Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 29 January 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

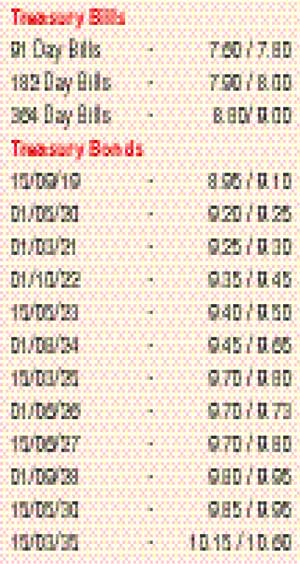

The secondary market bond yields closed steady during the week ending 26 January 2018 subsequent to increasing during the early part of the week and decreasing once again during the second half of the week.

Selling interest at the start of the week saw yields on the liquid maturities of 01.05.20, 01.03.21, 01.06.26 and 15.06.27 increase to weekly highs of 9.35%, 9.40% and 9.80% each respectively against its previous week’s closing levels of 9.15/20, 9.20/25, 9.66/69 and 9.68/73.

The increase on the 364 day bill weighted average for a second consecutive week was seen complementing the increase in bond yields. Nevertheless, buying interest, mainly from foreign market participants coupled with a wait-and-see approach by most local market participants ahead of the Treasury bond auctions saw yields decrease on the maturities of 01.03.21, 01.08.21, 01.09.23 and 01.08.26 to weekly lows of 9.23%, 9.28%, 9.45% and 9.67% respectively once again. This resulted in yields remaining broadly steady on a week-on-week basis.

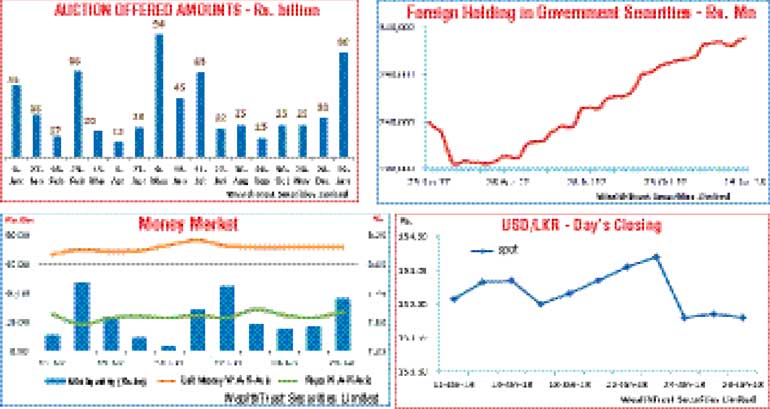

The volume of Rs. 80 billion on offer at today’s auction will be the highest since the Rs. 94 billion that was auctioned on 9 May 2017. This will consist of Rs. 40 billion each on a 5.03 year maturity of 15.05.2023 and a new 14.11 year maturity of 15.01.2033. The last Treasury bond auctions conducted on 28 December 2017 for the maturities of 15.12.2020 and 01.06.2026 recorded weighted averages of 9.55% and 10.06% respectively. Foreign holding in rupee bonds continued to increase with an inflow of Rs. 1.7 billion for the week ending 24 January while the daily secondary market Treasury bond/bill transacted volume for the first four days of the week averaged Rs. 4.51 billion.

In money markets, the overnight call money and repo rates averaged 8.15% and 7.57% respectively for the week as the Open Market Operations (OMO) Department drained out liquidity throughout the week on an overnight basis at weighted average ranging from 7.25% to 7.27%.

Further it drained out excess liquidity by way of auctions for outright sales of Treasury bills and term repo auctions as well. The auctions drained an amount of Rs. 54.8 billion in total at weighted average ranging from 7.34% to 7.84% for a period of four days to 119 days. The average net liquidity stood at Rs. 19.29 billion for the week.

Rupee closes stronger

The USD/LKR rate on spot contacts dipped to a low of Rs. 154.10 during the early part of the week against its previous week’s closing levels of Rs. 153.95/00 before closing the week stronger at Rs. 153.65/75 subsequent to hitting an intraweek high of Rs. 153.70 on the back of portfolio inflows. The daily USD/LKR average traded volume for the four days of the week stood at $ 103.25 million.

Some of the forward dollar rates that prevailed in the market were one month - 154.40/55; three months - 155.90/00 and six months - 158.40/55.