Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 23 January 2023 00:05 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The sharp drop in the weekly Treasury bill weighted averages, developments on the IMF front with regard to its Extended Fund Facility (EFF) to Sri Lanka coupled with restriction imposed on CBSL’s Standing Deposit Facility (SDF) of 14.50% for Licensed Commercial Banks (LCB) with effect from 16 January reflected positively on the trading sentiment in the secondary bond market during the short trading week ending 20 January.

The sharp drop in the weekly Treasury bill weighted averages, developments on the IMF front with regard to its Extended Fund Facility (EFF) to Sri Lanka coupled with restriction imposed on CBSL’s Standing Deposit Facility (SDF) of 14.50% for Licensed Commercial Banks (LCB) with effect from 16 January reflected positively on the trading sentiment in the secondary bond market during the short trading week ending 20 January.

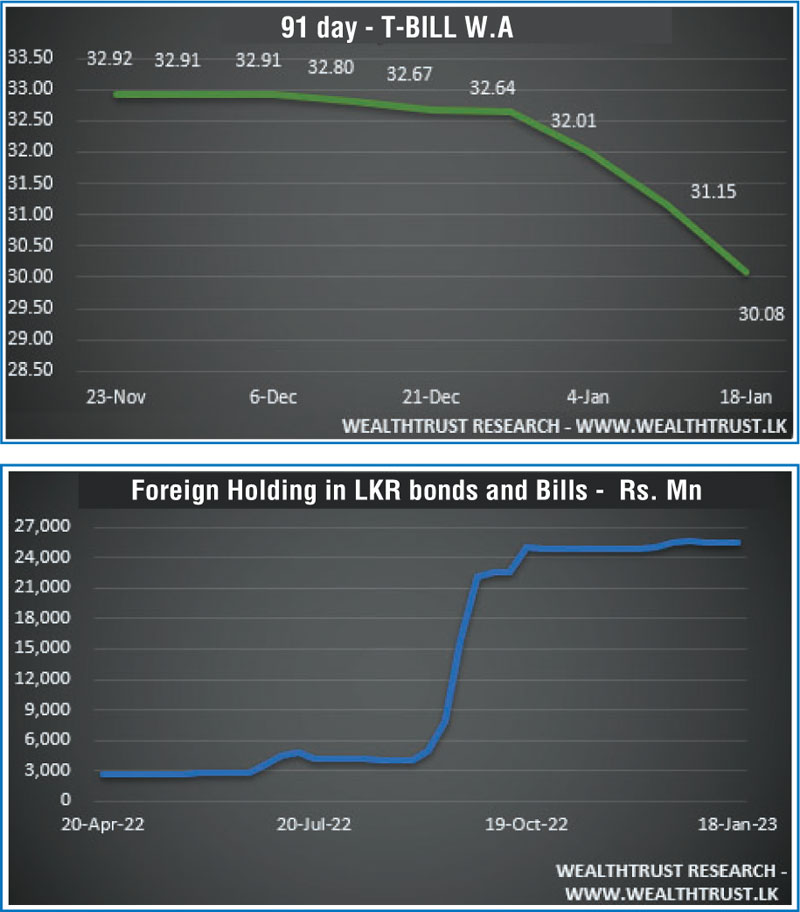

At the weekly Treasury bill auction, the 182-day bill weighted average tumbled by 230 basis points to 29.07% while the weighted averages on the 91-day and 364-day maturities dipped by 107 and 79 basis points respectively to 30.08% and 28.25%. Total offered amount of Rs. 95 billion was fully subscribed at its 1st phase of the auction while a further amount of Rs. 23.75 billion was taken at its 2nd phase.

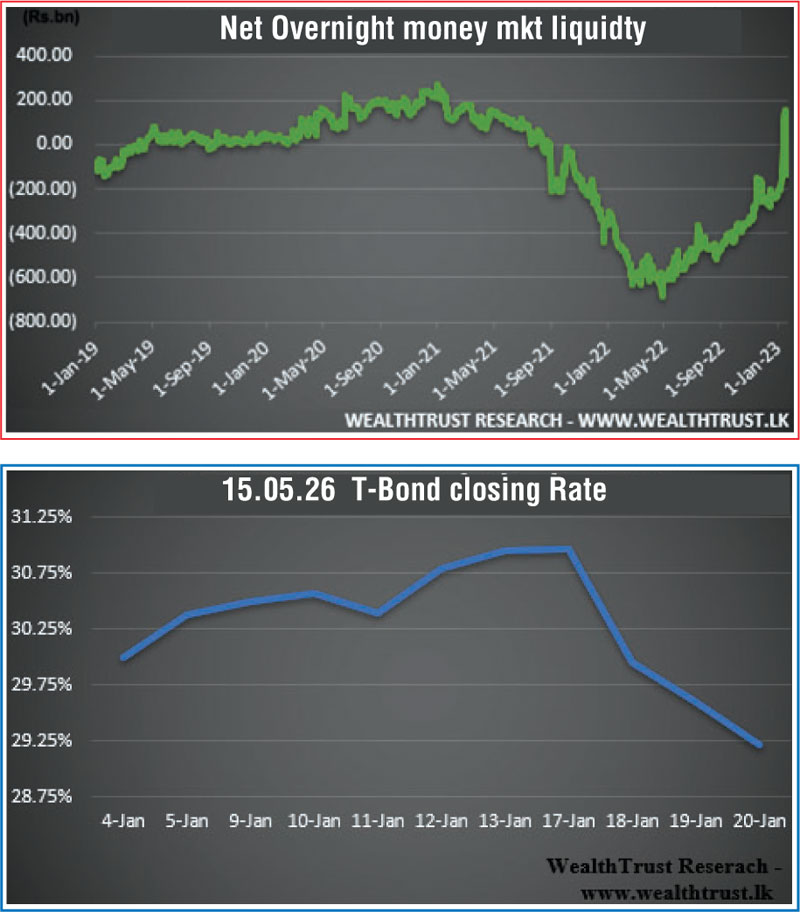

In the secondary bond market, the yields of the liquid maturities of 15.05.26 and 15.09.27 were seen decreasing to weekly lows of 29.00% and 28.50% respectively against its previous week’s closing levels of 30.80/10 and 27.75/95. In addition, 01.05.24 and 15.01.25 maturities dipped to weekly lows of 30.80% and 30.25% respectively against its previous week’s closings of 32.00/25 and 31.00/25, leading to a shift downwards on the short end of the yield curve.

The foreign holding in rupee bonds stood at Rs. 25.42 billion for the week ending 18 January while the daily secondary market Treasury bond/bill transacted volumes for the first three trading days of the week averaged Rs. 38.36 billion.

In money markets, the overnight net liquidity fluctuated during the week due to the restrictions imposed on CBSL’s Standing Deposit Facility while CBSL’s holding of Government Securities decreased marginally to Rs. 2,548.99 billion from its previous week’s Rs. 2,594.32 billion. The week ended with a net overnight surplus of Rs. 136.92 billion while the overall liquidity was a deficit of Rs. 333.59 billion.

USD/LKR

In the forex market, the middle rate for USD/LKR spot contracts stood at Rs. 362.1694 at the end of the week against its previous week’s closing of Rs. 362.24.

The daily USD/LKR average traded volume for the first three days of the week stood at $ 45.27 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)