Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 20 May 2020 00:33 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The yields in the secondary bond market decreased towards the latter part of yesterday subsequent to increasing in the morning hours of trading, on the back of renewed buying interest following the announcement of outright bond purchase auctions.

The Domestic Operations Department (DOD) of Central Bank announced auctions for outright purchase of Treasury bonds for a total volume of Rs. 20 billion on the maturities of 15.03.24, 15.06.24, 01.08.24, 15.09.24 and 01.05.25.

The yields on the liquid maturities of 15.01.23, 15.09.24, 01.05.25 and 15.10.27 decreased to intraday lows of 8.07%, 8.58%, 8.67%, and 8.90% respectively against its day’s highs of 8.10%, 8.68%, 8.70% and 8.93%. Furthermore, 01.10.22 and 15.06.27 maturities were seen trading at levels of 7.90% to 7.93% and 8.94% to 8.95% respectively. In the secondary bill market, June and July bills continued to trade at levels of 6.55% and 6.68% respectively.

At today’s weekly bill auction, a total amount of Rs. 30 billion will be on offer, consisting of Rs. 8 billion of the 91 day maturity, Rs. 6 billion of the 182 day maturity and Rs. 16 billion of the 364 day maturity. At last week’s auction, the weighted average yields decreased across the board by 10, 07 and 06 basis points respectively to 6.74%, 6.83% and 6.94%.

The total secondary market Treasury bond/bill transacted volume for 18 May was Rs. 8.66 billion. In money markets, The Domestic Operations Department (DOD) of the Central Bank of Sri Lanka refrained from conducting any auction yesterday as the overnight net liquidity surplus in the system increased to Rs. 127.52 billion. The weighted average rates on overnight call money and repo decreased marginally to 5.90% and 6.01% respectively.

Rupee appreciates further

The USD/LKR rate on spot contracts was seen appreciating further yesterday to close the day at levels of Rs. 187.40/50 against its previous day’s closing levels of Rs. 187.70/90 subsequent to trading within the range of Rs. 187.45 to Rs.187.80.

The total USD/LKR traded volume for 18 April was $ 56.50 million.

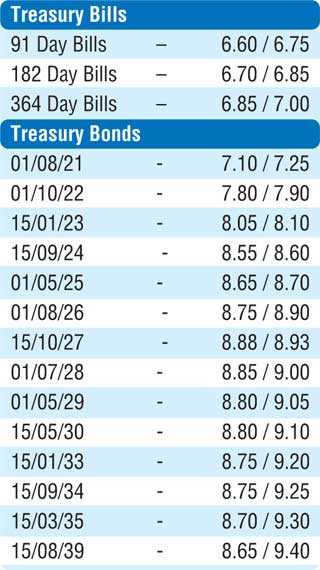

Given below are the closing, secondary market yields of the most frequently traded T – bills and bonds,