Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 24 May 2021 00:05 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

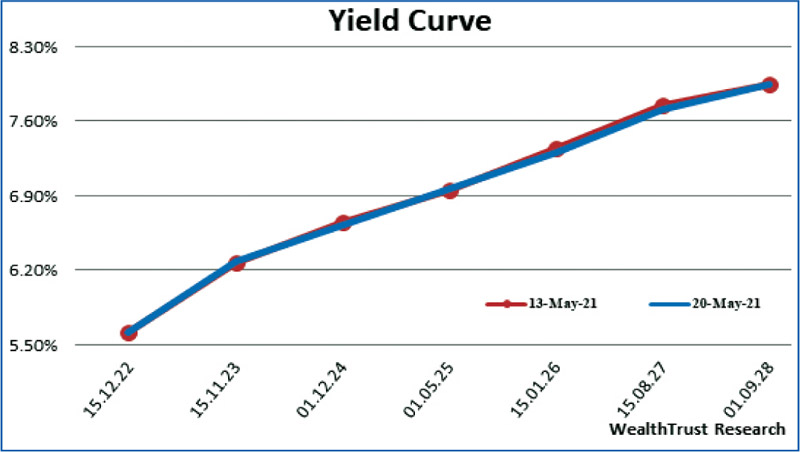

The secondary bond market yields seesawed during the week ending 21 May 2021, decreasing during the early part of the week and increasing towards the latter part of the week once again.

The secondary bond market yields seesawed during the week ending 21 May 2021, decreasing during the early part of the week and increasing towards the latter part of the week once again.

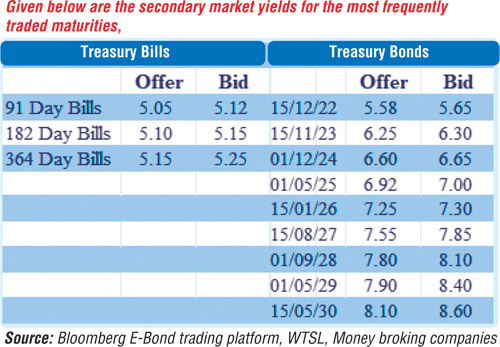

Activity mainly centred on the short end of the yield curve as yields on the liquid maturities of 2022’s (i.e. 01.10.22 and 15.12.22), 2023’s (i.e. 15.07.23 and 15.11.23), 01.12.24 and 01.05.25 were seen decreasing during the early part of the week to weekly lows of 5.57%, 5.58%, 6.10%, 6.19%, 6.58% and 6.88%, respectively, against their previous weeks closing levels of 5.55/60, 5.60/62, 6.15/20, 6.25/28, 6.60/70 and 6.92/97 on the back of the 364-day bill cut off rate held steady at 5.18% for a fifth consecutive week.

The positive outcome at the weekly Treasury bill auction, where the total accepted amount increased to a high of 90.28% of its total offered amount against its previous weeks 44.70% helped boost sentiment as well.

Nevertheless, profit-taking following the outcome of the monitory policy statement, at where policy rates were held steady for a consecutive seventh announcement led to renewed selling interest. Yields increased once again with the maturities of 2023’s (i.e. 15.07.23 and 15.11.23) and 01.12.24 hitting highs of 6.15%, 6.27% and 6.64%, respectively. In addition, maturities of 15.11.22, other 2023’s (i.e. 15.01.23, 15.03.23, 15.05.23 and 01.09.23), 15.09.24, 01.08.25, 2026’s (i.e. 15.01.26,01.02.26 and 01.08.26), 01.07.28 and 15.05.30 changed hands at levels of 5.60%, 5.65%, 5.80%, 6.05% to 6.06%, 6.20% to 6.23%, 6.50% to 6.52%, 7.04%, 7.30% to 7.36%, 7.25% to 7.32%, 7.50% to 7.52%, 7.97% and 8.10%, respectively, as well. In secondary market bills, durations centring July, August and October 2021 maturities changed hands at levels of 5.01% to 5.02%, 5.00% to 5.12% and 5.11% to 5.15%, respectively.

Today’s Treasury bill auction, conducted two day ahead due to a shortened trading week, will have on offer a total amount of Rs. 39 billion, consisting of Rs. 8 billion on the 91-day, Rs. 12 billion on the 182-day, and Rs. 19 billion on the 364-day maturities. At its last week’s auction, weighted average yields remained steady across the board at 5.12%, 5.14% and 5.18%, respectively. The stipulated cut off rate on the 364-day maturity remained steady at 5.18% for a sixth consecutive week while the maximum yield rates of the 91 day and 182-day maturities will be decided below the level of the 364-day maturity at the auction.

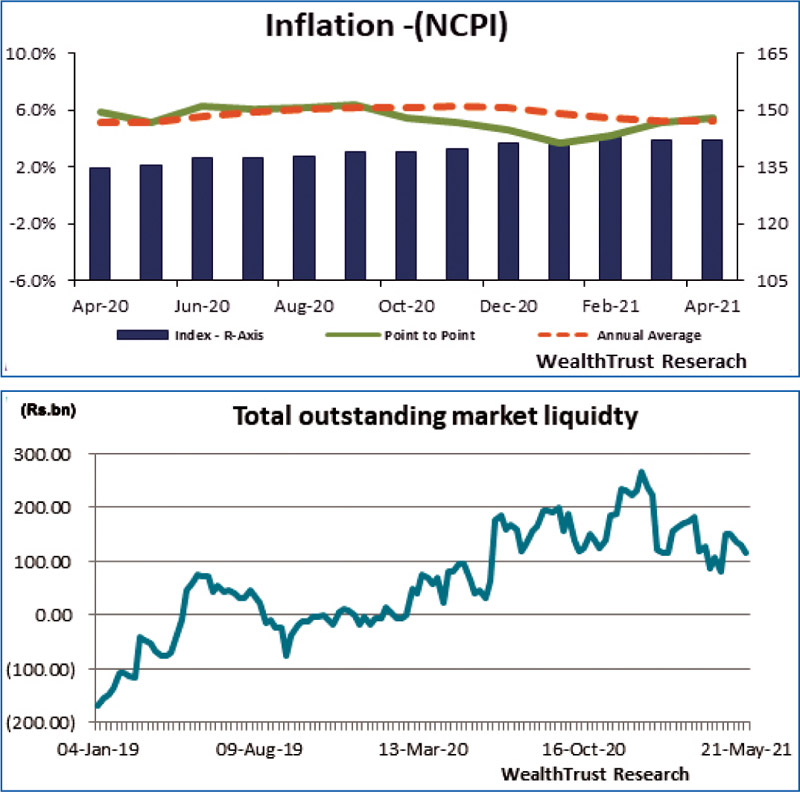

Meanwhile, the National Consumer Price Index (NCPI) was seen increasing for a third consecutive month to register 5.5% on its point to point for the month of April against 5.1% recorded in March. The annualised average remained steady at 5.3%. The foreign holding in Rupee bonds remained steady at Rs. 5.29 billion for the week ending 19th May 2021.

In money markets, the total outstanding liquidity surplus decreased for a third consecutive week to Rs. 116.42 billion against its previous week’s Rs. 130.56 billion while CBSL’s holding of Government securities decreased to Rs. 861.73 billion against its previous weeks of Rs. 874.02 billion. The weighted average rates on overnight call money and repo remained mostly unchanged to average 4.67% and 4.69%, respectively, for the week.

USD/LKR

In the Forex market, USD/LKR rate on spot contracts traded at the level of Rs. 199.99 during the early part of the week while the overall market remained inactive during the week.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 91.33 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)