Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 1 April 2022 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

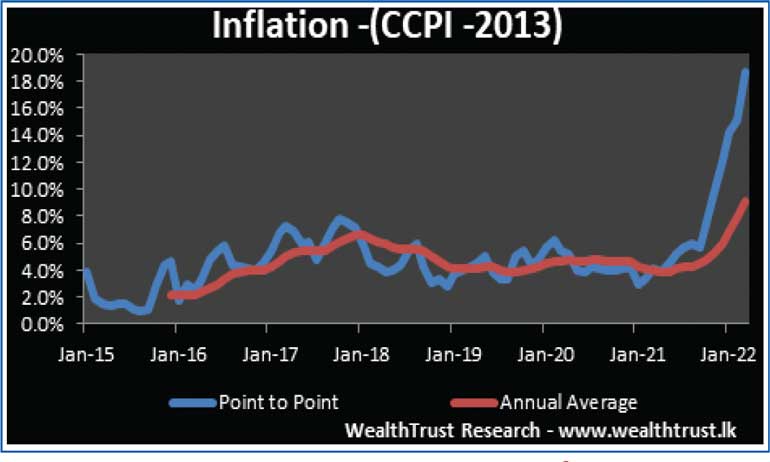

The Colombo Consumer Price Index or CCPI which was reconstructed in 2016 with a base of 2013=100 recorded its highest level yesterday on its point to point by exceeding the 18.00% psychological level for the first time (CCPI; Base 2013=100) to be recorded at 18.7% against its previous months 15.1%. The annual average rate too increased to 9.1% from 7.9%.

psychological level for the first time (CCPI; Base 2013=100) to be recorded at 18.7% against its previous months 15.1%. The annual average rate too increased to 9.1% from 7.9%.

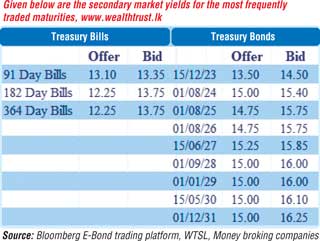

The secondary bond market continued to be inactive yesterday with only the 01.08.24 maturity changing hands at a level of 15.40% against its previous day’s closing level of 14.85/25 while two way quotes on the rest of the yield curve edged up. In the secondary bill market, the latest 91 day bill traded at levels of 13.25% to 13.35%.

The total secondary market Treasury bond/bill transacted volume for 30 March was Rs. 34.26 billion.

In money markets, the weighted average rates on overnight Call money and REPO was at 7.49% and 7.50% respectively as an amount of Rs. 668.39 billion was withdrawn from Central Banks Standard Deposit Facility Rate (SDFR) of 7.50%. The net liquidity deficit was registered at Rs. 612.84 billion yesterday as an amount of Rs. 130.56 billion was deposited at Central Banks Standard Lending Facility Rate (SLFR) of 6.50%.

Furthermore, the Domestic Operations Department (DOD) of the Central Bank of Sri Lanka was seen injecting an amount of Rs. 75.00 billion by way of a 7 day reverse Repo auction at a weighted average rate of 7.50%.

Forex market

The forex market remained inactive yesterday. The total USD/LKR traded volume for 30 March was $ 34.94 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)