Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 12 March 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market commenced the week on a positive note as yields decreased during the early part of the week ending 9 March 2018 on fresh buying interest fuelled by comments on the future interest rate outlook in the country.

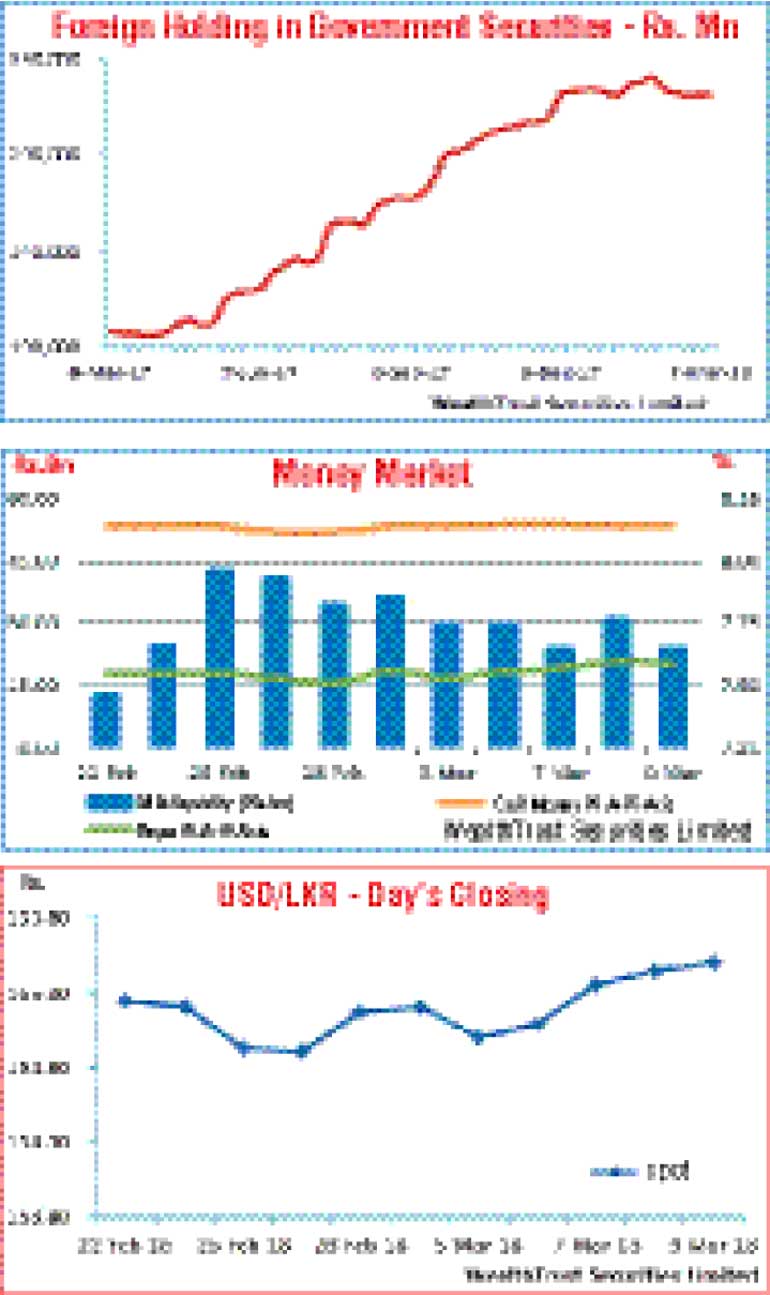

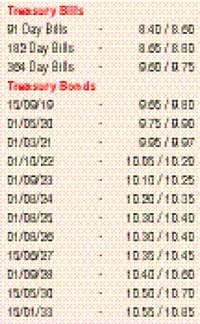

Yields of the two 2021 maturities (i.e. 01.03.21 and 01.08.21) as well as the 01.09.23, 01.08.25 and 15.05.30 maturities hit weekly lows of 9.90%, 9.96%, 10.12%, 10.35% and 10.50% respectively against its previous week’s closing levels of 9.90/100, 10.00/10, 10.15/30, 10.37/40 and 10.50/65.

However, selling interest mid-week onwards saw yields on the two 2021 maturities hitting highs of 9.97% and 10.05% respectively with two way quotes on the rest of the yield curve widening. This, coupled with the continuous increase of the 364 day bill weighted average at the weekly bill auction, saw sentiment turn bearish towards the latter part of the week.

Furthermore, the foreign holding in Rupee bonds was seen decreasing once again to record a marginal outflow of Rs. 42 million for the week ending 7 March.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged Rs. 7.07 billion.

In money markets, the average net surplus liquidity in the system remained at a high of Rs. 27.67 billion, with the Open Market Operation (OMO) Department of the Central Bank of Sri Lanka draining out liquidity throughout the week on an overnight basis at weighted averages ranging from 7.26% to 7.28%. The overnight call money and repo rates averaged 8.14% and 7.57% respectively.

Furthermore, the OMO Department of the Central Bank of Sri Lanka was also seen mopping up excess liquidity by way of term repo auctions, where an amount of Rs. 16.5 billion was drained out in total at weighted averages ranging from 7.35%-7.50% for periods ranging from seven to 10 days.

Rupee dips during the week

The USD/LKR rate on spot contracts fluctuated once again within the range of Rs. 155.00-Rs. 155.65 during the week before closing at levels of Rs. 155.45/55 against its previous week’s closing levels of Rs. 155.15/25.

The daily USD/LKR average traded volume for the four days of the week stood at $ 81.39 million. Some of the forward dollar rates that prevailed in the market were one month - 156.35/45; three months - 157.95/10 and six months - 160.45/55.