Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 18 August 2020 00:42 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The fresh trading week saw secondary market bond yields seesaw yesterday, increasing during morning hours of trading and dipping towards the later part of the day to close the day marginally lower in comparison to its Friday’s closings.

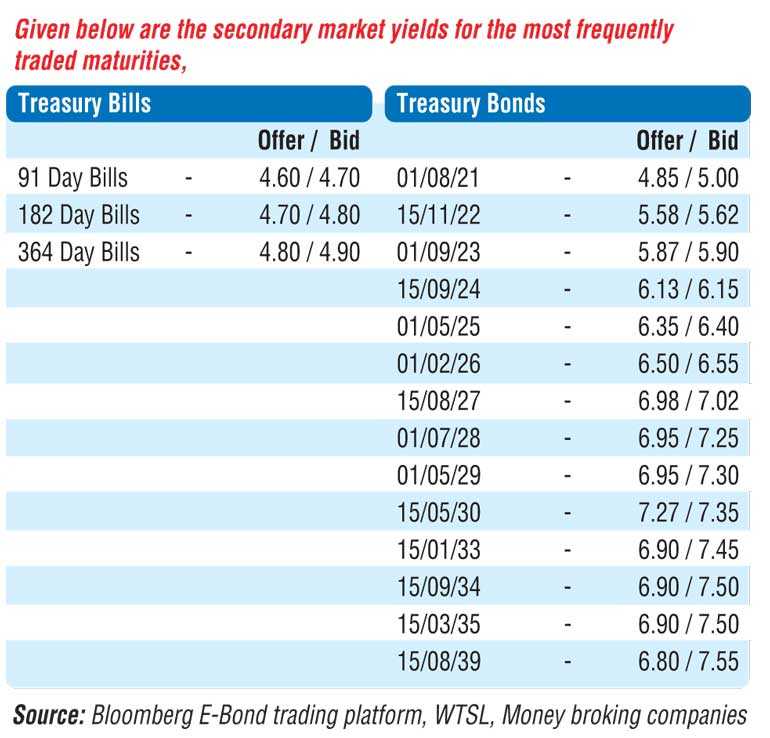

Selling interest saw yields on the 15.12.22, 01.09.23, 15.09.24 and 01.02.26 increase to intraday highs of 5.70%, 5.95%, 6.20% and 6.52% respectively against its previous day’s closing levels of 5.62/65, 5.87/95, 6.13/18 and 6.47/53.

However, renewed buying interest at these levels saw yields dip once again on the maturities of 2022’s (i.e. 15.11.22 & 15.12.22), 2023’s (i.e. 15.01.23 & 01.09.23), 15.09.24, 01.05.25, 01.02.26 and 15.08.27 to lows of 5.60% each, 5.65%, 5.90%, 6.15%, 6.37%, 6.50% and 7.00% respectively. In addition, maturities of 2021’s (i.e. 01.08.21 & 15.12.21) traded at levels of 4.95% and 5.10% respectively while the 01.01.21 bill changed hands at a level of 4.70% in the secondary bill market.

The total secondary market Treasury bond/bill transacted volumes for 14 August was Rs. 13.83 billion. In money markets, overnight liquidity increased to Rs. 186.03 billion yesterday which in turn saw weighted average rates on overnight call money and repo recorded at 4.52% and 4.55% respectively.

Rupee loses

The USD/LKR rate on spot contracts was seen depreciating during the day to close the day at Rs. 183.75/90 against its previous day’s closing level of Rs. 183.50/70 on the back of buying interest by banks.

The total USD/LKR traded volume for 14 August was $ 95.35 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)