Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 16 October 2023 01:46 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market saw some volatility during the trading week ending 13 October.

The secondary bond market saw some volatility during the trading week ending 13 October.

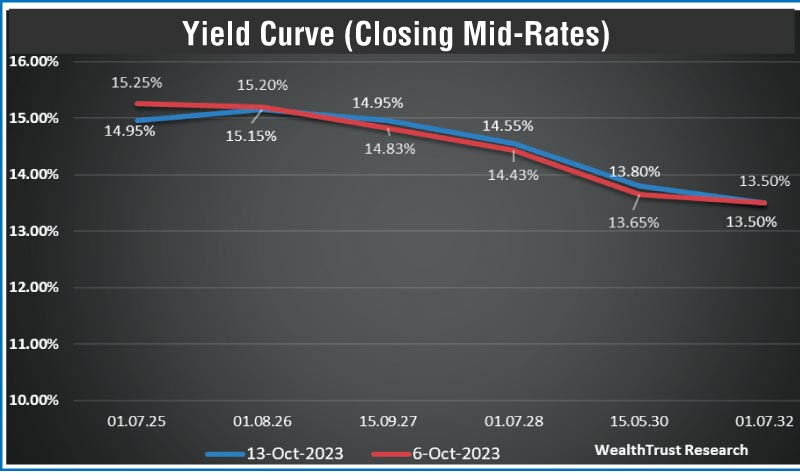

Commencing the week, buying interest predominately on the 2026 (i.e., 01.06.26 and 01.08.26) maturities saw its yields decline from weekly highs of 15.30% to 15.15% leading to the bond auctions and hit a weekly low of 15.05% following the auction outcome. However, at the close of the week last Friday, profit taking saw yields edge up once again. In addition, the maturities of 01.07.25 and the two 2028’s (i.e. 01.05.28 and 01.07.28) were seen changing hands at levels of 15.00% to 14.90% and 14.65% to 14.20% respectively as well. The yield curve saw a dip on maturities up to 2027 while an increase on maturities beyond.

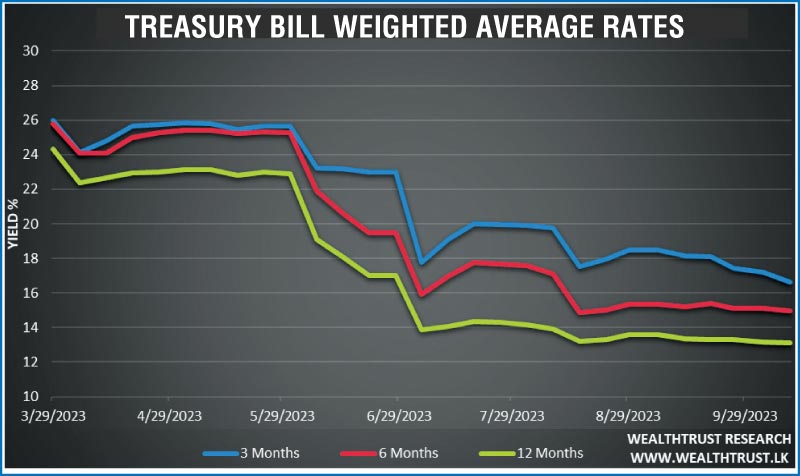

The response for the primary auctions last week was bullish as the weekly Treasury bill auction saw its weighted averages decline for a third consecutive week while the Treasury bond auctions were fully subscribed at its 1st and 2nd phases.

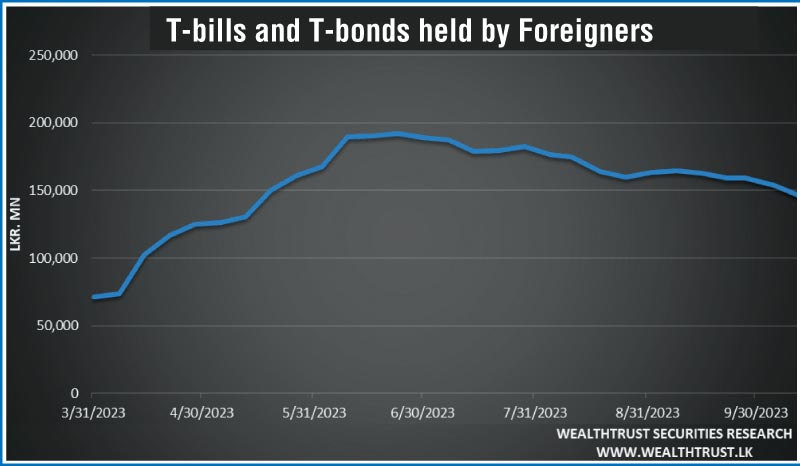

The foreign holding in Rupee bonds and bills recorded a further decline with a steep net outflow of Rs. 7.90 billion for the week ending 13 October. This makes it five consecutive weeks of net outflows totalling Rs. 18.37 billion.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 23.09 billion.

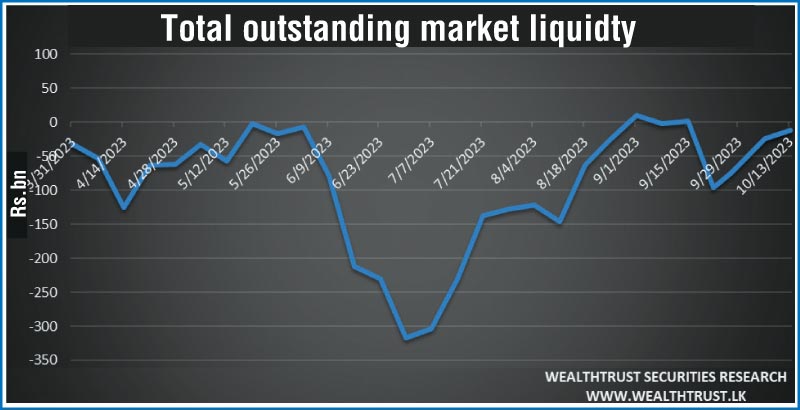

In money markets, the total outstanding liquidity deficit improved to Rs. 12.23 billion by the end of the week against its previous week’s of Rs. 24.60 billion. The Domestic Operations Department (DOD) of Central Bank continued to inject liquidity during the week by way of overnight to 31-day Reverse repo auctions at weighted average yields ranging from 10.07% to 13.41%.

The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,839.35 billion, unchanged against its previous week’s level.

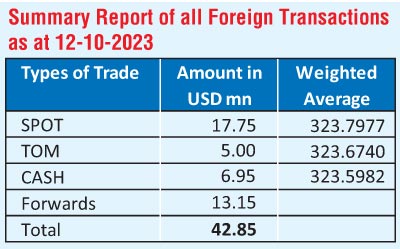

In the forex market, the USD/LKR rate on spot contracts was seen holding broadly steady during the week to close at Rs. 323.80/323.90 against its previous week’s closing level of Rs. 323.85/323.95, subsequent to trading at a low of Rs. 323.50 and a high of Rs. 323.90.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 39.56 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)