Monday Feb 16, 2026

Monday Feb 16, 2026

Wednesday, 15 May 2024 00:15 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market yesterday remained active and saw yields continue to drop on the back of aggressive buying during morning hours of trading. Accordingly, the yield curve was seen making a parallel shift downwards, with the closing market two-ways steadily below the previous day. This was despite activity tapering off towards the end of the trading day, along with slight profit taking pressure. Trading continued to be focused on the short to medium end of the yield curve with a specific emphasis on 2026 to 2032 durations.

The secondary bond market yesterday remained active and saw yields continue to drop on the back of aggressive buying during morning hours of trading. Accordingly, the yield curve was seen making a parallel shift downwards, with the closing market two-ways steadily below the previous day. This was despite activity tapering off towards the end of the trading day, along with slight profit taking pressure. Trading continued to be focused on the short to medium end of the yield curve with a specific emphasis on 2026 to 2032 durations.

The popular 15.12.26 maturity was seen declining to a fresh low of 10.05% as against an opening high of 10.10%. The 2027 tenors 15.09.27 were also seen dropping to hit an intraday low of 10.25% as against an intraday low of 10.30%. The 2028 tenors rallied with demand pushing the 15.03.28, 01.05.28, 01.07.28 and 15.12.28 to trade at a low of 10.60 as against opening highs of 10.90% collectively. The medium tenor bonds saw bullish sentiment push down the 15.05.30 and 01.10.32 maturities to lows of 11.40% and 11.75% as against highs of 11.55% and 11.90% respectively.

The Treasury bill auction due today will see a total volume of only Rs. 177.50 billion on offer, an increase of Rs. 22.50 billion from the previous week. This will consist of Rs. 45.00 billion on the 91-day maturity, Rs. 77.50 billion on the 182-day and Rs. 55.00 billion on the 364-day maturities.

For context, at the weekly Treasury bill auction conducted last Wednesday (8 May 2024), weighted average yields declined across all three maturities for a fifth consecutive week, reaching the lowest levels in over two years. The 91-day bill fell by 18 basis points to 9.43%, the 182-day bill by 13 basis points to 9.76% and the 364- day by 09 basis points to 9.90%.

For context, at the weekly Treasury bill auction conducted last Wednesday (8 May 2024), weighted average yields declined across all three maturities for a fifth consecutive week, reaching the lowest levels in over two years. The 91-day bill fell by 18 basis points to 9.43%, the 182-day bill by 13 basis points to 9.76% and the 364- day by 09 basis points to 9.90%.

The total secondary market Treasury bond/bill transacted volume for 13 May was Rs. 20.77 billion.

In money markets, the weighted average rate on overnight call money was at 8.65% and repo was at 8.76%.

The net liquidity surplus stood at Rs. 173.63 billion yesterday as an amount of Rs. 0.18 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 9.50% against an amount of Rs. 173.82 billion deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.50%. Further, the DOD (Domestic Operations Department) of the Central Bank did not conduct any open market operations.

Forex Market

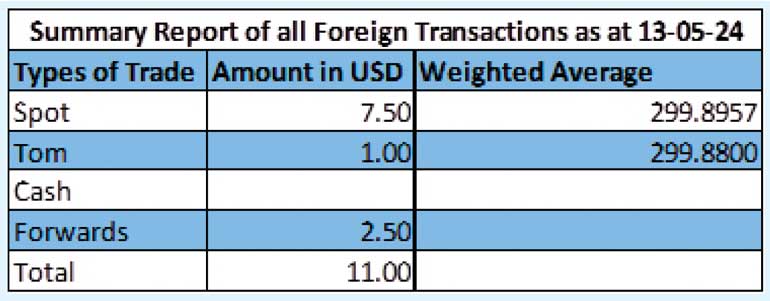

In the Forex market, the USD/LKR rate on spot contracts closed the day down at Rs. 301.00/302.00 against its previous day’s closing level of Rs. 300.20/301.00.

The total USD/LKR traded

volume for 13 May was US $ 11.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)