Sunday Feb 15, 2026

Sunday Feb 15, 2026

Thursday, 9 March 2023 00:07 - - {{hitsCtrl.values.hits}}

By WealthTrust Securities

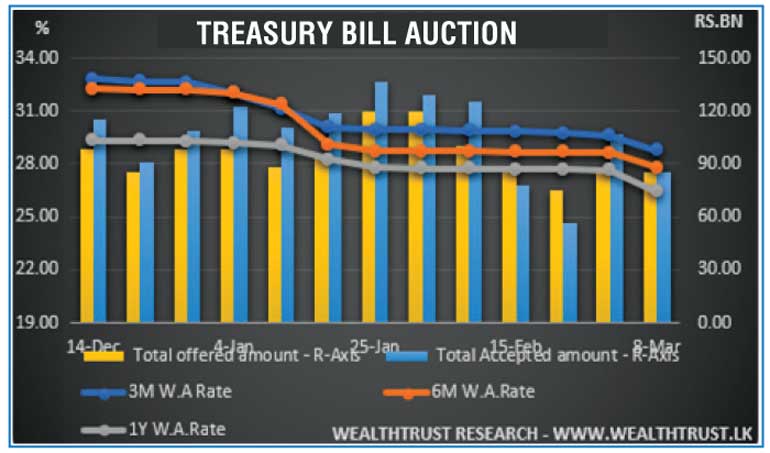

The weekly Treasury bill auction conducted yesterday saw its weighted averages record steep declines while the auction was fully subscribed for a second consecutive week.

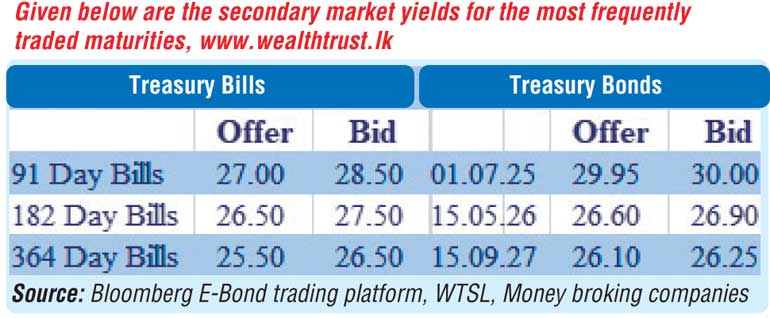

The one-year maturity recorded a fall of 121 basis points to 26.43% while the three-month and six-month maturities dipped by 84 and 87 basis points respectively to 28.75% and 27.77%. The total offered amount of Rs. 85 billion was successfully accepted at the auction while its bids to offer ratio stood at 2.68:1.

The Phase 2 of the auction will be opened for all three maturities at its weighted average yields, until close of business today. (i.e., 3.30 pm on 09.03.2023). Given below are the details of the auction,

The downward trend in secondary market bond yields, witnessed during the previous day, continued yesterday as well. Yields of the market favoured maturities of 01.07.25 and two 2027’s (i.e., 01.05.27 & 15.09.27) decreased to intraday lows of 29.70%, 26.00% and 26.05% respectively against its previous day’s closing levels of 31.45/50 and 28.00/30 each.

The total secondary market Treasury bond/bill transacted volume for 7 March 2023 was Rs. 11.44 billion.

In money markets, the weighted average rate of overnight call money and REPO stood at 16.48% and 16.31% respectively as an amount of Rs. 92.69 billion was withdrawn from the Central Banks SLFR (Standard Lending Facility Rate) at 16.50%.

Forex Market

In the Forex market, the USD/LKR or rupee appreciated further yesterday as its cash and spot contracts were traded within the range of Rs. 317.00 to Rs. 323.00 yesterday against its previous days Rs. 321.00 to 335.00.

The total USD/LKR traded volume for 7 March was $ 209.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)