Sunday Feb 15, 2026

Sunday Feb 15, 2026

Monday, 31 August 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary market bond yields, which picked up towards the early part of the week resulting from renewed selling interest, was seen trading within a tight range subsequent to the weekly bill auction.

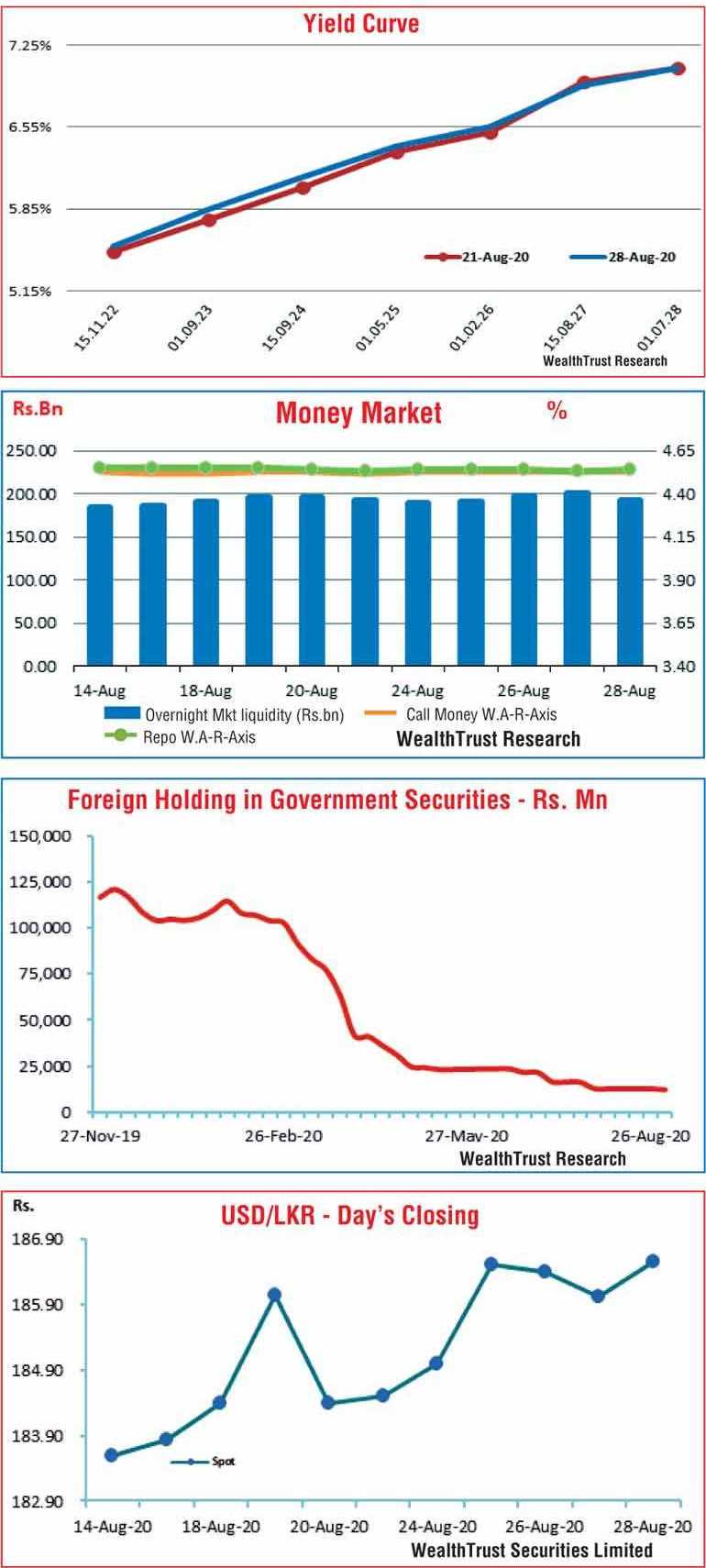

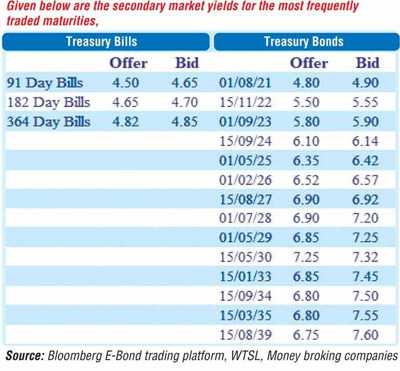

The liquid maturities of 2022’s (i.e. 15.11.22 and 15.12.22), 2023’s (i.e. 15.01.23 and 01.09.23), 01.05.25, 01.02.26, 15.08.27 and 15.05.30 hit intraweek highs of 5.55%, 5.61%, 5.63%, 5.85%, 6.41%, 6.58%, 7.00% and 7.34% respectively, against its previous weeks closing levels of 5.45/50, 5.45/52, 5.50/55, 5.73/78, 6.33/35, 6.48/52, 6.93/95 and 7.25/35.

However, buying interest subsequent to the weekly bill auction curtailed any further upward movement, with yields once again closing marginally lower. Nevertheless, the yield curve recorded a marginal upward shift week on week. In addition, maturities such as the 15.07.23, 2024’s (i.e. 15.06.24 and 15.09.24) and 2026’s (i.e. 01.06.26 and 01.08.26) also changed hands at levels of 5.78% to 5.80%, 6.10% to 6.17% and 6.59% to 6.65% respectively.

At the weekly Treasury bill auction, the weighted average rates of the 91 day and 182 day maturities decreased by 03 basis points each to 4.56% and 4.68% respectively with the 364 day bill decreasing by 01 basis point to 4.89% and the mammoth total offered amount of Rs. 40 billion being successfully subscribed.

The foreign holding in rupee bonds recorded a decrease of Rs. 0.5 billion for the week ending 26 August 2020.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged Rs. 9.43 billion.

Money market liquidity increases to Rs. 194 billion

In the money market, overnight surplus liquidity was seen increasing further to average Rs. 194.37 billion, as it recorded a surplus of Rs. 201.05 billion on Thursday for the first time since 26 June 2020. The previous week’s average stood at a surplus of Rs. 192.29 billion. The weighted average rate of overnight call money and repo’s remained steady at 4.53% and 4.54% respectively.

Rupee depreciates

In the Forex market, the Rupee on spot contacts was seen depreciating to close the week at levels of Rs. 186.45/65 against its previous weeks closing levels of Rs. 184.40/60 on the back of buying interest. The daily USD/LKR average traded volume for the first four days of the week stood at $ 76.28 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)