Saturday Feb 21, 2026

Saturday Feb 21, 2026

Wednesday, 5 August 2020 01:20 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

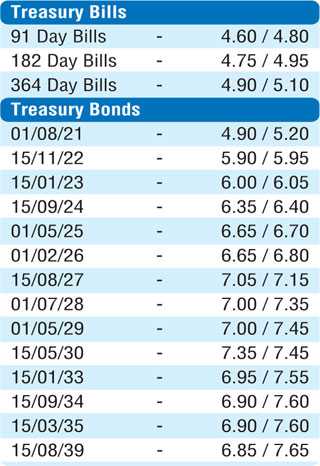

Secondary bond market yields continued to rise across the board yesterday, along with the stipulated cut-off rates for today’s bill auction also being increased to 4.67%, 4.76% and 4.94% respectively on the 91, 182 and 364 day maturities, up from last week’s 4.60%, 4.69% and 4.86%.

Today’s auction will have on offer a total amount of Rs. 35.5 billion, consisting of Rs. 6 billion of the 91 day, Rs. 11.5 billion of the 182 day and Rs. 18 billion of the 364 day maturities. At last week’s auction, the weighted average yields of the 91 and 182 day bills decreased by 01 basis point each to 4.59% and 4.68% respectively whilst the weighted average yield of the 364 day maturity remained steady at 4.86%. In the secondary bond market, liquid maturities consisting of the 2022s (i.e. 15.11.22 & 15.12.22), 2023s (i.e. 15.01.23 & 01.09.23), 15.09.24, 01.05.25 and 15.05.30 were seen increasing to intraday highs of 5.95%, 6.00%, 6.05%, 6.25%, 6.40%, 6.68% and 7.35% when compared against the previous day’s closing levels of 5.72/80 each, 5.75/85, 5.95/05, 6.22/30, 6.50/60 and 7.30/38.

The total secondary market Treasury bond/bill transacted volumes for 31 July was Rs. 8.05 billion.

In money markets, the surge in net surplus liquidity to Rs. 153.94 billion, resulted in overnight call money and repos averaging at 4.53% and 4.54% respectively.

LKR appreciates further

In the Forex market, the USD/LKR rate on spot contracts traded within the range of Rs. 185.51 to Rs. 185.65 before closing at Rs. 185.50/55 against the previous day’s closing levels of Rs. 185.60/65. The total USD/LKR traded volume for 31 July was $ 61.18 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)