Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Friday, 6 October 2023 01:07 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

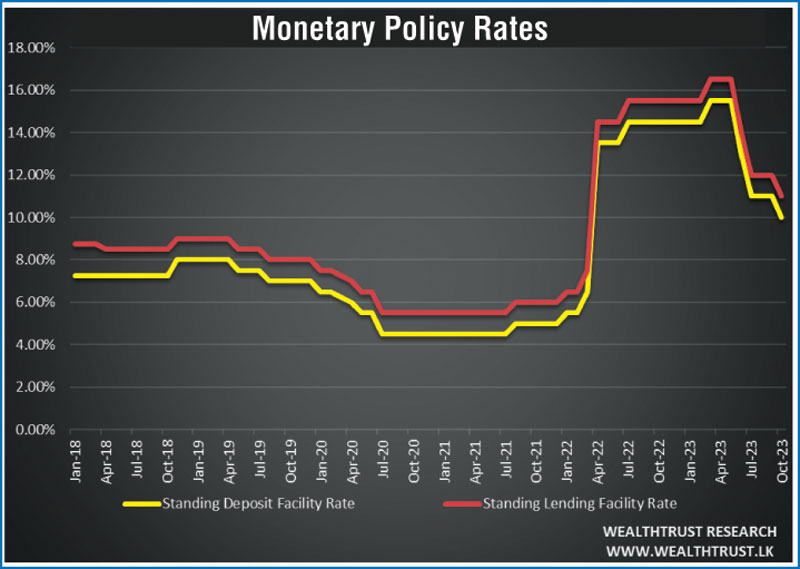

The Central Bank of Sri Lanka yesterday, resumed its monetary policy easing cycle, reducing both policy rates by 100 basis points. As such the Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) dropped to 10.00% and 11.00% respectively, while the Statutory Reserve Requirement (SRR) of commercial banks remained unchanged at 2.00%. This move was widely expected, as a Reuters survey of 17 economists and analysts also expressed a median estimate of a rate cut of 100 basis points.

The Central Bank of Sri Lanka yesterday, resumed its monetary policy easing cycle, reducing both policy rates by 100 basis points. As such the Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) dropped to 10.00% and 11.00% respectively, while the Statutory Reserve Requirement (SRR) of commercial banks remained unchanged at 2.00%. This move was widely expected, as a Reuters survey of 17 economists and analysts also expressed a median estimate of a rate cut of 100 basis points.

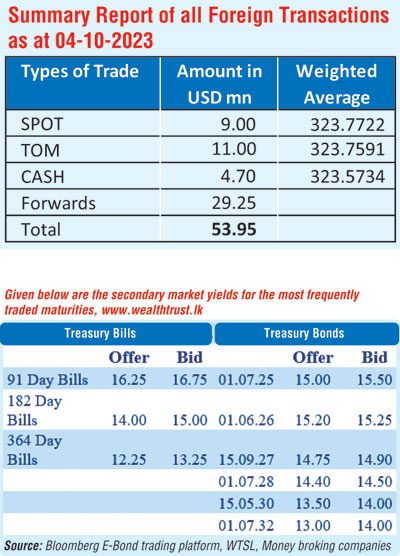

However, secondary bond market yields were seen edging up yesterday on the back of selling pressure while activity picked up. Trading primarily focused on the liquid tenors of the two 2026’s (i.e., 01.06.26 and 01.08.26) and 01.07.28 from intraday lows of 15.00% and 14.30% respectively to highs of 15.35% and 14.50%. These levels prompted a fresh wave of buying interest, which saw yields close the day marginally lower than its intraday highs.

In secondary market bills, durations centered on October/November 2023 maturities were seen trading at levels of 16.00% to 16.50% while January 2024 bills were seen trading at 16.25% to 16.75%.

The total secondary market Treasury bond/bill transacted volume for 4 October 2023 was Rs.55.62 billion. In money markets, the weighted average rate on Repo stood at 10.78% while the net liquidity stood at a deficit of Rs.107.96 billion yesterday.

The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of overnight and 7-day term reverse repo auctions for Rs 17.85 billion and Rs 35 billion at weighted average rates of 10.13% and 10.68% respectively. An amount of Rs.70.00 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 11.00% and an amount of Rs. 14.89 billion was deposited at its SLDR (Standard Deposit Facility Rate) of 10.00%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day flat at Rs.323.90/324.10 against its previous day’s closing level of Rs.323.70/324.00.

The total USD/LKR traded volume for 04th October was $53.95 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)