Saturday Feb 14, 2026

Saturday Feb 14, 2026

Monday, 5 October 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

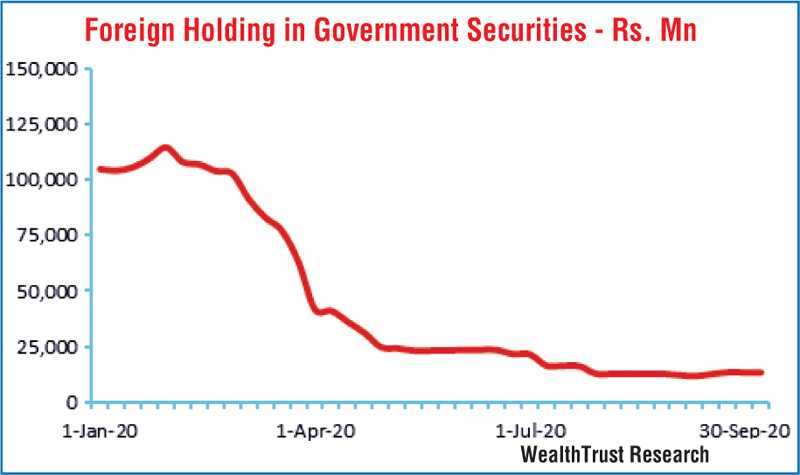

The secondary bond market ending 2 October witnessed a week of volatility with yields increasing during the first half of the week, on the back of Sri Lanka’s sovereign rating down grade by Moody’s Investor Services and the primary auction outcomes, where both the T-bill and T-bond auctions were undersubscribed. However, buying interest towards the latter part of the week saw yields decline once again but still end the week higher than its previous week’s closings, to record a parallel shift upwards of the yield curve.

The secondary bond market ending 2 October witnessed a week of volatility with yields increasing during the first half of the week, on the back of Sri Lanka’s sovereign rating down grade by Moody’s Investor Services and the primary auction outcomes, where both the T-bill and T-bond auctions were undersubscribed. However, buying interest towards the latter part of the week saw yields decline once again but still end the week higher than its previous week’s closings, to record a parallel shift upwards of the yield curve.

Yields of the 15.11.22, 2023’s (i.e. 15.01.23 and 15.07.23), 2024’s (i.e. 15.06.24, 15.09.24), 01.05.25 and 01.02.26 were seen increasing to weekly highs of 5.80%, 5.90%, 6.15%, 6.45%, 6.47%, 6.81% and 7.00% respectively during the early part of the week against its previous weeks closing level of 5.60/63, 5.63/70, 5.85/90, 6.11/17, 6.13/20, 6.43/50 and 6.63/68. On the downward momentum, the maturities of 2022’s (i.e. 15.11.22 and 15.12.22), 2024’s (i.e. 15.06.24 and 15.09.24), 01.05.25, 01.02.26 and 15.08.27 hit lows of 5.62%, 5.70%, 6.30%, 6.25%, 6.50%, 6.77% and 7.00% respectively.

In addition, 2021’s maturities (i.e. 01.08.21 and 15.10.21) changed hands within the range of 4.88% to 5.00% as well.

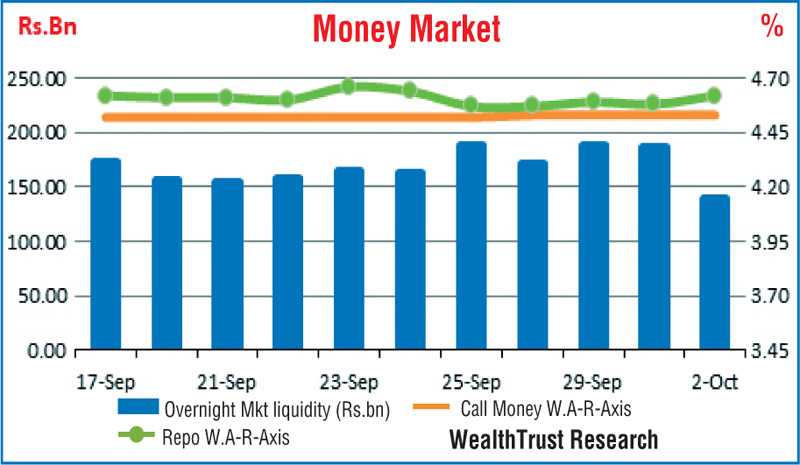

The foreign holding in Rupee bonds recorded an outflow Rs. 50 million for the week ending 30 September.

The daily secondary market Treasury bond/bill transacted volumes for the first three trading days of the week averaged Rs. 12.46 billion.

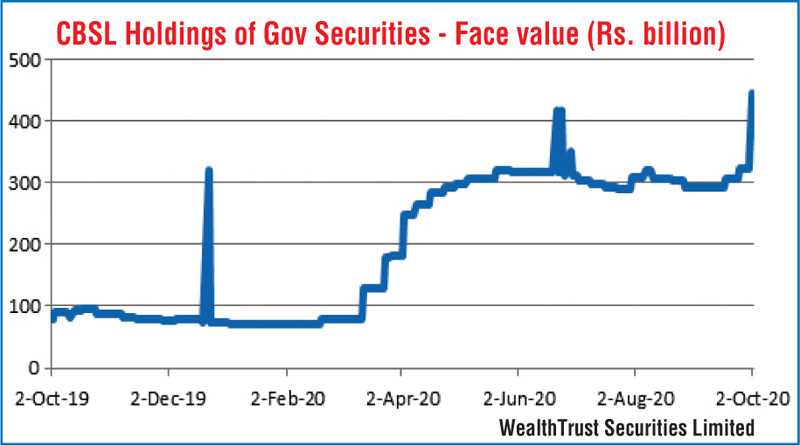

In the money market, the average net overnight surplus liquidity was recorded at Rs. 171.58 billion for the week against its previous week of Rs. 166.12 billion. However, the overnight net liquidity was seen decreasing to Rs. 139.40 billion on Friday while Central Banks bill holding was seen crossing the Rs. 400 billion level to register Rs. 445.16 billion on Friday as well. The Weighted average rates on overnight call money and repo averaged 4.53% and 4.59% respectively for the week.

Rupee appreciates further

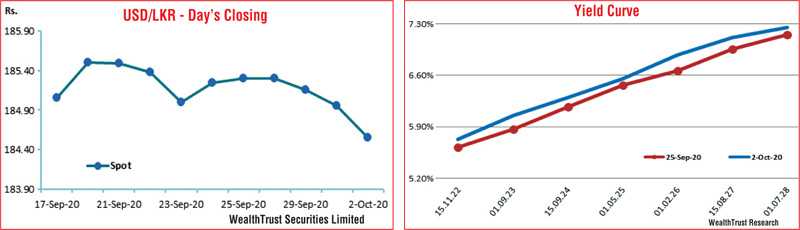

In the Forex market, the Rupee on spot contacts was seen appreciating further to close the week at Rs. 184.50/60 against its previous weeks closing levels of Rs. 185.25/35 subsequent to trading within the range of Rs. 184.50 to Rs. 186.10.

The daily USD/LKR average traded volume for the first three days of the week stood at $ 87.70 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)