Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 2 August 2023 00:20 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The bond market on Monday saw sustained aggressive buying interest across the yield curve. This drive was on the back of expectations of a rapidly cooling inflation and news that Sri Lanka’s Domestic Dollar Bond Exchange had received full participation.

The bond market on Monday saw sustained aggressive buying interest across the yield curve. This drive was on the back of expectations of a rapidly cooling inflation and news that Sri Lanka’s Domestic Dollar Bond Exchange had received full participation.

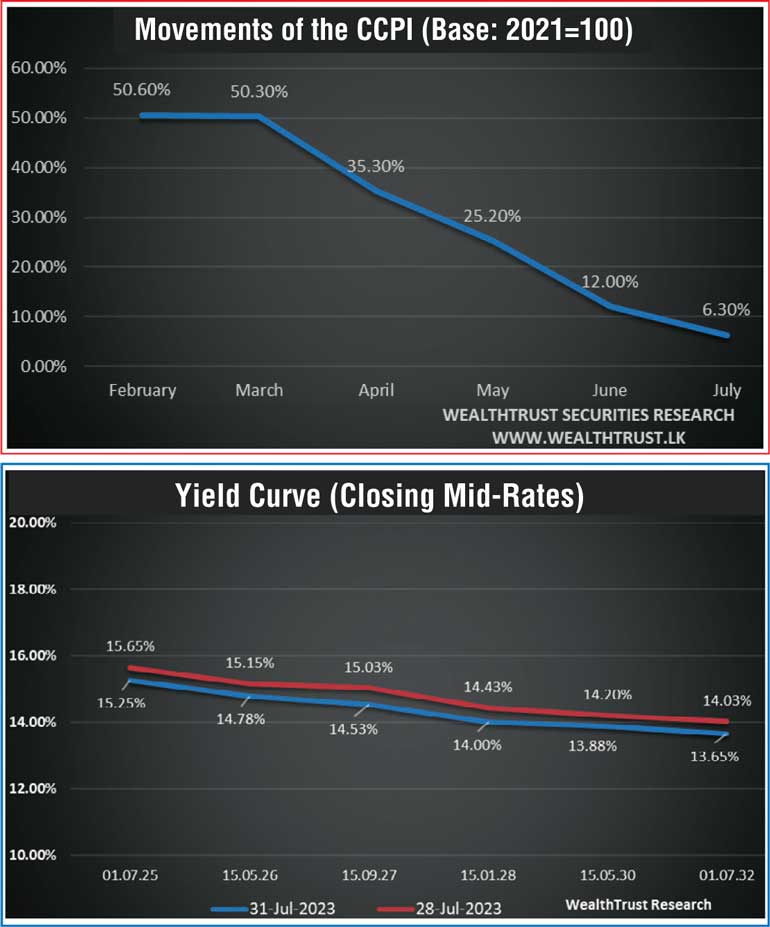

As such, the liquid maturities of the two 25’s (i.e. 01.06.25 and 01.07.25), 15.05.26, 15.09.27, 01.05.28 and 15.05.30 saw its yields hit intraday lows of 15.15% each, 14.65%, 14.43%, 14.00% and 13.75% respectively as against its intraday highs of 15.50% each, 15.10%, 14.95%, 14.35% and 14.10%. However, the slide in yields moderated following the announcement of inflation and profit taking.

The CCPI (Base: 2021 = 100) saw a significant reduction on a month on month basis, standing at an increase of 6.3% YoY in July against 12.0% YoY in June and the lowest since the index was rebased in February 2023. This outcome was below market expectations and a forecast of 7.50% as cited by a Bloomberg survey of economists (which had estimates ranging from 7.0% to 8.1%).

In secondary bills, September 2023 and January 2024 maturities traded at 18.00%, while a June 2024 maturity changed hands at 14.50%.

Today’s weekly Treasury bill auction will have in total an amount of Rs. 180 billion on offer which will consist of Rs. 80 billion on the 91-day maturity, Rs. 55 billion on the 182-day maturity and a further Rs. 45 billion on the 364-day maturity. At its previous week’s auction, averages dropped across the board to 19.96% on the 91-day maturity, 17.69% on the 182-day maturity and 14.29% on the 364-day maturity. A total of Rs. 160.50 billion was accepted vs. a total offered amount of Rs. 170 billion.

The total secondary market Treasury bond/bill transacted volume for 28 July was Rs. 9.54 billion.

In money markets, the DOD (Domestic Operations Department) of Central Bank injected liquidity by way of overnight and seven-day reverse repo auctions for a total volume of Rs. 85.23 billion at weighted average rates of 11.49% and 12.00% respectively while an amount of Rs. 77.95 billion was withdrawn from Central Bank’s SLFR (Standard Lending Facility Rate) of 12.00%. The net market liquidity surplus stood at Rs. 47.75 billion on Monday.

The weighted average rates on overnight call money and repo were registered at 11.50% and 12.00% respectively.

Forex market

In the forex market, the Rupee or USD/LKR rate on spot contracts appreciated considerably to close trading on Monday at Rs. 316.00/320.00 against its previous day’s closing level of Rs. 328.00/329.00.

The total USD/LKR traded volume for 26 July was $ 94.10 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)