Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 20 January 2023 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The bullish sentiment prevailing in the secondary bond market following Wednesday’s Treasury bill auction outcome and developments on the IMF Extended Fund Facility (EFF) front, led to bond yields declining yesterday on the back of increased activity levels.

The bullish sentiment prevailing in the secondary bond market following Wednesday’s Treasury bill auction outcome and developments on the IMF Extended Fund Facility (EFF) front, led to bond yields declining yesterday on the back of increased activity levels.

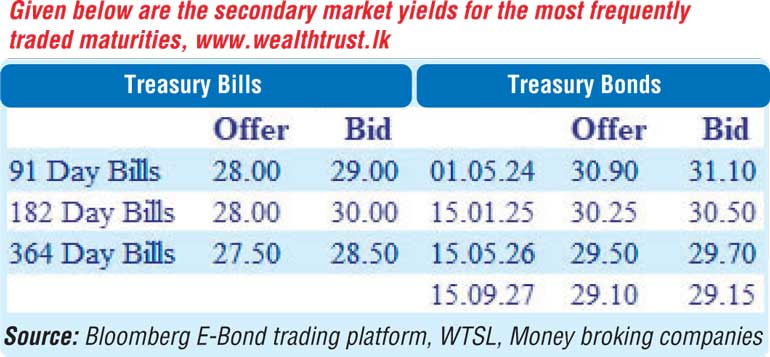

Buying interest during morning hours of trading on the liquid two maturities of 15.05.26 and 15.09.27 led to its yields dipping to intraday lows of 29.00% and 28.50% respectively against its previous day’s closings of 29.80/10 and 29.00/15. Profit taking from these levels onwards led to yields increasing once again to intraday highs of 29.60% and 29.25% respectively on the said two maturities.

In addition, maturities of 01.05.24 and 15.01.25 traded at levels of 30.80% to 31.10% and 30.25% to 30.75% respectively as well.

The total secondary market Treasury bond/bill transacted volume for 18 January was Rs. 15.21 billion.

In money markets, the overnight liquidity was at a net deficit of Rs. 134.06 billion yesterday following Wednesday’s deficit of Rs. 124.51 billion due to the restriction imposed on CBSL’s Standing Deposit Facility (SDF) of 14.50% for License Commercial Banks (LCB) with effect from 16 January 2023.

The weighted average rates on overnight call money and repo stood at 15.41% and 15.50% respectively. An amount of Rs. 163.91 billion was accessed from CBSL’s Standing Lending Facility (SLF) of 15.50%.

The DOD (Domestic Operations Department) of Central Bank injected an amount of Rs. 20.50 billion by way of a 10-day Reverse Repo auction at a weighted average yield of 20.44%.

Forex Market

In the Forex market, the middle rate for USD/LKR spot contracts was recorded at Rs. 362.2698 yesterday against its previous days of Rs. 362.24.

The total USD/LKR traded volume for 17 January was $ 36.91 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)