Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 26 February 2024 10:01 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market exhibited some volatility during the shortened trading week ending 22 February. The market continued to remain active, with yields moving up further until Thursday on selling pressure as market participants looked to realise gains following the recent bull run. However, the upward momentum was curtailed by renewed buying interest kicking in at the elevated levels on Friday, keeping a cap on rates.

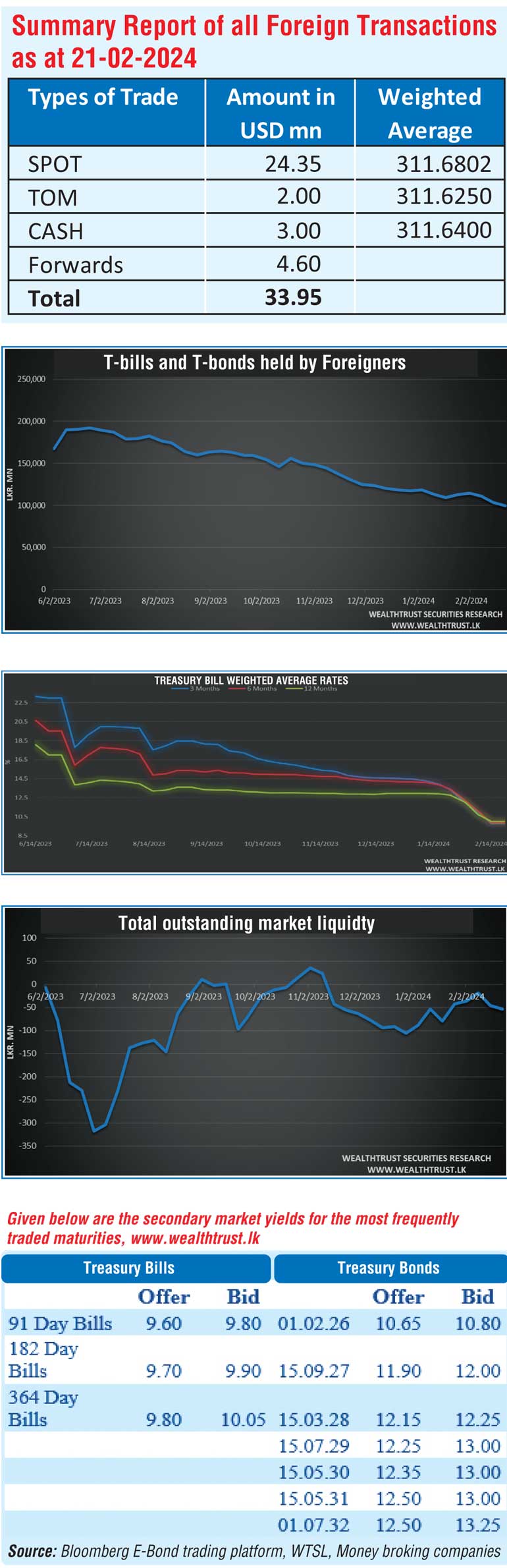

The week closed on a positive note following the news of the announcement of a new restructuring proposal sent by the Sri Lankan Government to dollar bondholders and Bank of America strategists upgrading their recommendation for Sri Lanka dollar bonds. The report encouraged investors to buy Sri Lanka’s external debt with an overweight endorsement. Subsequent to this news the local bond market experienced a small rally. Trading continued to be centred mainly on the short end of the yield curve with a particular emphasis on 2025-2028 durations while transaction volumes continued to be robust. The yield on 2028 tenors (15.03.28, 01.05.28, 01.07.28, and 15.12.28) were seen hitting intraweek high levels of 12.40% against intraweek lows of 12%. Similarly, 2026 tenors (01.02.26, 01.06.26 and 01.08.26) were seen ascending to intraweek highs of 11.25% as against lows of 10.85%. Additionally, trades were also seen on the maturities of 2025’s (01.06.25 and 01.07.25), 15.09.27 and 01.07.32 within intraweek lows and highs of 10.00% to 10.25%, 11.75% to 12.15% and 12.25% to 12.40% respectively. At the Treasury bill auction conducted last Wednesday, the weighted average yields remained broadly unchanged, following five consecutive weeks of steep declines across all tenors. Only the 91-day maturity was seen registering a marginal drop of one basis point to 9.78%, while the 182- day and 364-day maturities held static at 9.86% and 10.02% respectively. The auction went undersubscribed for the first time in seven weeks.

As such only Rs. 103.81 billion (86.51%) of the total offered amount of Rs. 120 billion raised at the first phase of the auction. This was despite total bids exceeding the offered amount by over two times. The foreign holding in Rupee bonds and bills for the week ending 22 February 2024 recorded a net outflow for a third consecutive week, amounting to Rs. 4.44 billion. As a result, the total holding decreased to Rs. 99.16 billion, falling below Rs. 100 billion for the first time since April 2023. This marks nearly a 50% drop since foreign holdings peaked at Rs. 191.91 billion in June of last year, following recovery from the economic crisis and ensuing external debt default, but has since witnessed a steady decline. On the inflation front, the National Consumer Price Index -NCPI (Base: 2021=100) or National inflation for the month of January 2024 was recorded at 6.50% on its point to point as against 4.20% recorded in December 2023. As such inflation was observed increasing for a fourth consecutive month since cooling to a low of 0.80% in September 2023.

The daily secondary market Treasury bond/bill transacted volumes for the first three days of the week averaged at Rs. 31.92 billion. In money markets, the total outstanding liquidity deficit increased to Rs. 53.91 billion by the week ending 22 February from its previous week’s deficit of Rs. 46.20 billion. The Domestic Operations Department (DOD) of the Central Bank continued to inject liquidity during the week by way of overnight and term reverse repo auctions at weighted average yields ranging from 9.18% to 9.48%. The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,735.62 billion as at 22 February 2024, unchanged from its previous week’s level. In the Forex market, the USD/ LKR rate on spot contracts was seen appreciating further during the week to close at Rs. 310.95/311.05. This is as against its previous week’s closing level of Rs. 312.20/312.35 and subsequent to trading at a high of Rs. 312.40 and a low of Rs. 310.98. The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 62.53 million. (References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)