amidst a moderation in activity.

The yield on the 15.12.26 maturity was seen moving down from an intraweek high of 8.80% to a low of 8.75%. The 01.05.27 maturity was seen trading within the range of 9.18%-9.25%. The 2028 tenors saw rates either increase or hold steady. For example, the 15.02.28 maturity was seen trading within the range of 10.00%-10.05%. Whereas the 01.07.28 maturity saw rates increase from an intraweek low of 10.22% to a high of 10.28%, before settling at a closing quote of 10.20%/10.25%.

The medium tenor bonds saw concentrated buying. The 15.09.29 maturity was seen trading from a high of 10.80% to a low of 10.70%. The yield on the 15.10.30 maturity was seen declining down from an intraweek high of 11.15% to an intraweek low of 11.08%.

At the weekly Treasury Bill auction conducted last Tuesday: the weighted average yields across all three offered maturities declined for the 12th consecutive week. This marks a continued downward trend, with yields on at least one tenor decreasing over the past 16 weeks. Accordingly, the weighted average rates on the 91-day tenor dropped by 04 basis points to 7.57%, the 182-day tenor by 03 basis points to 7.87% and the 364-day tenor by 01 basis point to 8.31%. Total bids received exceeded the offered amount by 2.04 times, and the entire Rs 140.00 billion on offer was successfully raised in the 1st phase in competitive bidding. This was followed by a round of Treasury Bond auction conducted last Thursday. The auctions successfully raised the entire Rs. 27.50 billion offered at the first phase in competitive bidding. The total bids received exceeded the offered amount by a staggering 4.56 times.

In particular, the 15.06.29 maturity (11.75% coupon) recorded a resoundingly bullish outcome and was issued at a weighted average yield of 10.63%. This was well below its pre-auction rate of 10.68%/10.72% and trades at 10.70%. Maturity-wise the entire Rs 15.00 billion offered was snapped up at the first phase of subscription in competitive bidding.

The 15.12.32 maturity (11.50% coupon) was issued at the weighted average rate of 11.41%. This was also slightly below market, as a similar, slightly shorter tenor, 01.10.32 maturity was seen quoted at the two-way rate of 10.40%/10.48% just prior to the auction. The maturity also raised the entire Rs 12.50 billion on offer at the first phase.

The foreign holding in Rupee Treasuries recorded a net inflow for the third consecutive week amounting to Rs. 1.66 billion for the week ending 27 February 2025, and as a result the total holding notched up to Rs. 80.43 billion. As such the foreign holdings were seen reaching the highest level by crossing Rs 80.00 billion for the first time since early May 2024.

The daily secondary market Treasury Bond/Bill transacted volumes for the first three days of the week averaged at Rs. 22.63 billion.

In money markets, the total outstanding liquidity surplus increased to Rs. 172.65 billion as at the week ending 28 February 2025, from Rs. 150.59 billion recorded the previous week. The weighted average interest rates on call money and repo were recorded within the rates of 7.98% and 7.98%-8.00% respectively.

The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,511.92 billion as at the February 28, 2025, unchanged from the previous week’s closing level.

Forex market

In the Forex market, the USD/LKR rate on spot contracts was seen appreciating, to close the week at Rs. 295.27/295.30 as against its previous week’s closing level of Rs. 295.65/295.90 and subsequent to trading at a high of Rs. 295.26 and a low of Rs. 295.95.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 51.32 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)