Saturday Feb 07, 2026

Saturday Feb 07, 2026

Monday, 24 August 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

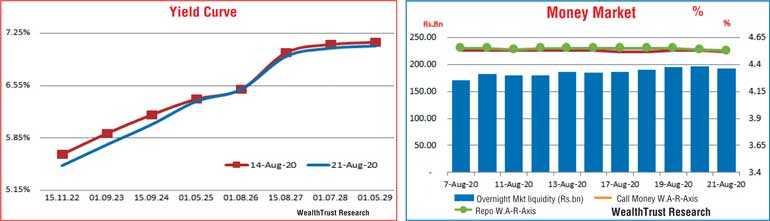

The week ending 21 August commenced with bond yields increasing marginally but swiftly reversing to drop from that point onwards leading to the monitory policy announcement.

Yields on the liquid maturities of 2022’s (i.e. 15.11.22 and 15.12.22) and 2023’s (i.e. 15.01.23 and 01.09.23), 15.09.24, 01.05.25, 01.02.26 and 15.08.27 were seen decreasing to weekly lows of 5.50% each, 5.53%, 5.75%, 6.03%, 6.31%, 6.47% and 6.93% respectively against its weeks highs of 5.62%, 5.70%, 5.95%, 6.20%, 6.45%, 6.52% and 7.00%, reflecting a shift downwards, mainly on the short end of the yield curve.

This was subsequent to yields increasing once again on Thursday for a brief period, following the monitory policy announcement by the Central Bank of Sri Lanka, at where policy rates were held steady. The downward trend in yields was further supported by the outcome of the weekly Treasury bill auction, at where weighted averages dipped across the board.

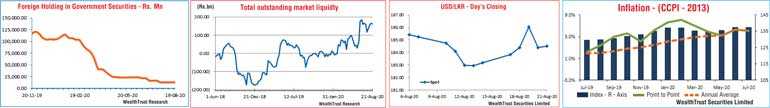

The foreign holding in rupee bonds recorded a minute increase of Rs. 4.19 million for the week ending 19 August.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged Rs. 20.71 billion.

Inflation as measured by the National Consumer Price Index (NCPI) decreased to 6.10% in July from 6.30% in June on its point to point while its annualised average increased to 5.90% from 5.60%.

The surplus liquidity in the money market was seen increasing to average Rs. 192.29 billion for the week against its previous week’s average of Rs. 182.64 billion. Overnight call money and repo remained steady to average 4.52% and 4.54% respectively for the week.

Rupee volatile

The Rupee against the dollar recorded some volatility during the week, depreciating sharply during the first four days of the week to a low of Rs. 187.10. However, the USD/LKR on spot contracts bounced back once again from this point to close the week at Rs. 184.40/60, lower than its previous week’s close of Rs. 183.50/70. The relaxation of certain import restrictions was seen as the reason behind the volatility.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 78.37 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)