Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 2 April 2024 01:22 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market commenced the week on a subdued note, with a complete standstill for much of the day, apart from a few transactions earlier on. The market overall saw two-way quotes move sideways, with yields holding broadly steady and relatively low volumes transacted.

Accordingly limited trades were observed on 2026 tenors (15.05.26 and 15.12.26) within the range of 11.30% to 11.28%. While the liquid 2028 tenor traded at 12.15%. The relatively longer tenor 15.03.31 was also seen changing hands at the rate of 12.35%.

Meanwhile in secondary market bill transactions, short term April 2024 maturities were seen changing hands within 9.50% on the back of substantial volumes. Additionally, July 2024 bills were seen trading at 10.15% also on the back of considerable volumes.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.69% and 8.90% respectively. The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight repo auction for Rs. 53.22 billion at the weighted average rates of 8.60% respectively.

Forex Market

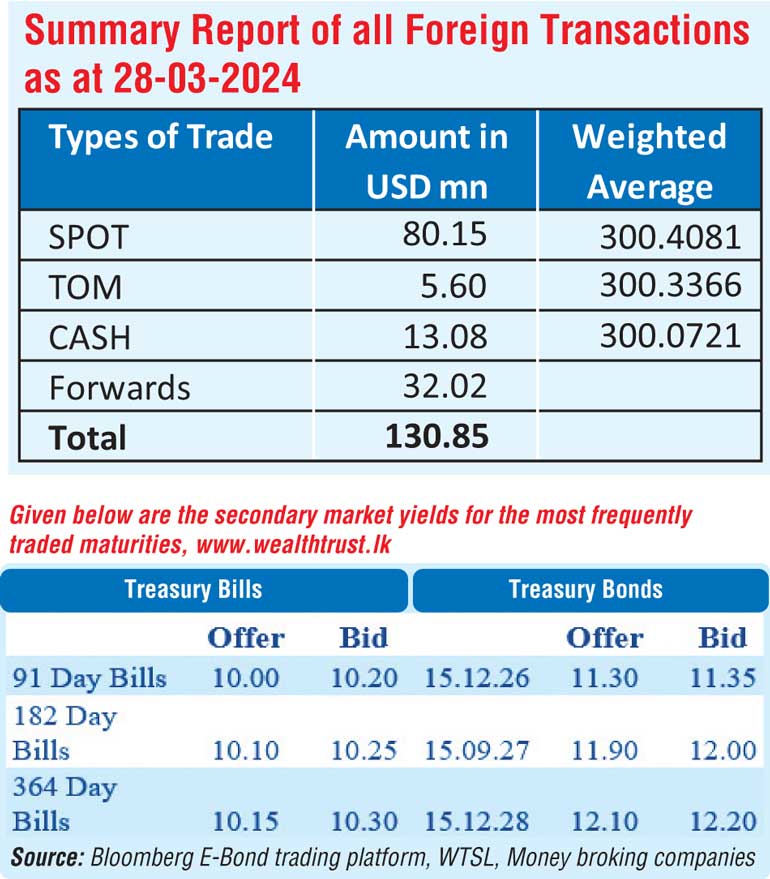

In the Forex market, the USD/LKR rate on spot contracts closed the day up at Rs. 300.00/300.05 against its previous day’s closing level of Rs. 300.40/300.50.

The total USD/LKR traded volume for 28 March was $ 130.85 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)