Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 14 August 2023 01:33 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

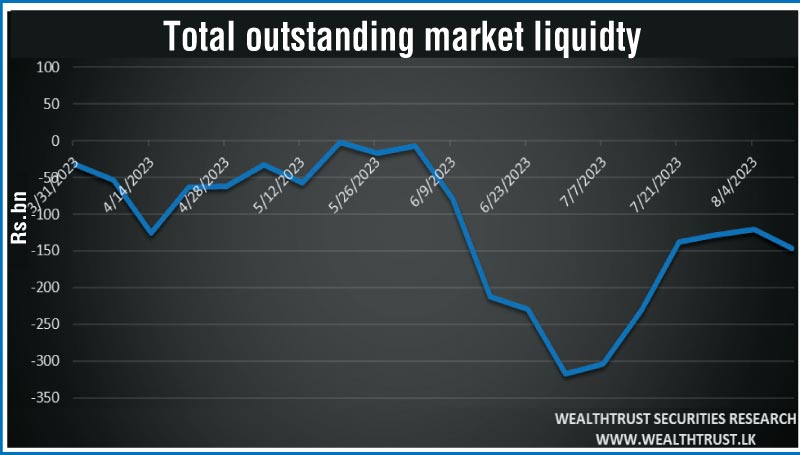

Sri Lanka’s Central Bank Monetary Board, in its 8 August meeting, decided to slash the Statutory Reserve Ratio (SRR) for Licensed Commercial Banks. The reduction, a significant 200 basis points from 4.00% to 2.00%, will take effect on the 16 August reserve maintenance period. This move seeks to bolster liquidity within the banking system, aligning with the Central Bank’s ongoing monetary policy stance.

Sri Lanka’s Central Bank Monetary Board, in its 8 August meeting, decided to slash the Statutory Reserve Ratio (SRR) for Licensed Commercial Banks. The reduction, a significant 200 basis points from 4.00% to 2.00%, will take effect on the 16 August reserve maintenance period. This move seeks to bolster liquidity within the banking system, aligning with the Central Bank’s ongoing monetary policy stance.

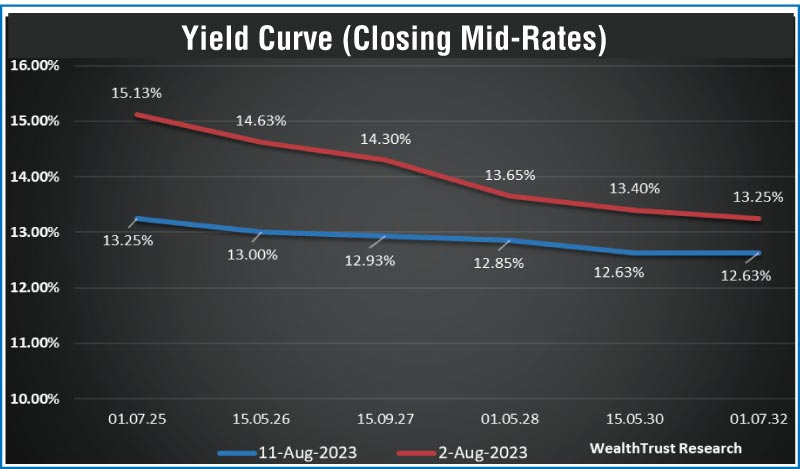

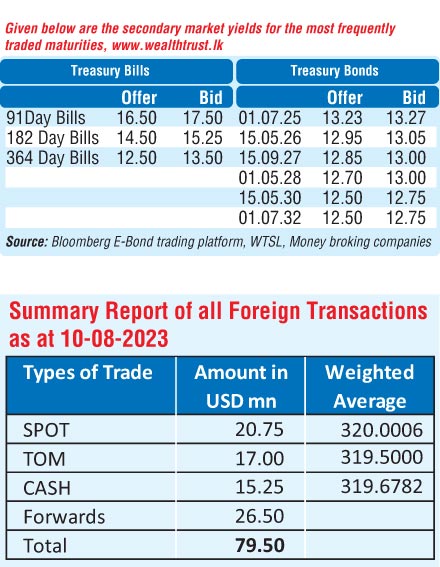

The secondary bond market remained active during the week ending 11 August, as aggressive buying interest following the policy rate cut announcement led to yields decreasing across the yield curve. The yields on the liquid maturities of 01.07.25, 15.05.26, 15.09.27, 15.05.30 hit intraweek lows of 13.00%, 12.50%, 11.90%, 11.00% respectively against its previous weeks closing levels of 14.90/10, 14.55/65, 14.32/40, 13.10/30. As such the yield curve experienced a downward shift but also continued to flatten relatively, when compared to the inversion seen at the start of the month of August.

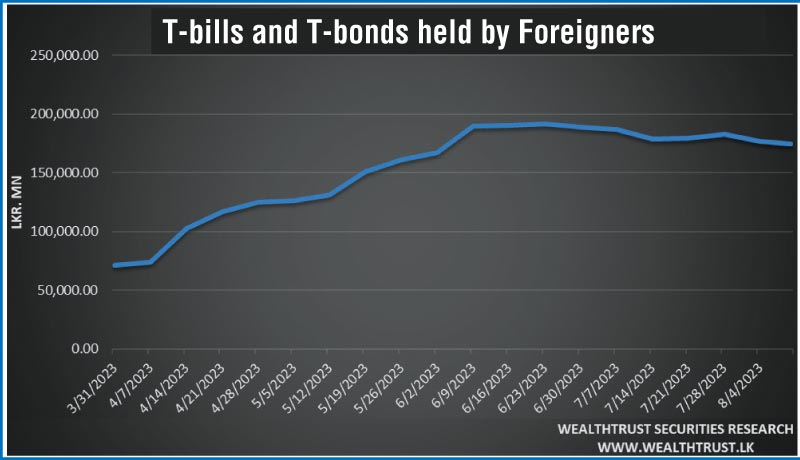

However, the foreign holding in rupee Treasury bills and bonds recorded a further decrease of Rs.1.94 billion for the week ending 11 August. This is the second consecutive week of net outflows, with last week also seeing a Rs. 5.97 billion reduction. The total foreign holding stands at Rs. 174.55 billion.

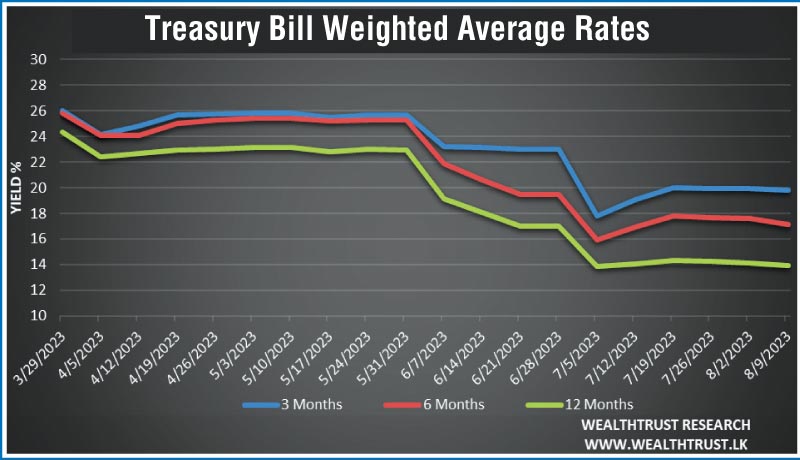

The weekly Treasury bill auction saw its weighted average rates decreasing across the board for a third consecutive week. An amount of Rs. 225 billion was accepted in total against a total offered amount of Rs. 180 billion.

The secondary market traded volume for the first 4 trading days stood at Rs. 46.65 billion.

In money markets, the total outstanding liquidity deficit worsened to Rs. 145.94 billion by the end of the week against its previous weeks of Rs. 121.28 billion while the Domestic Operations Department (DOD) of Central Bank continued to inject liquidity during the week by way of overnight to 7-day Reverse repo auctions at weighted average yields ranging from 11.47% to 12.00%.

The Central Bank of Sri Lanka’s (CBSL) holding of Gov. Security was registered at Rs. 2,649.07 billion against its previous weeks of Rs. 2,699.79 billion.

In the Forex market, the USD/LKR rate on spot contracts was seen appreciating during the week to close the week at Rs.319.50/320.50 against its previous weeks closing level of Rs. 322.00/324.00, subsequent to trading at a low of Rs.323.00 and a high of Rs.319.00.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 52.61 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)