Sunday Feb 15, 2026

Sunday Feb 15, 2026

Friday, 16 July 2021 01:56 - - {{hitsCtrl.values.hits}}

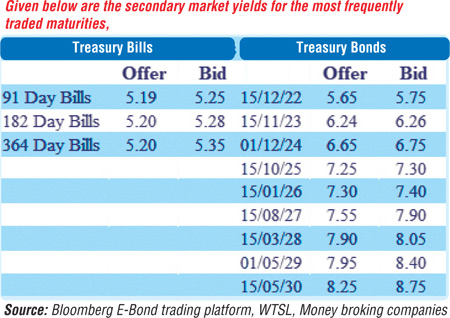

The secondary bond market yields remained mostly unchanged yesterday as activity moderated. Limited trades were seen on the maturities of 15.12.22, 15.05.23, 15.11.23 and 15.09.24 at levels of 5.70%, 5.95%, 6.25% and 6.65% respectively.

The secondary bond market yields remained mostly unchanged yesterday as activity moderated. Limited trades were seen on the maturities of 15.12.22, 15.05.23, 15.11.23 and 15.09.24 at levels of 5.70%, 5.95%, 6.25% and 6.65% respectively.

The total secondary market Treasury bond/bill transacted volume for 14 July was Rs. 50.58 billion.

In money markets, the overnight net liquidity surplus was seen decreasing yesterday to a 15-month low of Rs. 69.40 billion as only an amount of Rs. 116.39 billion was deposited at Central Banks SLDR of 4.50% against the previous day’s Rs. 143.55 billion. An amount of Rs. 46.99 billion was withdrawn from Central Banks SLFR of 5.50% against the previous day’s amount of Rs. 53.77 billion. The weighted average rates on overnight call money and repo were registered at 4.99% and 5% respectively.

USD/LKR

In Forex markets, the overall market continued to remain inactive yesterday.

The total USD/LKR traded volume for 14 July was $ 109.92 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)