Sunday Feb 15, 2026

Sunday Feb 15, 2026

Tuesday, 30 October 2018 01:19 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

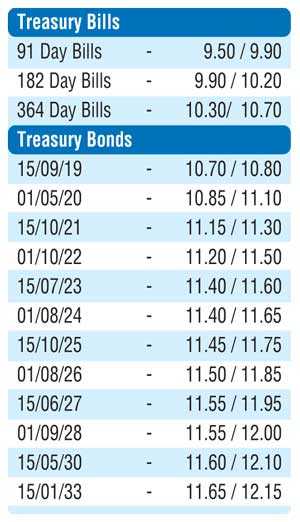

The secondary market bond yields was seen increasing considerably yesterday mainly on the three-year maturities of 01.05.21 and 15.12.21 to daily highs of 11.44% and 11.68% respectively against its previous days closings of 10.85/95 and 10.90/00, driven by foreign selling interest.

In addition, the 15.09.19 and 15.07.23 maturities were traded to highs of 10.95% and 11.75% respectively against its previous days closings of 10.20/25 and 11.35/40.

The total secondary market Treasury bond/bill transacted volume for 26 October was Rs. 4.60 billion.

In the money market, the net liquidity shortfall stood at Rs. 38.18 billion yesterday with call money and repo averaging 8.43% and 8.46% respectively.

The OMO department of Central Bank was seen infusing liquidity by way of an overnight and a seven day term repo auction for successful amounts of Rs. 10.75 billion and Rs. 20 billion respectively at weighted averages of 8.44% and 8.47%.

A further amount of Rs. 13.4 billion was injected by way of 14 day term repo auction at a weighted average of 8.48%, valued today.

Rupee loses further

In the Forex market, the USD/LKR rate on spot contracts was seen depreciating further yesterday to hit fresh low of Rs. 174.30 before closing the day at Rs. 173.80 against its previous day’s closing levels of Rs.173.05/20 on the back of foreign selling in capital markets and dollar buying interest by banks.

The total USD/LKR traded volume for 26 October was $ 59.90 million.

Some of the forward USD/LKR rates that prevailed in the market were: one month – 174.80/20; three months – 176.80/20; and six months – 179.80/30.