Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 20 April 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

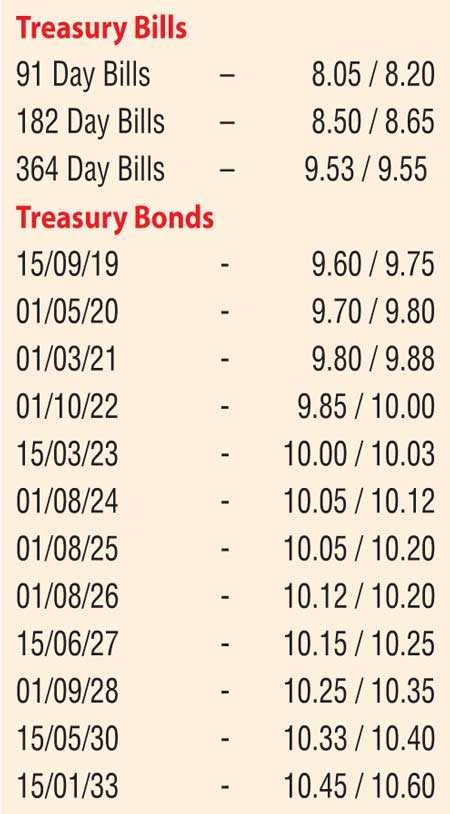

Secondary market bond yields increased marginally yesterday amidst thin volumes consisting mostly of the two liquid maturities of 15.03.23 and 15.05.30 at levels of 10% and 10.37%.

Furthermore, the 01.03.21 and 15.12.21 maturities too were seen changing hands at levels ranging from 9.75% to 9.90%.

In the secondary bill market, interest was shown on the October and November 2018 maturities which traded at levels of 8.50% and 8.75% while the January and February 2019 maturities traded at levels of 9.20% to 9.25%.

The total secondary market Treasury bond/bill transacted volumes for 19 April 2018 was Rs. 3.86 billion.

In money markets, the overnight call money and repo rates changed slightly to average 7.88% to 7.96% and 7.80% to 8.10% respectively. In the meantime, the Open Market Operations (OMO) Department of the Central Bank of Sri Lanka did not conduct any term reverse repo/repo auctions.

Meanwhile, in Forex markets, a gain on export conversions supported by forward sales led to an appreciation of the LKR to close the day at Rs. 156.25/30 against its previous day’s closing levels of Rs. 156.30/45.

The total USD/LKR traded volume for 18 April 2018 was $ 69.50 million.

Some of the forward USD/LKR rates that prevailed in the market were one month - 156.90/00; three months - 158.40/55 and six months - 160.60/70.