Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 13 June 2022 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market was seen closing the week ending 10 June 2022 on a bullish note subsequent to yields seesawing during the week on the back of impressive primary auction results.

The secondary bond market was seen closing the week ending 10 June 2022 on a bullish note subsequent to yields seesawing during the week on the back of impressive primary auction results.

Yields seesawed mainly on the liquid maturities of 01.06.25 and 15.01.28 as selling interest on the back of profit taking saw yields increase to weekly highs of 20.50% each during the early part of the week while renewed buying interest leading into the bond auctions and subsequent to it saw it dip once again to 19.90% each. Secondary bill market too witnessed the same trend as May-June 2023 maturities hit lows of 21.30% against its weeks high of 23.40%.

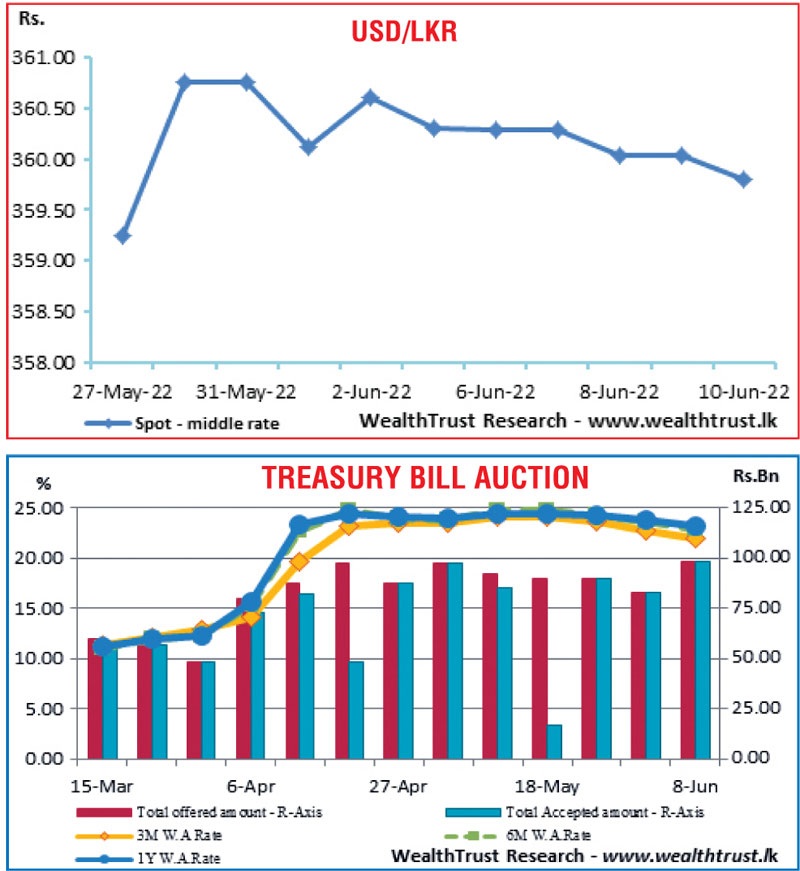

At the weekly Treasury bill auction, weighted average rates continued its steep decreasing trend reflecting drops of 84, 71 and 62 basis points respectively while the two Treasury bond auctions conducted on Friday recorded impressive outcomes, as the total offered amount of Rs. 50 billion was successfully accepted at its 1st phase of the auctions. The maturity of 01.06.2025 recorded a weighted average rate of 20.30% while the 15.01.2028 maturity fetched a weighted average rate of 20.19%. This in turn will see a further 20% been offered on each maturity, through a direct issuance window, until close of business today. (i.e. 4 p.m. on 13.06.22). Given in the table are the details of the auction.

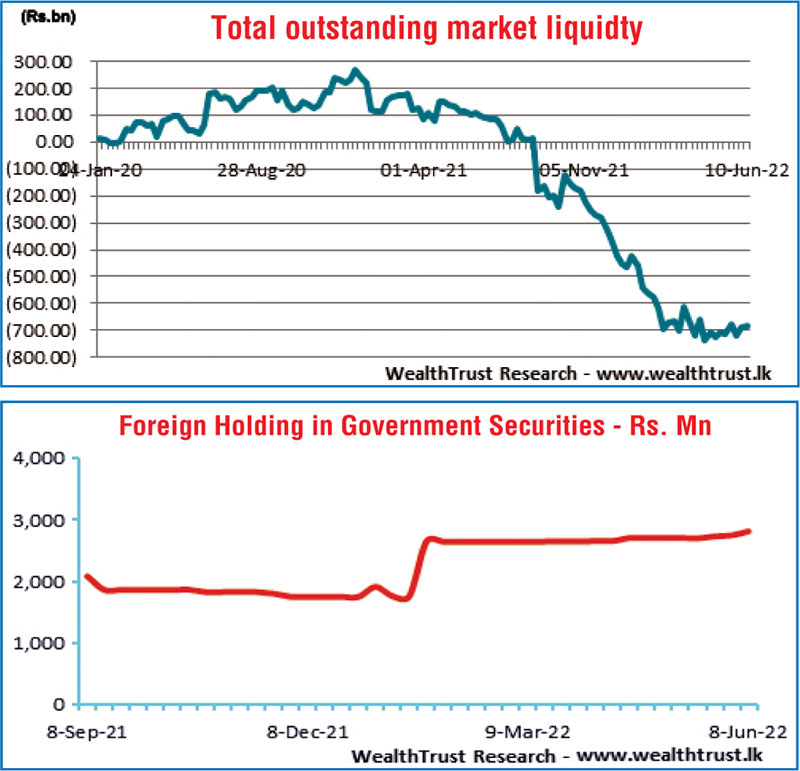

The foreign holding in rupee bonds continued to edge up, albeit on a very marginal basis to Rs. 2.82 billion for the week ending 8 June while the daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 25.68 billion.

In money markets, the total outstanding liquidity deficit at the end of the week decreased further to Rs. 680.84 billion against its previous weeks Rs. 686.64 billion while CBSL’s holding of Government Securities increased to Rs. 1,969.82 against its previous weeks closing levels of Rs. 1,964.91 billion. The weighted average rates on overnight call money and repo was 14.50% each for the week.

Rupee middle rate appreciates

In the forex market, the middle rate for USD/LKR spot contracts appreciated during the week to close the week at Rs. 359.80 against its previous weeks closing of Rs. 360.30.

The daily USD/LKR average traded volume for the four trading days of the week stood at $ 15.25 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)