Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Thursday, 6 July 2023 02:20 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities Ltd

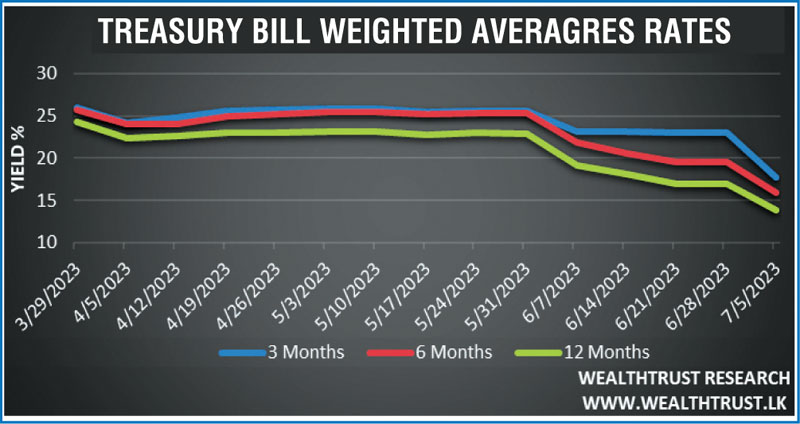

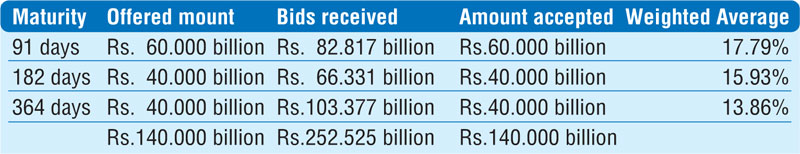

The crash in bond yields on 4 July led to a similar outcome at the weekly Treasury bill auction yesterday, as its weighted averages plunged, with the one year or 364-day bill average falling below 14% for the first time since March 2022. The steepest drop was witnessed on the 91-day bill by 521 basis points or 5.21% to 17.79% followed by the 182-day bill by 356 basis points or 3.56% to 15.93%. The 364-day bill average was 13.86%, recording a drop of 313 basis points or 3.13%.

The crash in bond yields on 4 July led to a similar outcome at the weekly Treasury bill auction yesterday, as its weighted averages plunged, with the one year or 364-day bill average falling below 14% for the first time since March 2022. The steepest drop was witnessed on the 91-day bill by 521 basis points or 5.21% to 17.79% followed by the 182-day bill by 356 basis points or 3.56% to 15.93%. The 364-day bill average was 13.86%, recording a drop of 313 basis points or 3.13%.

The total offered amount of Rs.140 billion was successfully accepted at the action.

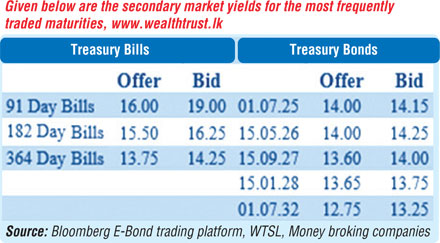

Meanwhile, continued buying interest in the secondary bond market saw yields on the liquid maturities of 01.07.25 and 15.05.26 the intraday low was 14.00%. On the liquid 27s (i.e. 01.05.27 & 15.09.27) yields decreased further to intraday lows of 14.00% and 13.50% each respectively against its previous day’s closing level of 14.50/15.50, 14.10/14.25 and 13.75/14.15 each. In addition, maturities of 01.06.25 and 15.01.28 traded at lows of 14.00% and 13.60% as well.

This was ahead of today’s monetary policy announcement, the fifth for the year 2023, due at 7:30 a.m. The Central Bank of Sri Lanka slashed its policy rates by 250 basis points at its announcement on 1 June 2023.

This was ahead of today’s monetary policy announcement, the fifth for the year 2023, due at 7:30 a.m. The Central Bank of Sri Lanka slashed its policy rates by 250 basis points at its announcement on 1 June 2023.

The total secondary market Treasury bond/bill transacted volume for 4 July 2023 was Rs. 26.72 billion.

In money markets, the DOD (Domestic Operations Department) of Central Bank injected liquidity by way of overnight and 7-day reverse repo auctions for a total volume of Rs. 124.00 billion at weighted average rates of 13.95% and 14.00% respectively while an amount of Rs. 130.77 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 14.00%. The weighted average rates on overnight call money and repo were registered at 13.85% and 14.00% respectively.

Forex Market

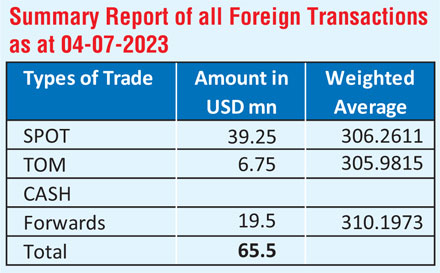

In the Forex market, the USD/LKR rate on spot contracts closed the day mostly unchanged at Rs. 306.50/308.00 yesterday, subsequent to trade within the range of Rs. 306.90 to Rs. 307.50.

The total USD/LKR traded volume for 4 July was $ 65.50 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)