Saturday Feb 14, 2026

Saturday Feb 14, 2026

Tuesday, 28 January 2020 01:23 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The fresh trading week commenced with secondary bond market yields closing the day mostly unchanged yesterday subsequent to increasing marginally in the early hours of trading.

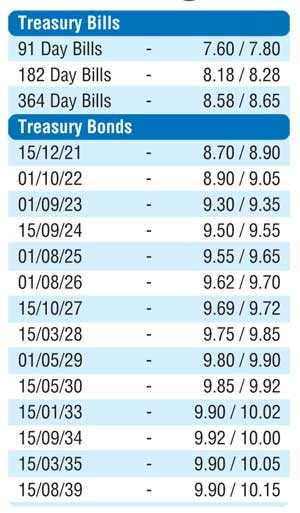

The yields on the liquid maturities of 01.09.23, 2024s (i.e. 15.06.24 and 15.09.24) and 15.10.27 rose to daily highs of 9.35%, 9.55%, 9.56% and 9.73% respectively against its previous day’s closing levels of 9.30/32, 9.50/53, 9.51/55 and 9.70/73.

Nevertheless, the equilibrium condition in the market saw yields dip once again to close the day mostly unchanged against its previous day’s closings. In addition, maturities of 15.06.27, 15.05.30 and 15.09.34 traded at levels of 9.71%, 9.87% to 9.90% and 9.97% to 9.98% as well.

The total secondary market Treasury bond/bill transacted volume for 24 f January 2020 was Rs. 7.82 billion.

In money markets, the overnight call money and repo rates averaged 7.46% and 7.49% respectively as the Domestic Operations Department (DOD) of the Central Bank of Sri Lanka was seen draining out an amount of Rs. 11.55 billion at a weighted average of 7.49% by way of an overnight repo auction. The overnight net liquidity surplus in the system stood at Rs. 32.50 billion.

Rupee trades within narrow range

The USD/LKR rate on spot contracts was seen trading within a narrow range of Rs. 181.55 to Rs. 181.60 before closing at levels of Rs. 181.55/65 against its previous day’s closing levels of Rs. 181.50/60.

The total USD/LKR traded volume for 24 January was $ 33.93 million. Some of the forward USD/LKR rates that prevailed in the market were one month - 182.05/20; three months - 183.00/30 and six months - 184.60/90.