Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 6 February 2023 00:25 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary market bond yields fluctuated once again during the week ending 3 February as yields increased during the first half of the week on the back of primary auction outcomes where both the T-bond and T-bill auctions went undersubscribed.

The secondary market bond yields fluctuated once again during the week ending 3 February as yields increased during the first half of the week on the back of primary auction outcomes where both the T-bond and T-bill auctions went undersubscribed.

The bond auction went undersubscribed as only Rs. 67.91 billion was accepted in total against a total offered volume of Rs. 70 billion while at the 1st Phase of the weekly bill auction, only an amount of Rs. 45.61 billion was accepted in total against its total offered amount of Rs. 120 billion.

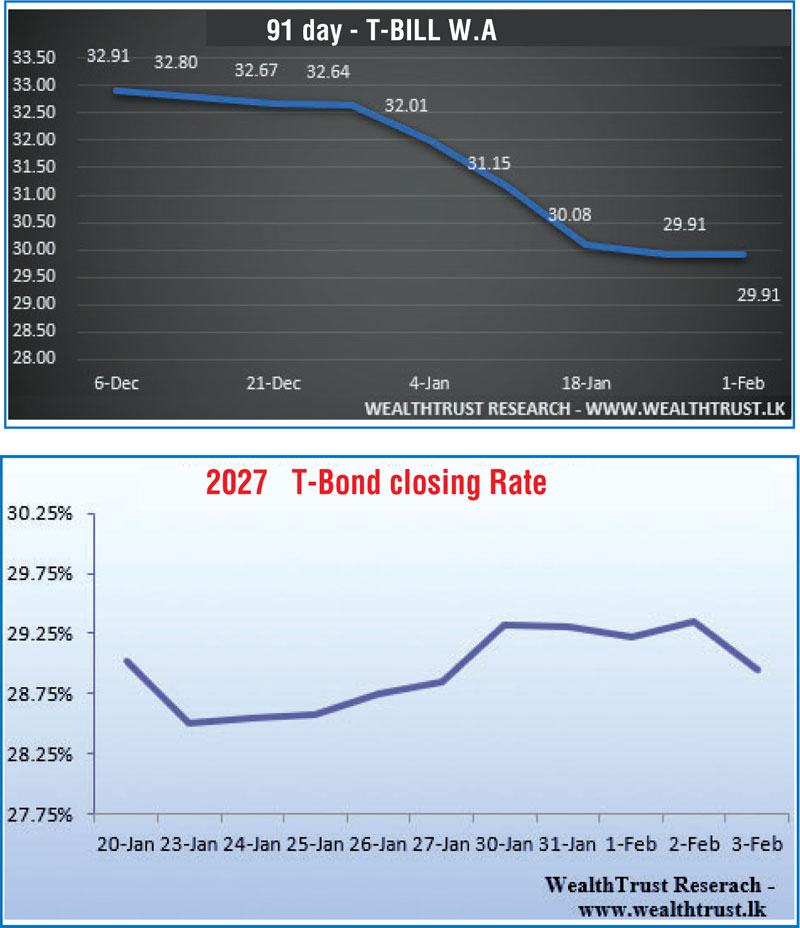

The weighted average rate on the 01.07.2025 bond maturity was registered at 32.19%, significantly higher that a pre-auction yields while weighted average rates on the 91-day bill and 182-day bill remained steady for the first time in eight weeks, halting a decreasing trend witnessed over the last seven weeks.

However, renewed buying interest towards the later part of the week on the back of developments on the IMF front with regard to its Extended Fund Facility (EFF) to Sri Lanka and results of the phase II of the weekly bill auction where a further amount of Rs. 83.82 billion was raised, led to yields declining once again but still end the week higher than its previous week’s closings.

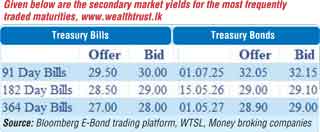

Yields of the 01.07.25, 15.05.26 and 01.05.27 bond maturities were seen increasing to weekly highs of 32.85%, 29.50% and 29.35% respectively during the early part of the week against its previous weeks closing level of 30.50/31.00, 28.80/90 and 28.70/00. On the downward movement, the said maturities hit lows of 32.10%, 29.10% and 28.90% respectively. In addition, maturities of 01.05.24, 15.09.27 and 15.01.28 changed hands at levels of 31.75% to 31.80%, 28.75% to 29.10% and 27.00% respectively as well.

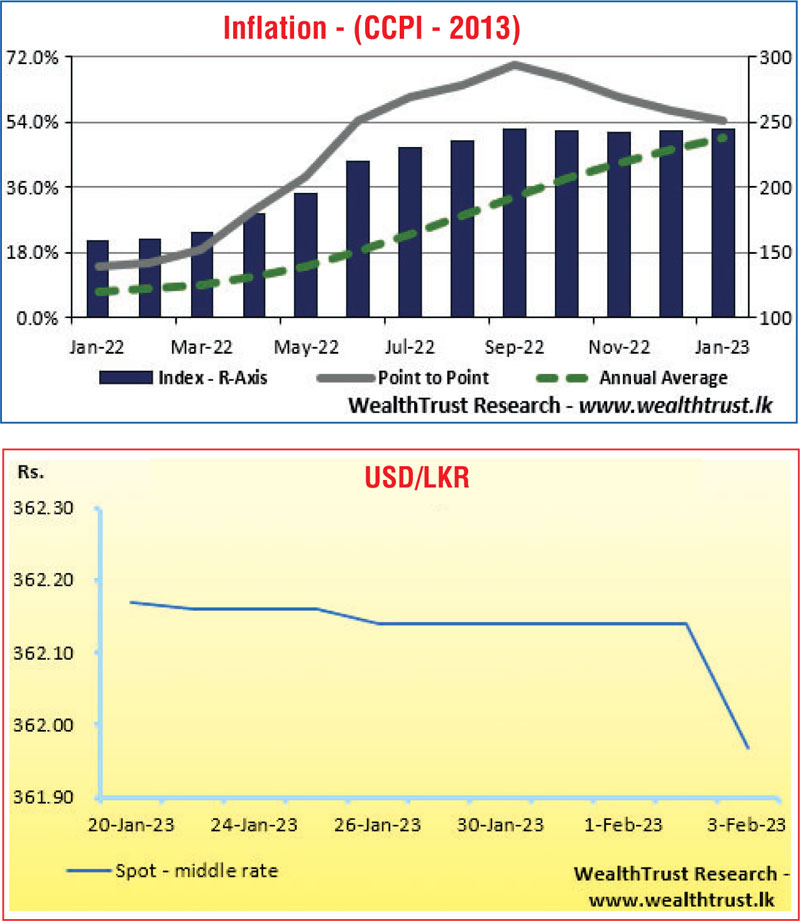

The Colombo Consumer Price Index (CCPI; Base 2013=100) for the month of January decreased further to 54.2% on its point to point against its previous month’s figure of 64.3%.

The foreign holding in rupee bonds remained steady at Rs. 25.48 billion for the week ending 1 February while the daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 32.54 billion.

In money markets, the overnight net liquidity figure continued to fluctuate during the week due to the restriction imposed on CBSL’s Standing Deposit Facility while the total outstanding liquidity deficit was registered at Rs. 297.63 billion by the end of the week against its previous week’s of Rs. 326.24 billion. The CBSL’s holding of Government Securities stood at Rs. 2,558.61 billion.

USD/LKR

In the forex market, the middle rate for USD/LKR spot contracts appreciated during the week to close at Rs. 361.9686 against its previous week’s closing of Rs. 362.14.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 35.11 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)