Saturday Feb 14, 2026

Saturday Feb 14, 2026

Tuesday, 8 December 2020 00:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The fresh trading week commenced on a positive note as bond yields continued to decline, mainly on the short end of the yield curve on the back of persistent buying interest.

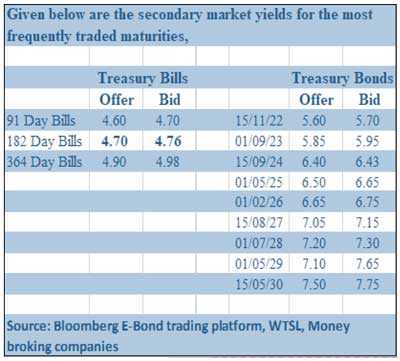

Demand for 15.12.22, 15.01.23 and 15.09.24 saw its yields hit daily lows of 5.62%, 5.74% and 6.43% respectively against its previous days closings of 5.70/77, 5.75/80 and 6.42/48.

In addition, 01.07.28 changed hands at 7.25%, while short-dated bonds and bills saw 15.12.21 along with March and October 2021 bills change hands at levels of 5.00%, 4.60% and 4.95% respectively.

The total secondary market Treasury bond/bill transacted volumes for 4 December was Rs. 15.81 billion. The money market liquidity continued to remain elevated at Rs. 238.33 billion yesterday, as overnight call money and repo averaged 4.54% and 4.57% respectively.

Rupee dips

The Forex market saw the USD/LKR rate on spot next contracts dip once again yesterday to close the day at Rs. 186.35/75 against its previous day’s closing of Rs.185.80/00 on the back of buying interest by banks. The total USD/LKR traded volume for 4 December was $ 49.31 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)