Tuesday Feb 03, 2026

Tuesday Feb 03, 2026

Monday, 13 December 2021 02:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market yields fluctuated during the week ending 10 December, initially decreasing during the first half of the week and then edging up marginally towards the latter part of the week.

The secondary bond market yields fluctuated during the week ending 10 December, initially decreasing during the first half of the week and then edging up marginally towards the latter part of the week.

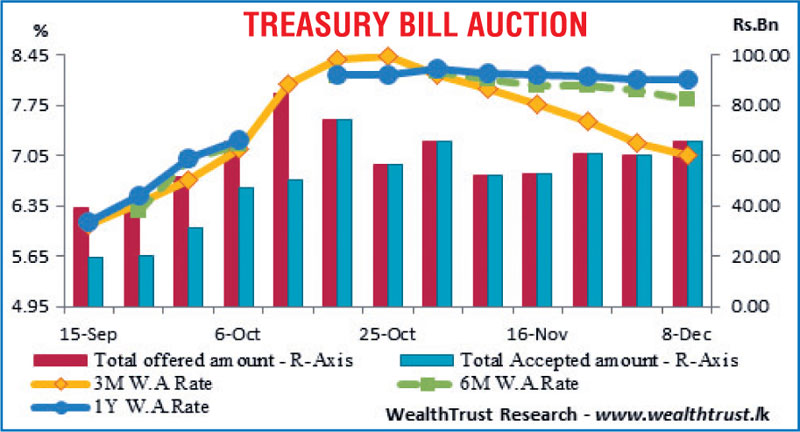

The expectation and final outcome of the weekly Treasury bill auction at where weighted averages declined across all three maturities for a fifth consecutive week led to yields on the liquid maturities of 01.12.24, 15.03.25, 15.01.26, 15.01.27 and 15.05.30 decreasing to weekly lows of 8.90%, 9.31%, 9.70%, 10.06% and 11.08% respectively against its previous weeks closing levels of 8.95/02, 9.45/50, 9.88/93, 10.28/32 and 11.30/40.

However, selling interest due to profit taking saw yields edge up once again to 8.99%, 9.40% and 9.90% on the liquid 01.12.24, 15.03.25 and 15.01.26 maturities to close the week marginally higher. Activity was also witnessed on the 15.01.23 maturity within the range of 8.00% to 8.10%.

The T-Bond auctions scheduled for today will see an amount of Rs. 120 billion on offer in lieu of an Rs. 117.78 billion maturity due on 15 December 2021. The auction will consist of Rs. 25 billion of a 01.05.2025 maturity, Rs. 20 billion each of a 15.10.2027 and 01.01.2029 maturity and a further Rs. 55 billion of a 15.03.2031 maturity. The weighted average yields at the bond auctions conducted on 29th November 2021 for the maturities of 15.03.2025 and 15.05.2030 were recorded at 9.67% and 11.63% respectively. In addition, an amount of Rs. 3 billion was successfully issued under the Direct Issuance window on the 15.05.2030 maturity.

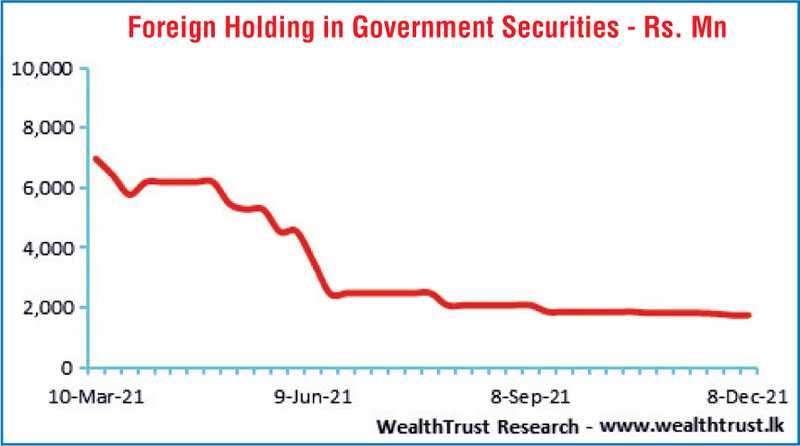

The foreign holding in rupee bonds remained mostly unchanged at Rs. 1.75 billion for the week ending 8 December while the daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 14.20 billion. In money markets, the Domestic Operations Department (DOD) of Central Bank was seen conducting outright sales of Treasury bills during the week for periods ranging from 84 days to 98 days at weighted averages ranging from 7.00% to 7.02%. Furthermore, Repo auctions were conducted during the week on overnight and 7 days at weighted average yields of 5.98% to 5.99%.

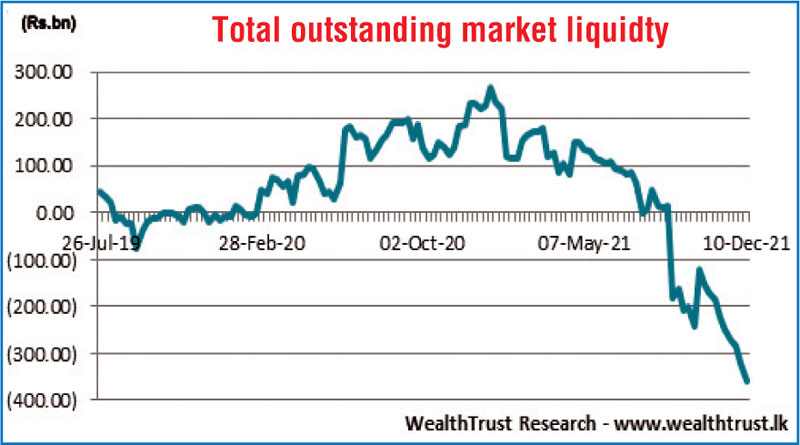

The declining trend in the total outstanding liquidity continued during the week to register a shortfall of Rs. 358.89 billion by the end of the week against its previous weeks Rs. 319.30 billion while CBSL’s holding of Government Securities continued to decrease to record Rs. 1,392.38 billion against its previous weeks Rs. 1,414.67 billion. The weighted average rates on overnight call money and repo were 5.92% and 5.97% respectively for the week.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts traded at levels of Rs. 202.97 to Rs. 203.00 during the week.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 39.80 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)