Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 2 November 2020 02:21 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market went through a week of sporadic activity due to most market participants seen on the sidelines with limited trades taking place within a steady range across the yield curve.

The secondary bond market went through a week of sporadic activity due to most market participants seen on the sidelines with limited trades taking place within a steady range across the yield curve.

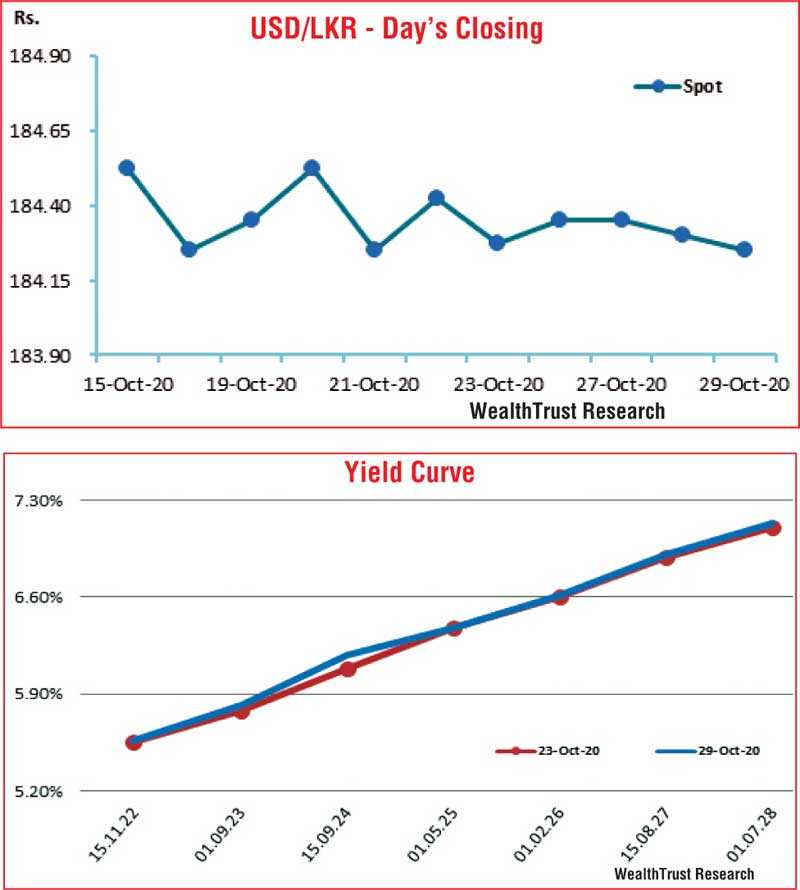

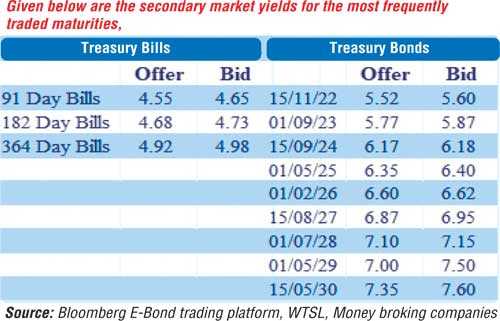

The limited activity during the shortened trading week ending 29 October, centred on the liquid maturities of 2022’s (i.e. 15.11.22 and 15.12.22), 2023’s (i.e. 15.07.23, 01.09.23 and 01.10.23), 15.09.24, 01.02.26 and 2027’s (i.e. 15.08.27 and 15.10.27) at levels of 5.58% to 5.61%, 5.82% to 5.95%, 6.10% to 6.18%, 6.55% to 6.64% and 6.89% to 6.99% respectively. The demand for secondary market bills saw September and October 2021 maturities change hands from weekly highs of 4.85% and 4.93% respectively to lows of 4.79% and 4.92%.

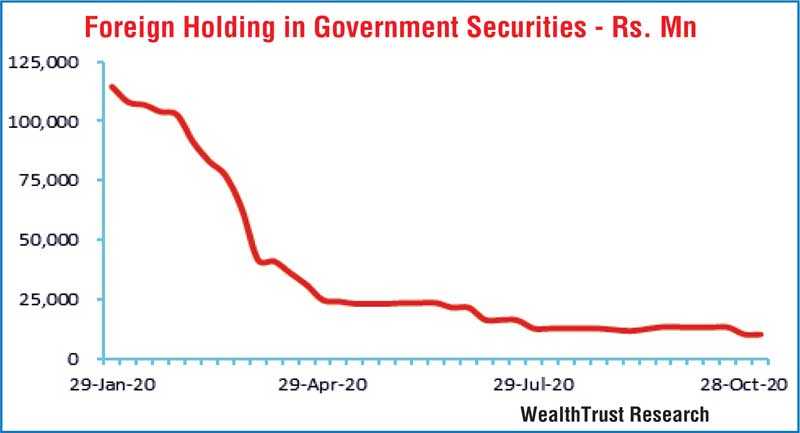

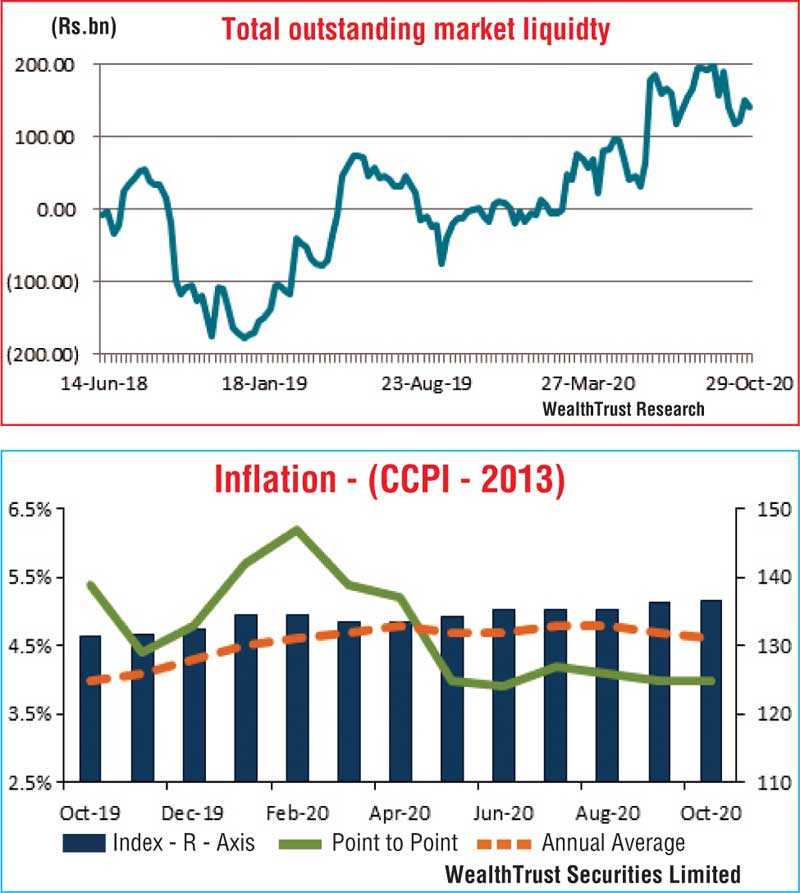

Meanwhile, the total subscription for the weekly Treasury bill auction was seen falling short of its total offered amount for the first time in two weeks once again while the foreign holding in Rupee bonds recorded a minute increase of Rs. 0.26 million for the week ending 28 October 2020. Furthermore, inflation (CCPI) for the month of October remained steady at 4.00% on the basis of its point to point. Its annual average decreased for a second consecutive month to 4.6% against its previous month of 4.7%.

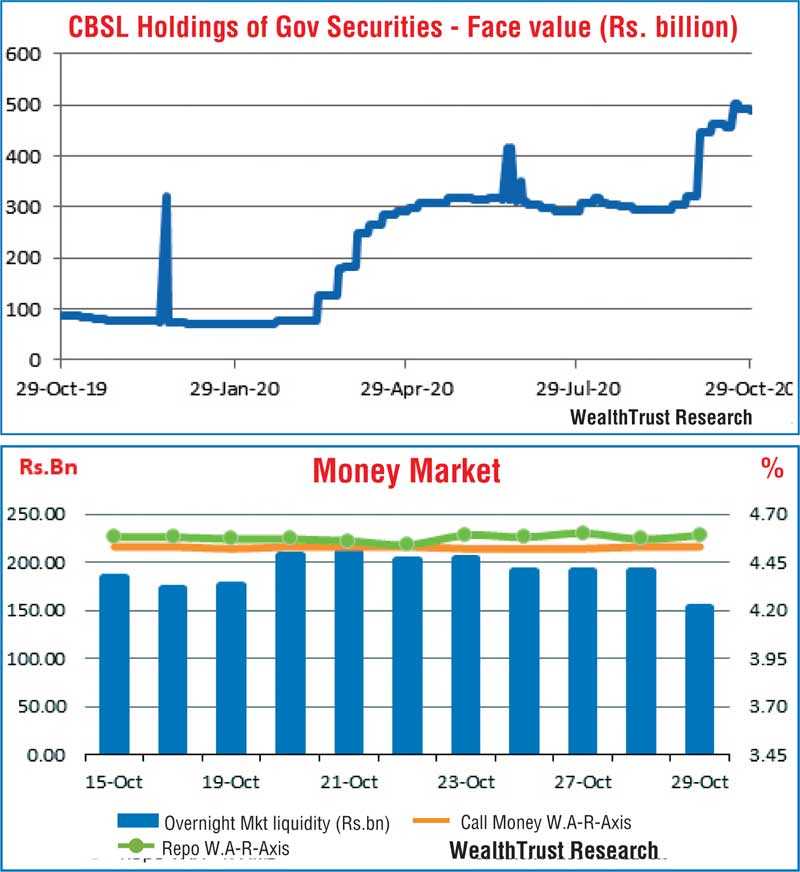

The daily secondary market Treasury bond/bill transacted volumes for the first three trading days of the week averaged Rs. 9.51 billion. In money markets, the weighted average rates on overnight call money and repo remained mostly unchanged at 4.53% and 4.59% respectively for the week as the total outstanding market liquidity remained high at Rs. 140.11 billion against Rs. 150.61 recorded the previous week. The CBSL’s holding of Gov. Security’s decreased marginally to 488.17 billion.

Rupee trades within a steady range

In the Forex market, USD/LKR rate on spot contracts were seen trading within a steady range of 184.20 to Rs. 184.40 during the week before closing the week at levels of Rs. 184.20/30 against its previous weeks of Rs. 184.20/35. The daily USD/LKR average traded volume for the first three days of the week stood at $ 70.20 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)