Friday Feb 13, 2026

Friday Feb 13, 2026

Friday, 14 August 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

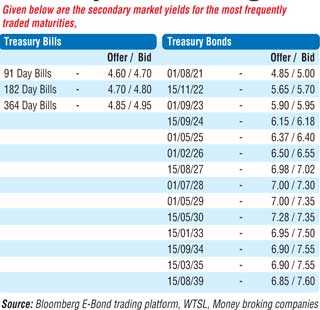

The yields in the secondary bond market remained mostly unchanged yesterday as the liquid maturities of 15.12.22, 2023s (i.e. 15.01.23 and 01.09.23), 15.09.24, 01.05.25, 01.02.26, 2027s (i.e. 15.08.27 and 15.10.27) and 15.05.30  changed hands at level of 5.67% to 5.70%, 5.74%, 5.90% to 5.95%, 6.15% to 6.17%, 6.37%, 6.51% to 6.52%, 6.98%, 7.02% to 7.07% and 7.28% respectively.

changed hands at level of 5.67% to 5.70%, 5.74%, 5.90% to 5.95%, 6.15% to 6.17%, 6.37%, 6.51% to 6.52%, 6.98%, 7.02% to 7.07% and 7.28% respectively.

In addition, the shorter end maturities of 01.03.21, 01.08.21 and 15.12.21 changed hands at levels of 4.85%, 4.95% and 5.20% respectively as well. Meanwhile in the secondary bill market, September 2020, October 2020, January 2021 and February 2021 maturities traded at levels of 4.60% to 4.69%, 4.65%, 4.74% and 4.75% respectively.

The total secondary market Treasury bond/bill transacted volumes for 12 August was Rs.24.72 billion. In money markets, overnight liquidity increased to Rs.186.82 billion which in turn saw weighted average rates on overnight call money and repo recorded at 4.53% and 4.55% respectively yesterday.

LKR closes mostly unchanged: Hits an intraday high of Rs.182.40

The USD/LKR rate on spot contracts was seen closing the day mostly unchanged at Rs. 182.90/00 yesterday subsequent to hitting an intraday high of Rs. 182.40.

The total USD/LKR traded volume for 12 August was $ 69.70 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)