Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 8 May 2023 01:17 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

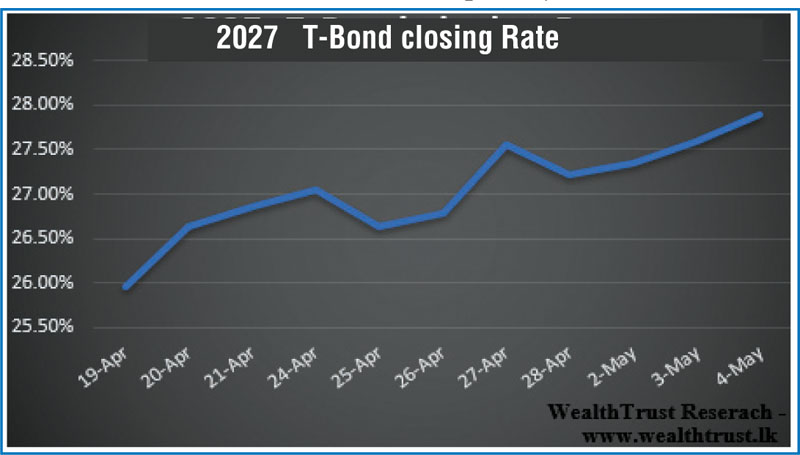

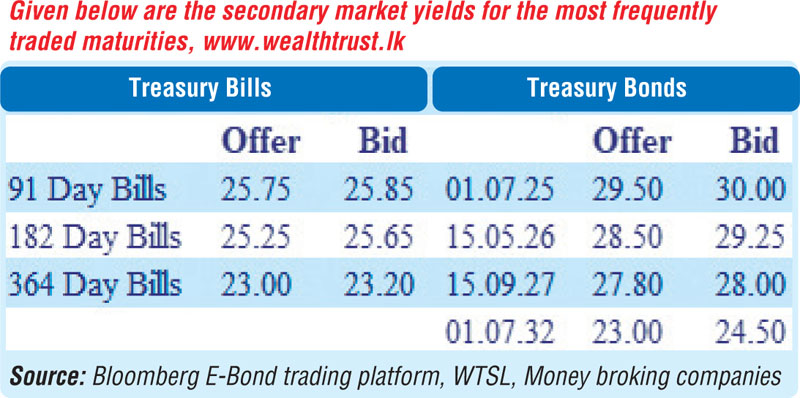

The wait and see strategy adopted by most market participants led to a bearish sentiment in the secondary bond market during the shortened trading week ending 4 May. The limited activity witnessed saw yields on the market favourite maturities of 01.07.25 and two 2027’s (i.e., 01.05.27 & 15.09.27) increase to intraweek highs of 29.80%, 27.75% and 27.80% respectively against its previous weeks closing levels of 29.25/30.00, 27.15/30 and 27.20/40.

The wait and see strategy adopted by most market participants led to a bearish sentiment in the secondary bond market during the shortened trading week ending 4 May. The limited activity witnessed saw yields on the market favourite maturities of 01.07.25 and two 2027’s (i.e., 01.05.27 & 15.09.27) increase to intraweek highs of 29.80%, 27.75% and 27.80% respectively against its previous weeks closing levels of 29.25/30.00, 27.15/30 and 27.20/40.

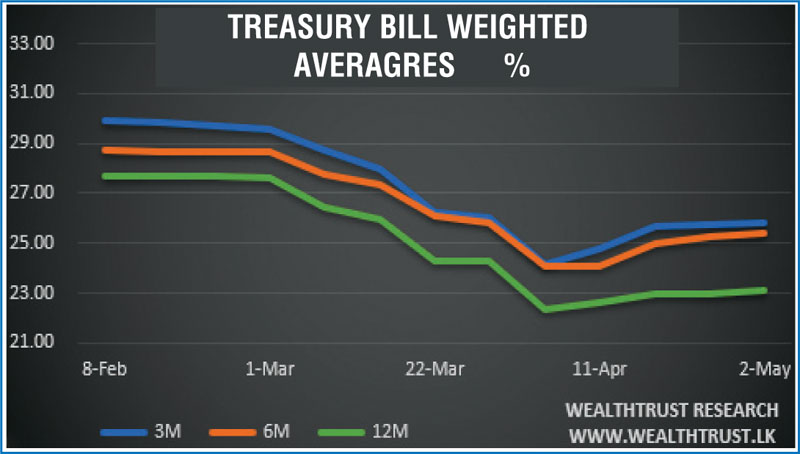

At the weekly T-bill auction, weighted average rates increased to 25.82%, 25.42% and 23.14% on the 91-day, 182-day and 364-day maturities respectively while in total an amount of Rs. 145.20 billion was accepted at the phase 1 of the auction against its total offered amount of Rs. 160 billion.

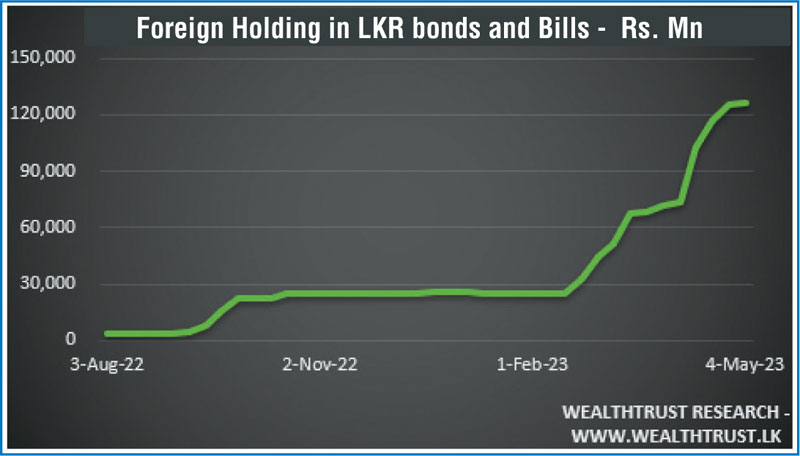

The foreign holding in rupee bonds increased further by Rs. 1.03 billion for the week ending 3 May.

In money markets, the total outstanding liquidity deficit decreased to Rs. 32.37 billion by the end of the week against its previous week’s deficit of Rs. 61.61 billion while CBSL’s holding of Government Security’s stood at Rs. 2,724.33 billion against its previous weeks of Rs. 2,667.36 billion.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts appreciated further during the week to close the week at Rs. 319.00/40 as against its previous weeks closing level of Rs. 320.90/30.

The daily USD/LKR average traded volume for the first two days of the week stood at $ 91.63 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)