Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Friday, 25 August 2023 01:30 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The Central Bank of Sri Lanka yesterday took a pause on its monetary easing cycle, keeping the policy rates steady.

The Central Bank of Sri Lanka yesterday took a pause on its monetary easing cycle, keeping the policy rates steady.

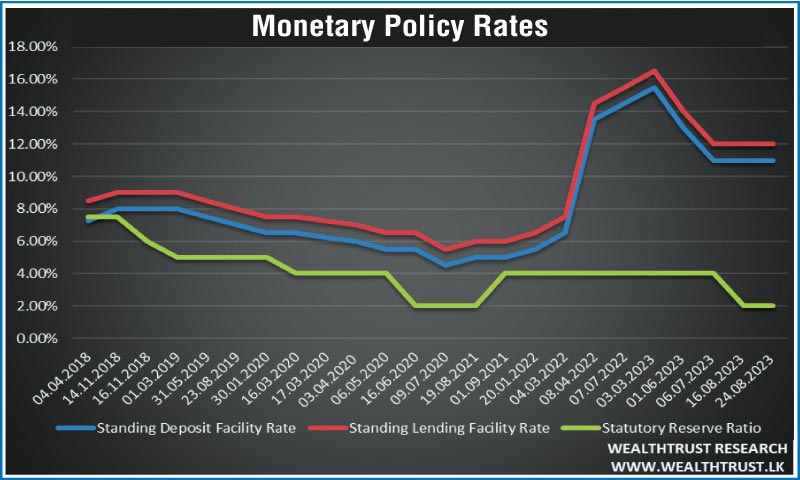

As such, the Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) remained at 11.00% and 12.00% respectively. This move came as a surprise, as Bloomberg reported a prediction of a 200-basis point reduction and a consensus forecast of a 100-basis point reduction. At its previous two announcements on 6 July and 1 June, the Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) were cut by 200 basis points and 250 basis points respectively from its highs of 15.50% and 16.50%.

In addition, earlier this month on 9 August, the CBSL in another surprise move, in line with its current dovish stance, announced a reduction in the Statutory Reserve Ratio (SRR) for all commercial banks by 200 basis points to 2.00% from 4.00%, with the move coming into effect on the 16 August.

The secondary market bond yields spiked upwards, initially seeing an increase following the policy announcement and thereafter seeing a fresh surge upwards following the announcement of upcoming Treasury bond auctions on 28 August.

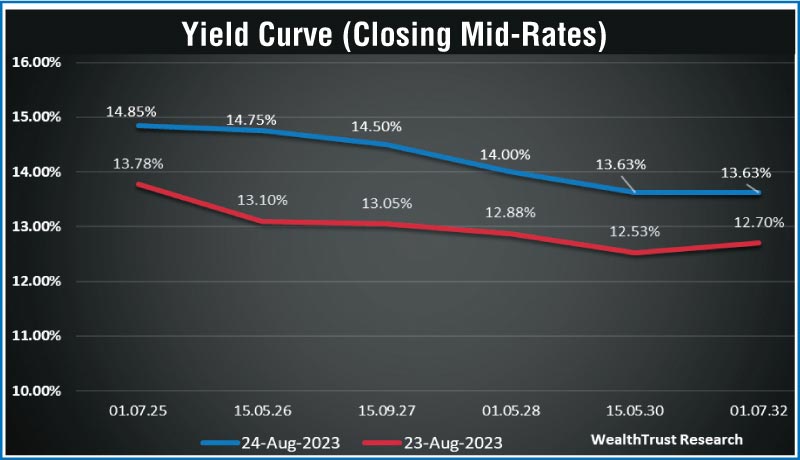

As such, yields were seen increasing quite drastically, with the yield curve recording a parallel shift upwards. The yields on the liquid maturities of 01.07.25, 15.05.26, 15.09.27, 01.05.28 and 01.07.32 hit intraday highs of 14.70%, 14.50%, 14.25%, 13.80% and 13.50% respectively against its day’s lows of 13.70%, 13.50%, 13.25%, 13.00% and 13.00%.

The total secondary market Treasury bond/bill transacted volume for 23 August was Rs. 54.71 billion.

In money markets, the weighted average rates on overnight call money and repo were registered at 11.78% and 12.00% respectively as the DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight reverse repo auction for a volume of Rs. 128.30 billion at weighted average rate of 11.49%. Further an amount of Rs. 60.37 billion was withdrawn from Central Bank’s SLFR (Standard Lending Facility Rate) of 12.00% against an amount of Rs. 0.40 billion deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 11.00%.

Forex market

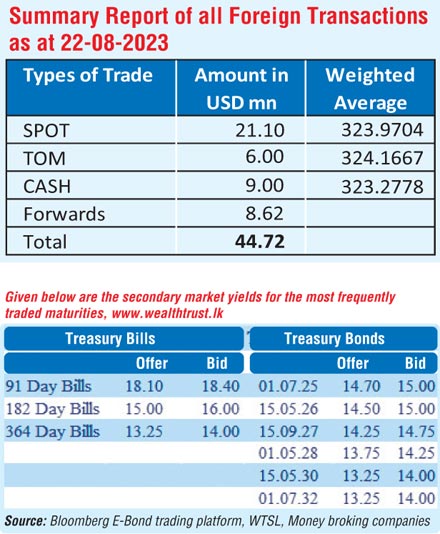

In the forex market, the USD/LKR rate on spot contracts closed the day at Rs. 323.85/324.15 yesterday against its previous day’s closing level of Rs. 324.00/324.25.

The total USD/LKR traded volume for 23 August was $ 44.72 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)