Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 30 December 2024 01:57 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market started off last week on a positive note, following news that Fitch Ratings had issued credit rating upgrades on Sri Lanka’s foreign currency and local currency debt issuances. This coincided with the stock market continuing to rally and hitting new all-time highs. Initially, as a knee-jerk reaction, yields declined sharply driven by aggressive buying interest.

The secondary bond market started off last week on a positive note, following news that Fitch Ratings had issued credit rating upgrades on Sri Lanka’s foreign currency and local currency debt issuances. This coincided with the stock market continuing to rally and hitting new all-time highs. Initially, as a knee-jerk reaction, yields declined sharply driven by aggressive buying interest.

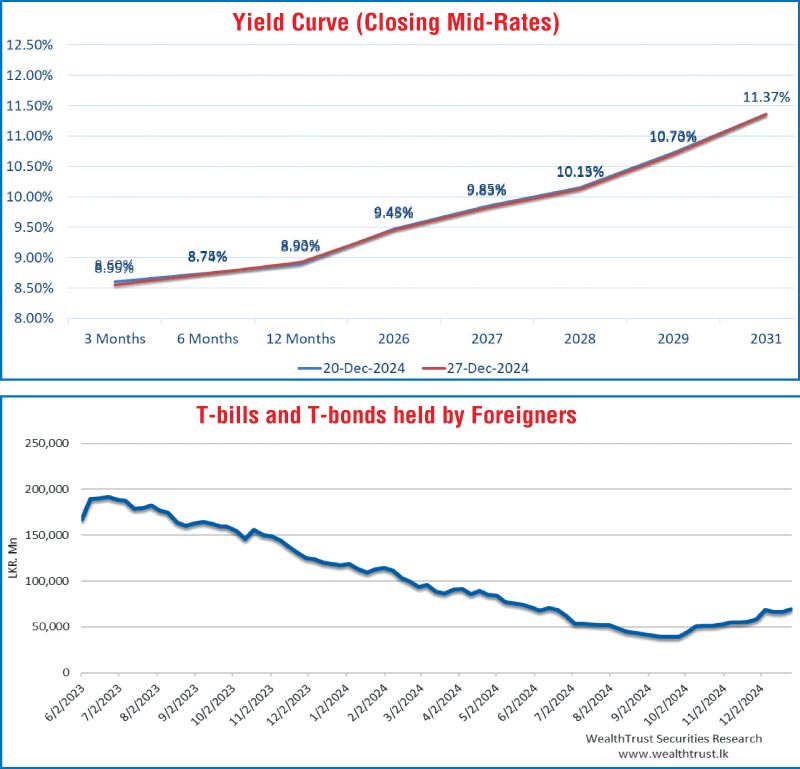

However, this was short-lived, as momentum shifted and profit-taking pressure led to a reversal, pushing yields up. Activity and transaction volumes, which were observed at healthy levels at the start of the week, began to moderate, leaving the market at a virtual standstill for much of the latter part of the week. In conclusion, market two-way quotes closed broadly steady on a week-on-week basis as renewed buying interest was seen kicking in at the higher levels curtailing further upwards movement. As a result, the yield curve was also seen remaining practically unchanged as compared to the week prior. This was against the backdrop of the lull typically associated with the Christmas holiday season and market participants adopting a wait-and-see approach ahead of the upcoming Rs. 80 billion Treasury bond auction.

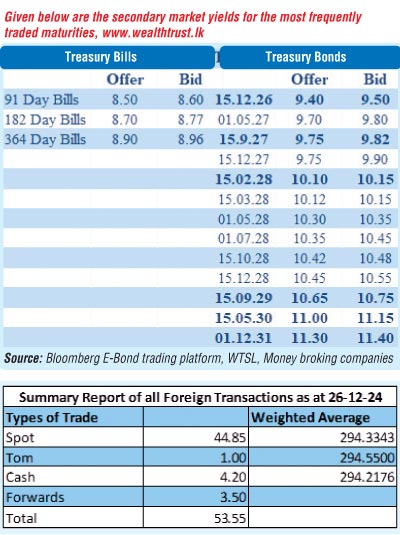

The 15.02.28 maturity was seen closing at the two-way quote of 10.10%/10.15%, after initially hitting intraweek lows of 10.00% and rebounding back up to touch intraweek highs of 10.15%. The other 2028 tenors followed a similar V-shaped trading pattern. The 01.05.28 and 01.07.28 maturities settled at the closing two-way quotes of 10.30%/10.35% and 10.35%/10.45% respectively. Earlier in the week, the same maturities hit lows of 10.07% and 10.20%, before reversing course and climbing to highs of 10.40% and 10.50% respectively. The 15.09.29 maturity traded up from an intraweek low of 10.65% to a high of 10.70%. The 15.05.30 maturity was seen changing hands at the rates of 11.00%-11.05%. The 01.07.32 maturity was seen trading within the narrow band of 11.47%-11.50%.

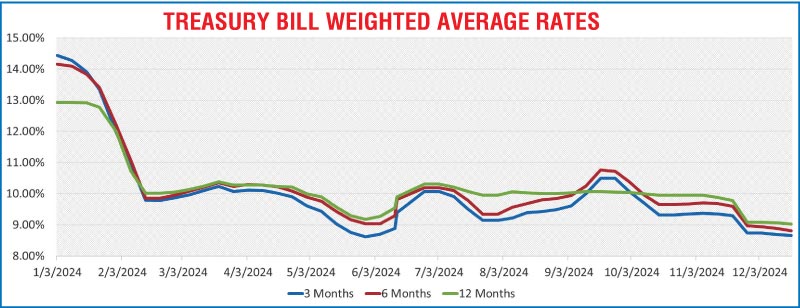

At the weekly Treasury bill auction conducted last Wednesday

(25 December), weighted average rates declined across all three maturities for the third consecutive week. As such rates were seen continuing on a downward trajectory with a reduction in yields observed on at least one tenor over the last seven weeks. Accordingly, the weighted average rates on the 91-day tenor dropped by 4 basis points to 8.62%, the 182-day tenor by 04 basis points to 8.77% and the 364-day tenor by 6 basis point to 8.96%. Total bids received exceeded the offered amount by 2.13 times, and the entire Rs. 120.00 billion on offer was successfully raised at the first phase in competitive bidding. An additional amount of Rs. 12.00 billion was raised at the second phase, being the maximum aggregate amount offered, out of a total market subscription of Rs. 63.28 billion.

This comes ahead of a round of Treasury bond auctions scheduled to be held today, 30 December. The round of auctions will have a total amount of Rs. 80 billion on offer. This will comprise of Rs. 45 billion from a 15 October 2028 maturity bearing a coupon rate of 11% and Rs. 35 billion from a 1 June 2033 maturity bearing a coupon rate of 9%. This will be the final bond auction for the year 2024.

For context, the Rs. 132.50 billion Treasury bond auction conducted on 12 December successfully raised Rs. 130.77 billion or 98.70% of the total offered amount. A 15.09.29 maturity (bearing an 11% coupon) recorded a resoundingly bullish outcome, being issued at a weighted average yield of 10.75%. The Rs. 77.50 billion on offer was raised during the first phase of subscription through competitive bidding. Additionally, the 01.06.33 maturity (bearing a 9% coupon) was issued at a weighted average yield of 11.47%, raising 96.86% or Rs. 53.27 billion of the Rs. 55.00 billion offered across both phases.

For the week ending 26 December 2024, the foreign holdings in Sri Lankan rupee-denominated Treasury securities saw a net inflow for the second consecutive week amounting to Rs. 2.71 billion. As a result, total foreign holdings were seen increasing to Rs. 69.26 billion reaching the highest level since mid-June this year.

The daily secondary market Treasury bond/bill transacted volumes for the first three days of the week averaged at Rs. 31.40 billion.

In money markets, the total outstanding liquidity surplus increased to Rs. 148.27 billion as at the week ending 27 December, from Rs. 136.15 billion recorded the previous week. The Domestic Operations Department (DOD) of Central Bank injected liquidity during the week by way of a seven-day term reverse repo auction at the weighted average rate of 8.11%. The weighted average interest rate on call money and repo ranged between 7.99% to 8.00% and 8.06% to 8.13% respectively.

The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,515.62 billion as at 27 December 2024, unchanged from the previous week’s level.

Forex market

In the forex market, the USD/LKR rate on spot contracts was seen appreciating, to close the week at Rs. 292.40/292.70 as against its previous week’s closing level of Rs. 290.15/290.30 and subsequent to trading at a high of Rs. 292.00 and a low of Rs. 297.40.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 90.58 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies.)