Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 21 August 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

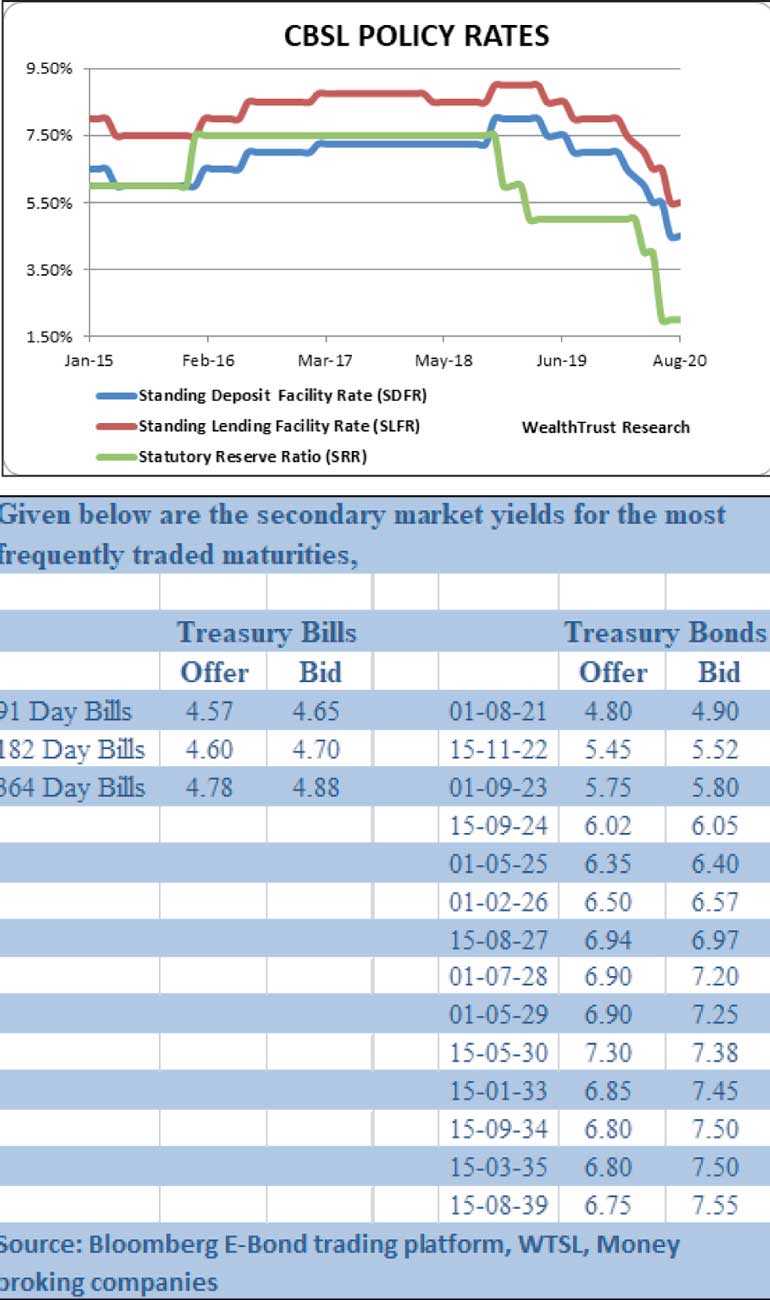

The secondary market bond yields were seen closing the day broadly steady yesterday in comparison to its previous day’s closings, subsequent to increasing during morning hours of trading. The Central Bank of Sri Lanka was seen holding its policy rates steady at 4.50% and 5.50% at its announcement yesterday.

In the secondary bond market, selling interest during morning hours of trading saw yields on the 2022s (i.e. 15.11.22 & 15.12.22), 2023s (i.e. 15.01.23 & 01.09.23), 15.09.24, 01.05.25 and 15.08.27 increase to intraday highs of 5.62%, 5.60%, 5.65%, 5.90%, 6.12%, 6.45% and 7.00% respectively against its previous days closings of 5.45/52, 5.47/53, 5.50/55, 5.75/83, 6.05/10, 6.32/38 and 6.93/98. However, buying interest from these levels onwards saw yields dip once again on the said maturities to daily lows of 5.50% each, 5.55%, 5.80%, 6.05%, 6.40% and 6.94% respectively. In secondary bills, November 2020 and March 2021 maturities were seen changing hands at levels of 4.59% to 4.60% and 4.70% to 4.71% respectively.

The total secondary market Treasury bond/bill transacted volumes for 19 August was Rs. 40.22 billion.

In the money market, overnight call money and Repo averaged 4.53% and 4.54% respectively yesterday as the surplus liquidity stood at Rs. 196.26 billion.

Rupee appreciates subsequent to fluctuating

The USD/LKR rate on spot contracts was seen closing the day higher at Rs. 184.30/50 yesterday subsequent to hitting an intraday low of Rs. 187.10 and against its previous day’s closing of Rs. 185.90/20.

The total USD/LKR traded volume for 19 August was $ 94.37 million.

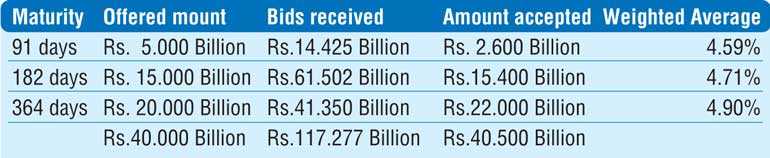

Please note we regret the error on the details of the bill auction published on 19/08/2020. Given herein are the correct details.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)