Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 25 August 2020 01:33 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The fresh trading week opened on a bearish note as secondary market bond yields increased marginally yesterday with activity moderating towards the latter part of the day.

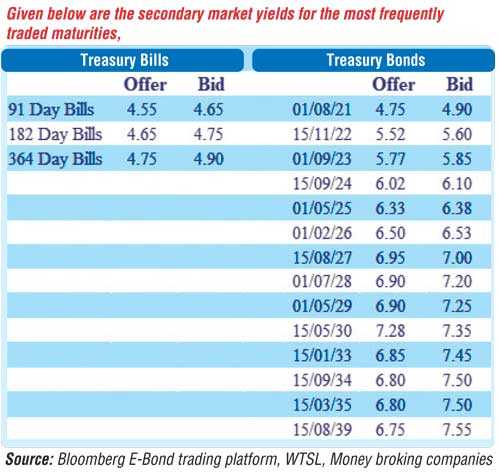

Trades were witnessed on the 2022’s (i.e. 15.11.22 & 15.12.22), 2023’s (i.e. 15.01.23 & 01.09.23), 01.05.25, 01.02.26 and 15.08.27 at levels of 5.55%, 5.55% to 5.58%, 5.60% to 5.63%, 5.80%, 6.36% to 6.37%, 6.50% to 6.52% and 6.98% to 7.00% respectively against its previous day’s closing levels of 5.45/50, 5.45/52, 5.50/55, 5.73/78, 6.33/35, 6.48/52 and 6.93/95.

In addition, on the short end of the curve, 01.05.21 maturity changed hands at a level of 4.80% while September and October 2020 secondary bills traded within the range of 4.50% to 4.55%. The total secondary market Treasury bond/bill transacted volumes for 21st August 2020 was Rs. 10.64 billion.

In the money market, overnight call money and Repo averaged 4.53% and 4.54% respectively yesterday, as the overnight surplus liquidity stood at Rs. 189.18 billion.

Rupee depreciates

In the Forex market, USD/LKR rate on spot contracts was seen deprecating yesterday to close the day at Rs. 184.90/10 against its previous day’s closing level of Rs. 184.40/60 on the back of buying interest by Banks. The total USD/LKR traded volume for 21 August was US$ 83.33 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month: 184.95/20; 3 Months: 185.15/40 and 6 Months: 185.30/70.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)