Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 19 May 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The start of a fresh week saw secondary market bond yields increasing yesterday on the back of small volumes changing hands with most market participants seen on the sidelines.

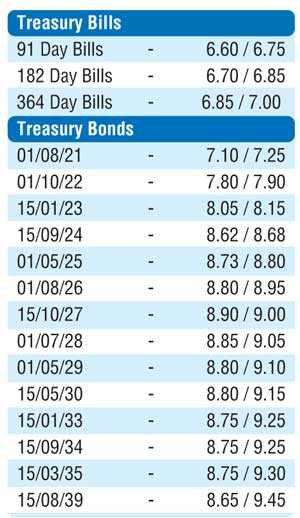

Yields on the liquid maturities of 15.06.24, 01.05.25 and 15.10.27 increased to intraday highs of 8.66%, 8.77% and 8.91% respectively against its last Friday’s closing levels of 8.53/60, 8.65/70 and 8.85/90. In addition, the maturities of 01.08.21, 15.03.23 and 01.08.24 were seen changing hands at levels of 7.20%, 8.20% to 8.30% and 8.60% to 8.62% respectively.

In the secondary bill market, June and July 2020 bills were traded at levels of 6.55% and 6.63% to 6.68% respectively.

The total secondary market Treasury bond/bill transacted volume for 15 May was Rs.8.65 billion.

In money markets, the weighted average rates on overnight call money and repo stood at 5.91% and 6.04% respectively as the DOD (Domestic Operations Department) of Central Bank injected an amount of Rs.5 billion by way of a four-day reverse repo auction at a weighted average rate of 5.99%, subsequent to offering Rs. 10 billion.

It further injected an amount of Rs. 15 billion for Standalone Primary Dealers by way of a four-day reverse repo auction at a weighted average rate of 6.46%. The overnight net liquidity surplus in the system decreased to Rs. 103.31 billion yesterday.

Rupee appreciates marginally

In the Forex market, the USD/LKR rate on spot contracts traded within the range of Rs. 187.45 to Rs. 187.80 yesterday before closing the day at levels of Rs. 187.70/90 against its previous day’s closing levels of Rs. 187.80/00.

The total USD/LKR traded volume for 15 April was $ 72.25 million.