Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 23 February 2021 00:50 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The activity in the secondary bond market moderated at the commencement of a shortened trading week yesterday with yields increasing marginally once again, as most market participants stayed on the sidelines ahead of the scheduled primary auctions this week.

The activity in the secondary bond market moderated at the commencement of a shortened trading week yesterday with yields increasing marginally once again, as most market participants stayed on the sidelines ahead of the scheduled primary auctions this week.

Yields of the maturities of 01.10.22 and 2024’s (i.e. 15.03.24, 15.06.24, 15.09.24 and 01.12.24) were seen hitting highs of 5.80%, 6.70%, 6.75%, 6.70% and 6.72% respectively against its previous day’s closing level of 5.60/70, 6.45/55, 6.50/60 and 6.55/63 each. Furthermore, shorter tenure maturities 01.08.21 and 15.12.21 traded at levels of 4.84% and 5.09% respectively while 19 March maturity changed hands at a level of 4.60% in the secondary bill market.

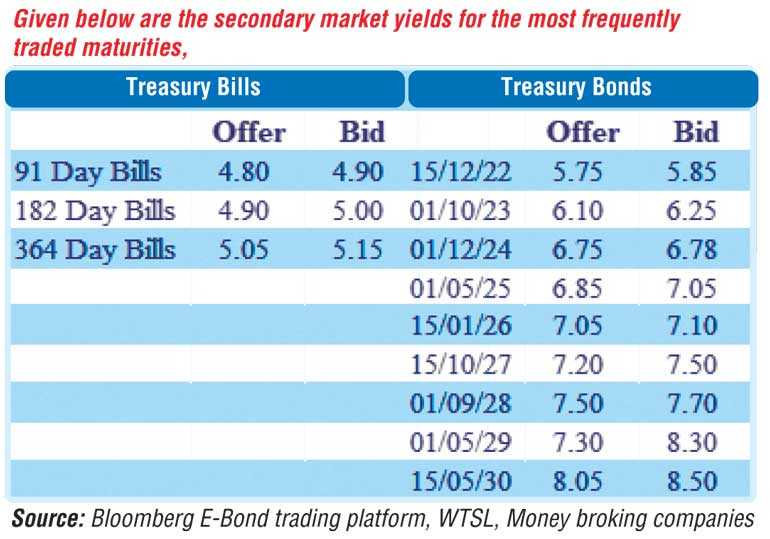

The weekly bills auction due for today will see a total amount of Rs. 42.5 billion on offer, consisting of Rs. 7 billion of the 91 day maturity, Rs. 10.5 billion of the 182 day maturity and a further Rs. 25 billion of the 364 day maturity.

At last week’s auction, weighted average yields increased across the board for a third consecutive week by 10, 08 and 05 basis points on the 91 day, 182 day and 364 day maturities respectively to 4.82%, 4.93% and 5.09%. The stipulated cut off rate on the 364 day maturity remained unchanged at 5.09%, while the yield rates of the 91 day and 182 day maturities will be decided below the level of the 364 day maturity at the auction.

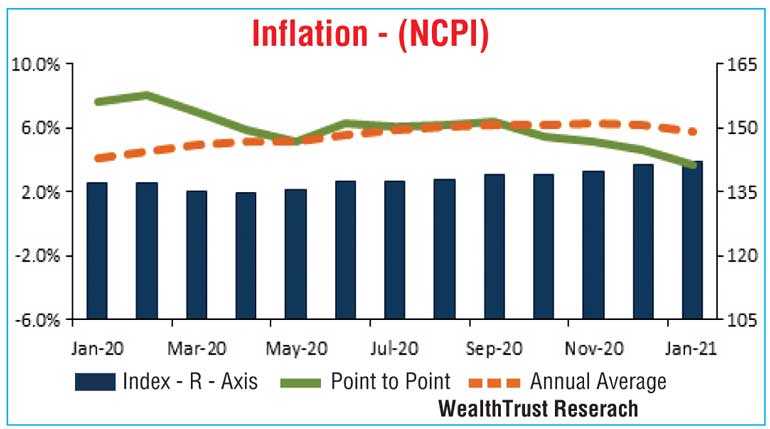

Inflation or the National Consumer Price Index (NCPI) for the month of January decreased for a fourth consecutive month to 3.7% on the basis of its point to point against its previous month 4.6% while its annual average decreased to 5.8% against its previous month of 6.2%. The total secondary market Treasury bond/bill transacted volumes for 19 February was Rs. 4.85 billion. In the money market, overnight surplus liquidity was seen increasing further to Rs. 168.62 billion yesterday while weighted average rates on call money and repo remained mostly unchanged at 4.55% and 4.56% respectively.

USD/LKR

In Forex markets, the USD/LKR rate on spot contracts was seen trading within a range of Rs. 193.75 to Rs. 194.90 before closing the day at Rs. 193.50/194.25 in comparison to its one week forward contract closing of Rs. 195.00/196.00 the previous day.

The total USD/LKR traded volume for 19 February was $ 73.30 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)