Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 2 July 2024 02:03 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market kicked off the trading week with some renewed buying interest, resulting in a change in sentiment. The market was buoyed by the news that Sri Lanka is likely to finalise an agreement with private creditors by “next week” as per a statement made by President Ranil Wickremesinghe at a public rally on Sunday (30) in the Southern town of Matara. This enthusiasm was also augmented by the news that Sri Lanka’s Finance Ministry has maintained a positive cash balance of 542.3 billion rupees by end April 2024, as per the Mid-Year Fiscal position report published by the Ministry.

The secondary bond market kicked off the trading week with some renewed buying interest, resulting in a change in sentiment. The market was buoyed by the news that Sri Lanka is likely to finalise an agreement with private creditors by “next week” as per a statement made by President Ranil Wickremesinghe at a public rally on Sunday (30) in the Southern town of Matara. This enthusiasm was also augmented by the news that Sri Lanka’s Finance Ministry has maintained a positive cash balance of 542.3 billion rupees by end April 2024, as per the Mid-Year Fiscal position report published by the Ministry.

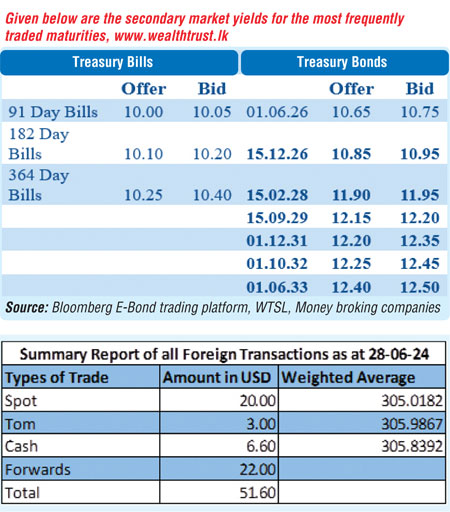

Trading activity was witnessed mostly during the earlier part of the day and centred predominantly on 2026 to 2029 durations. The 2026 tenors in particular saw strong demand, with the 15.12.26 maturity trading down to an intraday low of 10.90% from a high of 11.00%. Similarly, the other 2026 tenors 01.06.26 and 01.08.26 were seen dropping to lows of 10.70% from highs of 10.80%. Additionally, the 15.02.28 and 15.09.29 maturities traded at 11.90% to 11.88% and 12.15% respectively.

Meanwhile in the secondary treasury bill market, significant interest was also observed. Particularly on short term bills, with September 2024 (close to 3 months) maturities trading on large volumes down the range from 10.15% down to lows of 9.95%. In addition, March 2025 maturities were seen transacting at the rate of 10.17%.

The total secondary market Treasury bond/bill transacted volume for 28 June was Rs. 10.32 billion.

In money markets, the weighted average rate on overnight call money was at 8.78% and repo was at 9.06%.

The net liquidity surplus stood at Rs. 90.99 billion yesterday as an amount of Rs. 5.86 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 9.50% against an amount of Rs. 126.85 billion been deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.50%.

Further, the DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight reverse repo auction for Rs. 30.00 billion at the weighted average rate of 8.78%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day appreciating to Rs. 304.80/305.00 against the previous day’s closing level of Rs. 306.00/306.20.

The total USD/LKR traded volume for 28 June was $ 51.60 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)