Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 8 June 2021 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The start of a fresh trading week saw secondary market bond yields remain mostly unchanged yesterday on the back of moderate activity. Trades were witnessed on the maturities of 15.03.23, 15.07.23, 15.09.24, 01.05.25 and two 2026’s (i.e. 15.01.26 and 01.02.26) at levels of 6.00%, 6.12%, 6.61%, 7.00% to 7.01% and 7.30% to 7.31% respectively.

The start of a fresh trading week saw secondary market bond yields remain mostly unchanged yesterday on the back of moderate activity. Trades were witnessed on the maturities of 15.03.23, 15.07.23, 15.09.24, 01.05.25 and two 2026’s (i.e. 15.01.26 and 01.02.26) at levels of 6.00%, 6.12%, 6.61%, 7.00% to 7.01% and 7.30% to 7.31% respectively.

The total secondary market Treasury bond/bill transacted volume for 4 June 2021 was Rs. 2.15 billion.

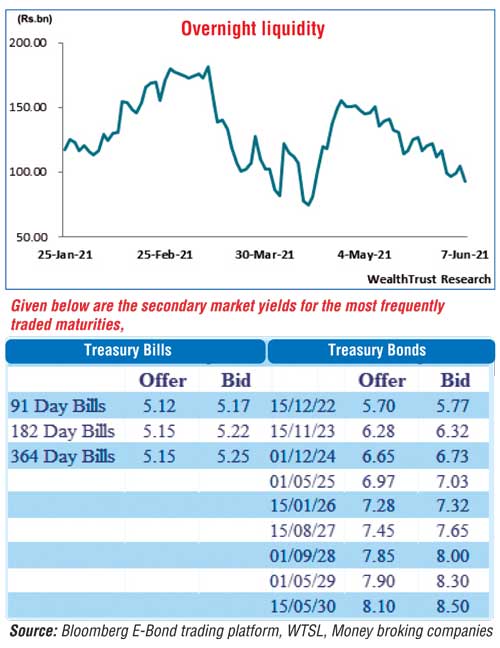

Money market liquidity decreased yesterday as the overnight net surplus liquidity dipped to a 32-day low of Rs. 92.97 billion. The weighted average rates on call money and repo were registered at 4.74% and 4.75% respectively.

USD/LKR

The Forex market continued to remain inactive yesterday.

The total USD/LKR traded volume for 4 June 2021 was $ 11.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)