Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 7 October 2022 00:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

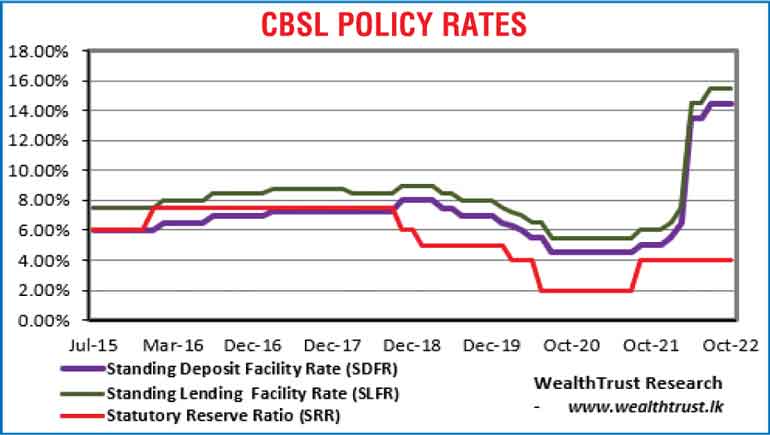

The secondary bond market yields were seen increasing yesterday following the seventh monetary policy announcement at where policy rates remained steady at 14.50% and 15.50% respectively on the Standing Deposit Facility Rate (SLDR) and Standing Lending Facility Rate (SLFR).

The secondary bond market yields were seen increasing yesterday following the seventh monetary policy announcement at where policy rates remained steady at 14.50% and 15.50% respectively on the Standing Deposit Facility Rate (SLDR) and Standing Lending Facility Rate (SLFR).

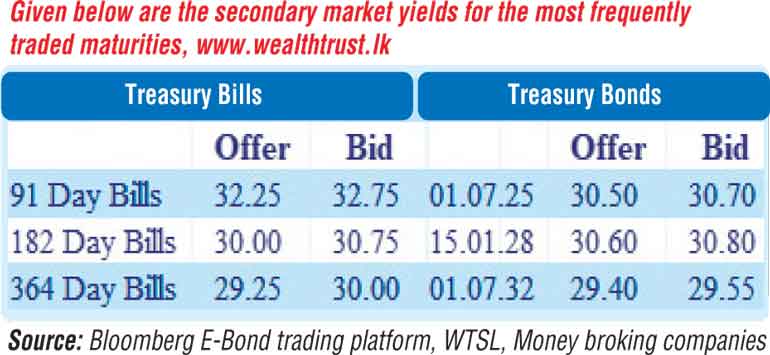

In morning hours of trading, selling interest on the 01.06.25, 15.01.28 and 01.07.32 maturities saw its yields increase to intraday highs of 30.80%, 31.10% and 29.60% respectively against its previous day’s closing levels of 30.45/65, 30.40/70 and 29.45/75. Nevertheless, buying interest at these levels saw yields decreasing marginally once again as the 15.01.28 and 01.07.32 maturities hit lows of 30.75% and 29.45%. The latest 91-day bill maturity changed hands at 32.75% to 33.00%.

The total secondary market Treasury bond/bill transacted volume for 5 October was Rs. 49.66 billion.

In money markets, the net liquidity deficit stood at Rs. 353.45 billion yesterday as an amount Rs. 683.51 billion was withdrawn from Central Banks Standard Deposit Facility Rate (SDFR) of 15.50% against an amount of Rs. 330.06 billion been deposited at Central Banks Standard Lending Facility Rate (SLFR) of 14.50%. The weighted average rate on overnight REPO stood at 15.50%.

Forex market

In the forex market, the middle rate for USD/LKR spot contracts remained steady at Rs. 362.90.

The total USD/LKR traded volume for 5 October was $ 28.91 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)