Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Wednesday, 2 December 2020 00:55 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

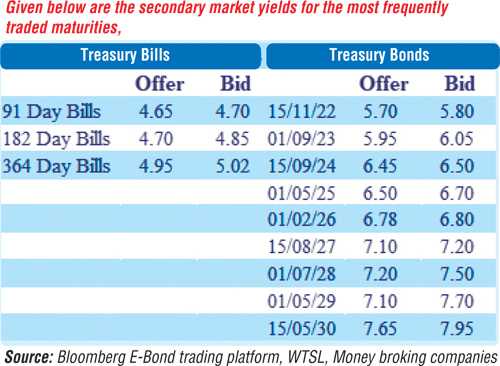

The secondary market bond yields were seen dipping marginally yesterday on the back of persistent buying interest ahead of today’s Treasury bill auction. Demand for 15.12.22, 2023’s (i.e. 15.01.23 and 15.12.23), 15.09.24 and 01.02.26 saw its yields dip to intraday lows of 5.79%, 5.82%, 6.02%, 6.48% and 6.79% respectively against its previous days closings of 5.80/90, 5.85/95, 6.05/15, 6.50/55 and 6.75/95. In addition, the very short end of the yield curve saw January and October 2021 Treasury bills and 15.10.21 bond change hands at levels of 4.65%, 5.00% and 5.04% to 5.05% respectively.

The secondary market bond yields were seen dipping marginally yesterday on the back of persistent buying interest ahead of today’s Treasury bill auction. Demand for 15.12.22, 2023’s (i.e. 15.01.23 and 15.12.23), 15.09.24 and 01.02.26 saw its yields dip to intraday lows of 5.79%, 5.82%, 6.02%, 6.48% and 6.79% respectively against its previous days closings of 5.80/90, 5.85/95, 6.05/15, 6.50/55 and 6.75/95. In addition, the very short end of the yield curve saw January and October 2021 Treasury bills and 15.10.21 bond change hands at levels of 4.65%, 5.00% and 5.04% to 5.05% respectively.

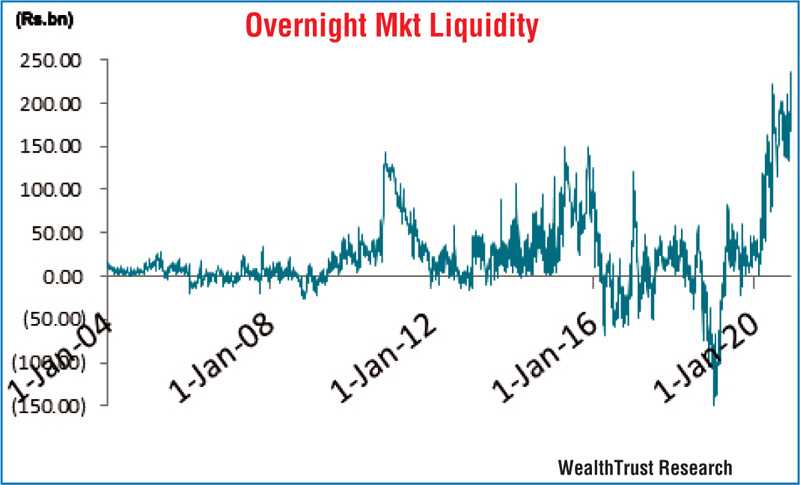

Today’s bill auction will see Rs. 40 billion on offer, consisting of Rs. 5.5 billion on the 91-day, Rs. 12.5 billion on the 182-day and a further Rs. 22 billion on the 364-day maturities. The stipulated cut-off rates were published at 4.65%, 4.76% and 5.00% on the 91, 182 and 364-day maturities respectively, unchanged from its previous week. The total secondary market Treasury bond/bill transacted volumes for 30 November was Rs. 4.97 billion. The overnight surplus liquidity in the system was seen increasing considerably yesterday to Rs. 235.98 billion, recording its highest levels seen over the past sixteen years. The overnight call money and repo averaged 4.54% and 4.57% respectively.

Rupee dips

In the Forex market, the USD/LKR rate on spot next contracts was seen depreciating yesterday to close the day at Rs. 186.00/20 against its previous day’s closing of Rs. 185.80/10, while spot contracts were not quoted.

The total USD/LKR traded volume for 30 November was $ 40 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)