Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 9 October 2023 00:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The activity levels in the secondary bond market picked up during the week ending 6 October subsequent to a lethargic start.

The activity levels in the secondary bond market picked up during the week ending 6 October subsequent to a lethargic start.

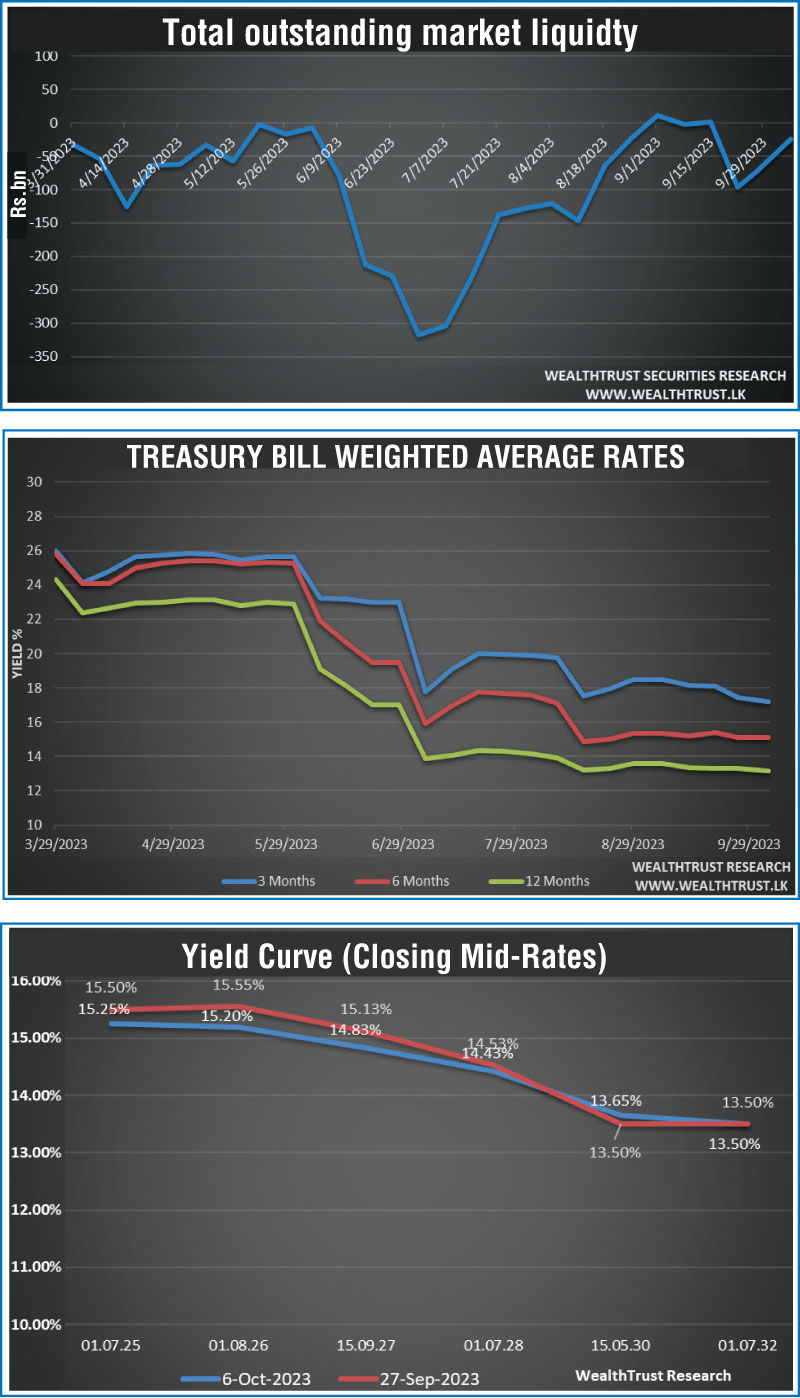

Initially, yields were seen dipping in anticipation of the monetary policy announcement, at where policy rates were reduced by 100 basis points and increased subsequent to it on profit taking and reduced once again on Friday on the back of buying interest.

Trading centred predominantly on the liquid maturities of the two 2026’s (i.e., 01.06.26 and 01.08.26) and 01.07.28 which saw its yields initially decrease from weekly highs of 15.50% and 14.50% respectively to lows of 14.90% and 14.15% by mid-week. Then yields were seen increasing on Thursday to 15.35% and 14.50% once again and buying interest on Friday at these levels saw its close the week marginally lower.

The response for last week’s Treasury bill auction was a bullish one ahead of the monetary policy announcement. As such, weighted average rates decreased across the board for a second consecutive week. Notably, the 91-day bill saw significant demand, causing its average to drop by 20 basis points, as bids totalled

Rs. 112.87 billion against an offered amount of only Rs. 55 billion. The first phase of the auction was oversubscribed by 1.86 times. Similarly, the 182-day and 364-day bills also saw their averages decrease by 04 and 14 basis points to 15.09% and 13.16% respectively. An amount of Rs. 105.02 billion or 95.47% was raised of the total offered amount of Rs. 110 billion at the 1st phase of the auction while an additional amount of Rs. 32.48 billion was raised at the 2nd phase on all three maturities at its respective weighted averages.

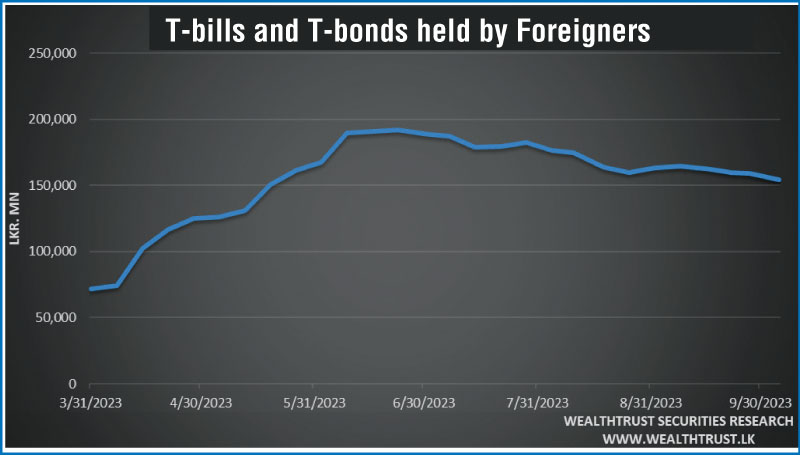

The foreign holding in Rupee bonds and bills recorded a further decline with a steep net outflow of Rs. 5.08 billion for the week ending 5 October. This makes four weeks of consecutive net outflows totalling Rs. 10.46 billion.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 25.01 billion.

In money markets, the total outstanding liquidity deficit improved significantly to Rs. 24.60 billion by the end of the week against its previous weeks of Rs. 73.51 billion. The Domestic Operations Department (DOD) of Central Bank continued to inject liquidity during the week by way of overnight to 7-day Reverse repo auctions at weighted average yields ranging from 10.13% to 13.41%.

The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,839.35 billion, unchanged against its previous week’s level.

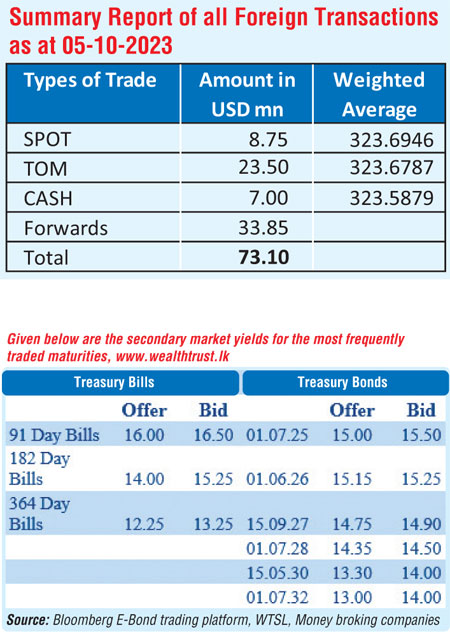

In the forex market, the USD/LKR rate on spot contracts was seen depreciating marginally during the week to close the week at Rs. 323.85/323.95 against its previous week’s closing level of Rs. 323.50/324.25, subsequent to trading at a low of Rs. 323.90 and a high of Rs. 323.60.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 65.90 million.