Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 14 October 2020 00:53 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market yields see-sawed yesterday as yields were seen decreasing further on the back of continued buying interest during most part of the day and increased once again towards the latter part of the day.

The secondary bond market yields see-sawed yesterday as yields were seen decreasing further on the back of continued buying interest during most part of the day and increased once again towards the latter part of the day.

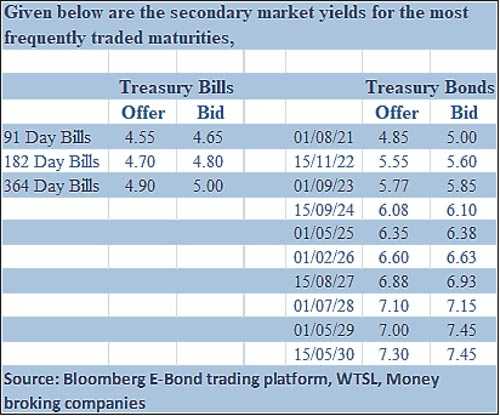

Activity centred on the maturities of 15.12.22, 01.02.26 and 15.08.27 as its yields were seen decreasing to intraday lows of 5.55%, 6.57% and 6.88% respectively against its previous day’s closing level of 5.55/62, 6.60/63 and 6.90/93. However, renewed selling interest at these levels saw yields increasing once again to hit highs of 5.62%, 6.63% and 6.94% respectively.

In addition, maturities of 15.11.22, 15.01.23, 15.09.24, 01.05.25, 01.06.26 and 15.10.27 changed hands at level of 5.55%, 5.58% to 5.60%, 6.05% to 6.10%, 6.35% to 6.36%, 6.62% and 6.93% to 6.95% respectively.

At today’s weekly Treasury bill auction, a total amount of Rs.40 billion will be on offer consisting of Rs.9 billion on the 91 day maturity, Rs. 15 billion on the 182-day maturity and a further Rs. 16 billion on the 364 day maturity.

Stipulated cut off rates were published as 4.60%, 4.71% and 4.99% respectively subsequent to increasing the previous week. In the secondary bill market, 27 November, 22 January 2021 and 8 October 2021 maturities were traded at levels of 4.61%, 4.70% and 4.95% to 4.98% respectively.

The total secondary market Treasury bond/bill transacted volumes for 12 October was Rs. 4.21 billion.

In the money market, the overnight call money and Repos registered weighted averages of 4.52% and 4.60% respectively as the overnight net liquidity surplus stood at Rs. 183.72 billion yesterday. The Domestic Operations Department (DOD) of Central Bank injected an amount of Rs. 6 billion by way of a 14 day reverse repo auction at a weighted average rate of 4.53%, subsequent to offering Rs. 10 billion, valued today.

Rupee dips marginally

In the Forex market, USD/LKR rate on spot contracts was seen trading within the range of Rs. 184.25 to Rs. 184.40 yesterday before closing the day at Rs. 184.30/40 against its previous day’s closing level of Rs. 184.15/25.

The total USD/LKR traded volume for 12 October was $ 50.50 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)