Monday Feb 16, 2026

Monday Feb 16, 2026

Friday, 23 December 2022 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

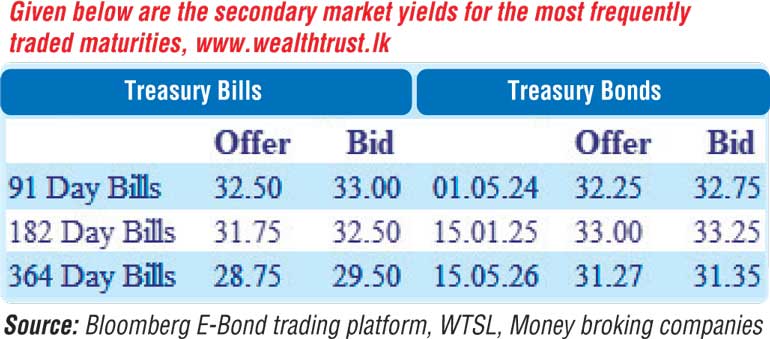

The secondary bond market yields edged up yesterday as the liquid maturity of 15.05.26 hit an intraday high of 31.30% against its previous day’s closing level of 31.10/15, amidst moderate activity levels. In addition, limited trades were reported on the maturities of 15.01.28 and 15.05.31 at levels of 28.50% to 28.60% and 26.40% respectively.

The total secondary market Treasury bond/bill transacted volume for 21 November 2022 was Rs. 54.83 billion.

In money markets, the weighted average rate on overnight call money stood at 15.50% while an amount of Rs. 561.42 billion was withdrawn from Central Bank’s Standard Deposit Facility Rate (SDFR) of 15.50%. The net liquidity deficit stood at Rs. 231.55 billion yesterday as an amount of Rs. 329.87 billion was deposited at Central Bank’s SDFR of 14.50%.

Forex Market

In the Forex market, the middle rate for USD/LKR spot contracts remained steady at Rs. 363.16 yesterday.

The total USD/LKR traded volume for 21 December was $ 31.45 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)